Extended Viewer

US Commercial Real Estate Sales Motor on in First Quarter

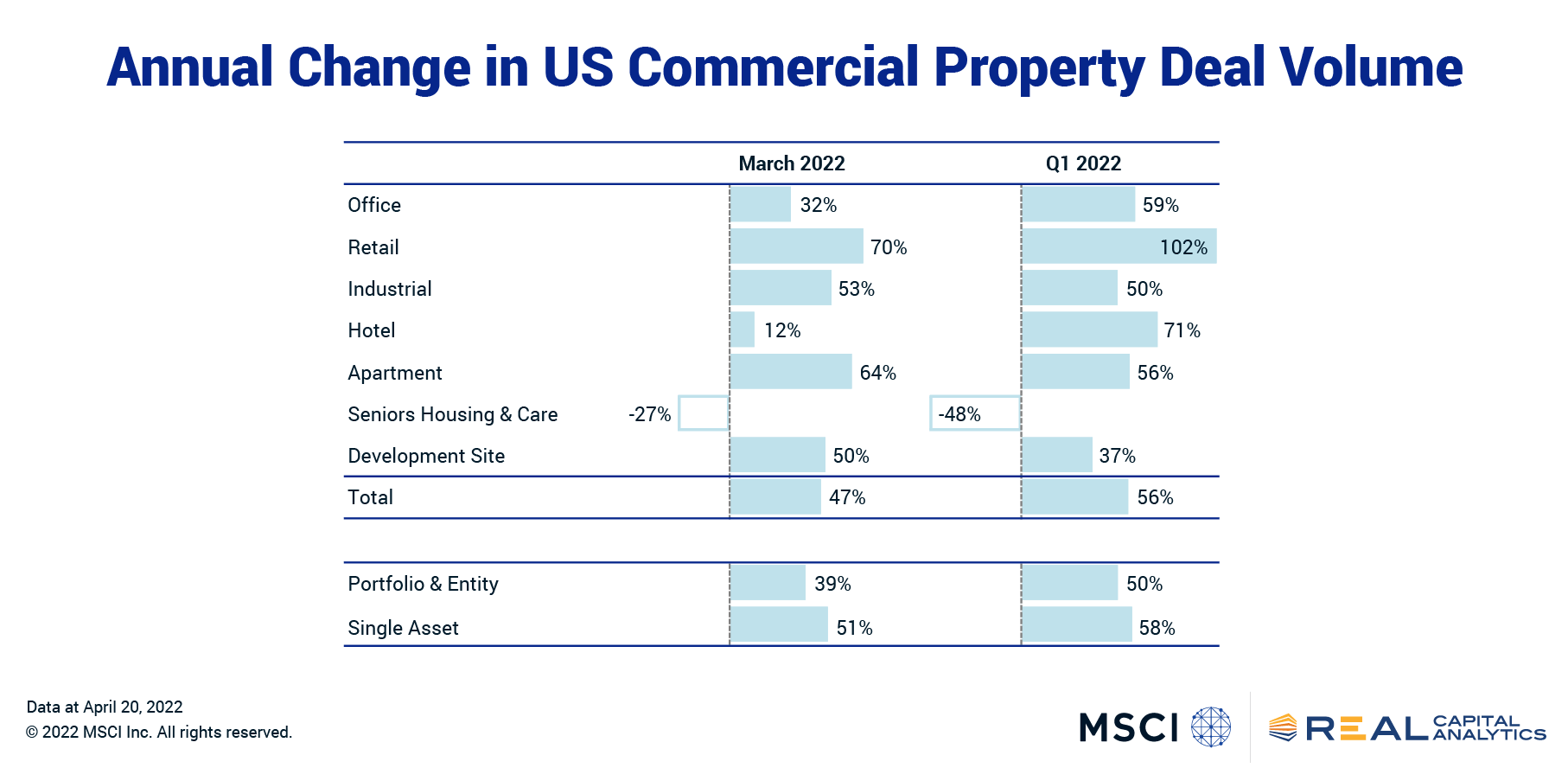

U.S. commercial property sales climbed at double-digit rates from a year ago in Q1 2022 despite the uncertainty around war, interest rates and inflation. Sales activity in the first quarter increased 56% on the same period a year ago and in March activity increased 47% from a year prior, the latest edition of US Capital Trends shows.

Closing a commercial property transaction is a process measured in months and weeks however, so the activity through the end of March likely reflects sentiment from the start of the year. The fallout from recent uncertainty, if any, would likely be seen in coming months.

Individual asset sales grew at a 58% year-over-year rate in the first quarter, a slightly stronger pace than the market overall. Portfolio and entity-level activity rose because of M&A-type transactions. Entity-level deals totaled $11.8 billion versus none a year earlier.

While deal activity climbed, the pace of price growth did decelerate from the recent record highs, as shown in the latest RCA CPPI: US report. The RCA CPPI All-Property Index climbed 17.4% from a year earlier in the first quarter.

Related Content

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Explore More