Extended Viewer

Value Construction as a Performance Driver

In a market environment fraught with recessionary concerns, the reversal in value investing’s fortunes after nearly a decade of lackluster performance has been a breath of fresh air for its long-standing loyalists. The current high-interest-rate regime has been favorable for value stocks, which have outperformed the broader market over the past year in the U.S., developed ex U.S. and emerging markets. But how a value strategy is constructed may have an impact, even in a market environment that has been tilting its way.

Valuation in motion

Certain shades of value have done better than others over time. Valuation measures such as price to book, forward price to earnings and enterprise value to operating cash flow are widely used to identify stocks that may be viewed as inexpensive. The enterprise multiple was the most resilient of the three value measures over the last decade in the U.S., in a period that was not favorable for value stocks. That trend has continued as firms with a high enterprise multiple have significantly outperformed those with a high book-value multiple over the past year.

A focus on enterprise value

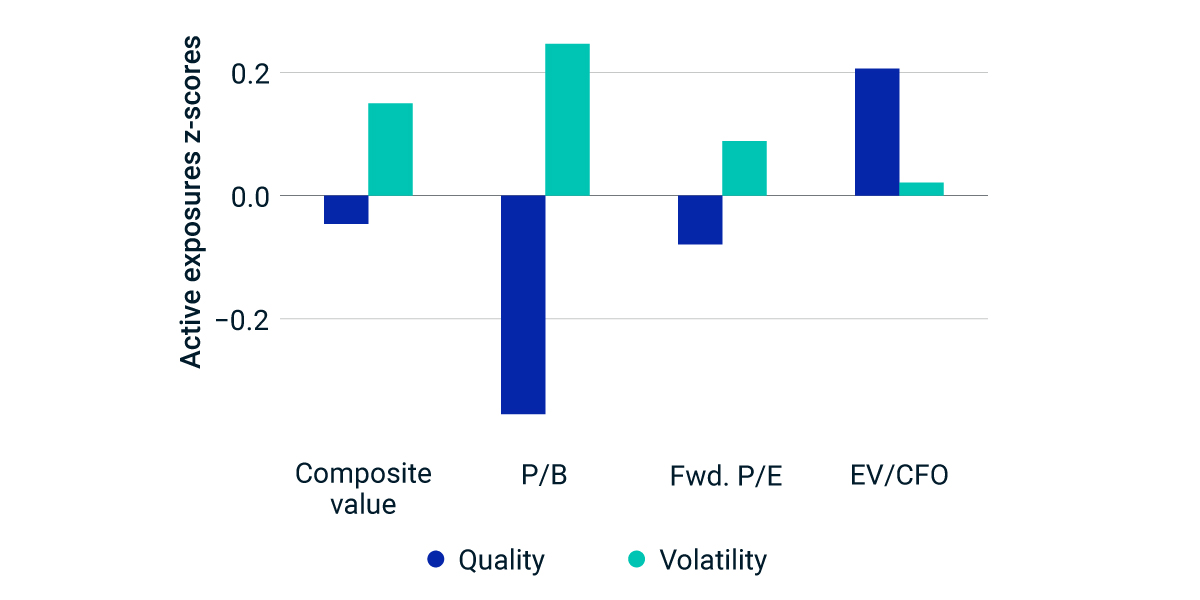

The enterprise multiple can be effective when comparing businesses with different levels of financial leverage, as well as in the evaluation of capital-intensive companies. It also complements asset- and income-focused valuation measures. We found in our analysis that including enterprise-multiple valuation in index construction resulted in constituent firms that were more defensive and of higher quality, which may have implications for investors in the current environment.

Varied performance of valuation measures

The enterprise multiple’s defensive streak

Related Content

The Value of a Sector-Based Perspective

After years in the shadows, value stocks have emerged into the light this year, amid higher inflation and rising interest rates.

Explore MoreFinding Value, Building Single-Factor Portfolios

In this study, we focus on some of the issues investors face when constructing long-only non-optimized single-factor portfolios using simple heuristics-based rank-select-weight algorithms.

Learn More