Extended Viewer

This Is What Overseas Firms Have Been Buying in Australia

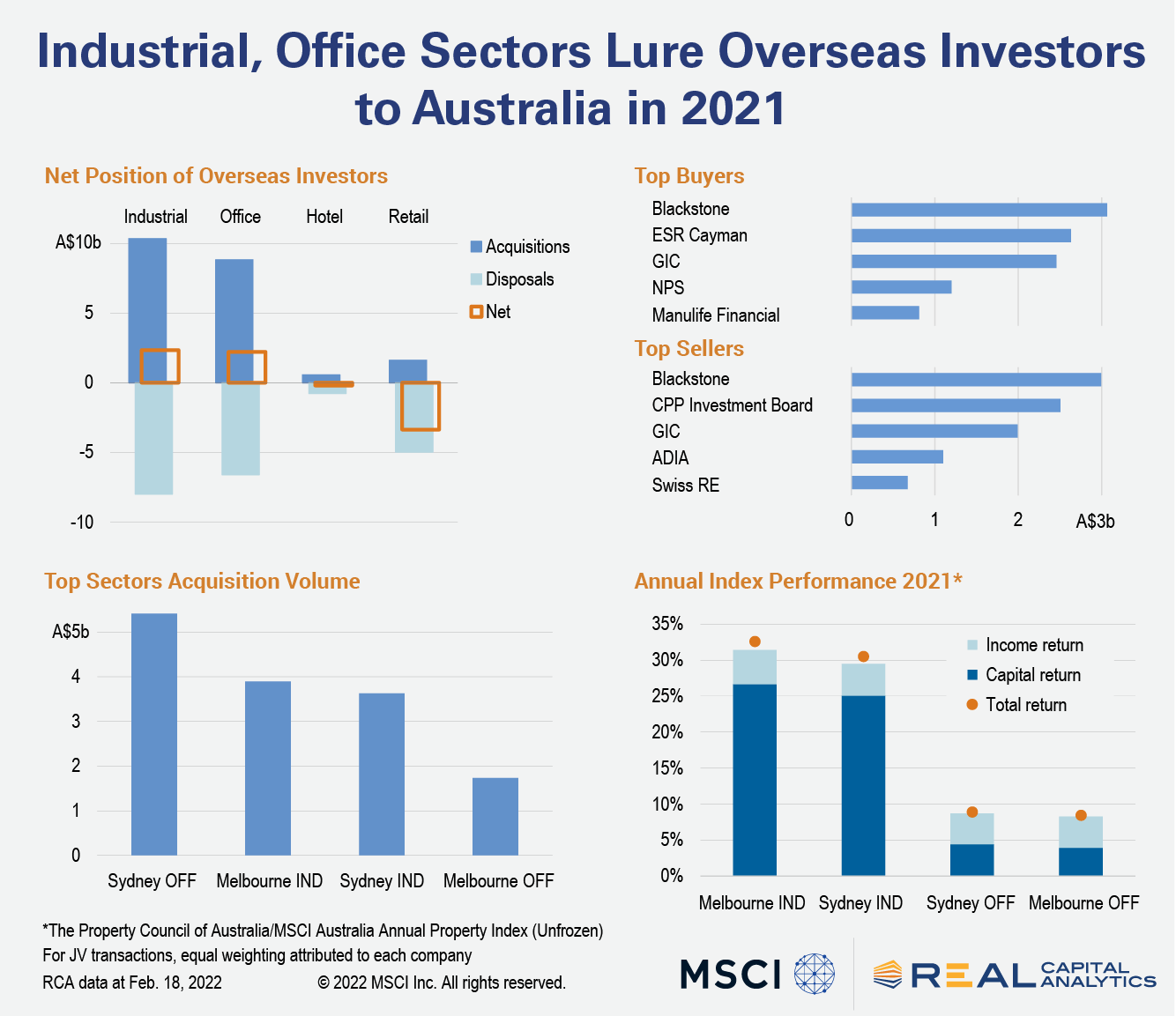

In 2021, overseas investors in Australia accounted for nearly 30% of commercial real estate transaction volume and cross-border players were involved in some of the year’s most significant deals. However, unlike their domestic counterparts, these investors were mainly focused on two core sectors and two core markets.

The industrial sector logged A$10.3 billion (US$7.4 billion) of acquisitions by cross-border players and A$8.0 billion in disposals in 2021. The office sector also saw its fair share of activity, with A$8.8 billion in acquisitions and a positive net position of A$2.2 billion. Conversely, the retail sector saw limited appetite from overseas capital and ended the year with a negative net position of A$3.4 billion.

The top five overseas investors for 2021 were heavily focused on industrial, with four of them deploying more capital to the sector than any other asset class. However, it was also the most divested asset class. Blackstone was the number one overseas buyer and seller of assets in Australia for 2021, having been involved in two of the most significant transactions for the year: the sale of the Milestone Logistics Portfolio and the purchase of a 49% share of the Dexus Australia Logistics Trust.

Cross-border investors were heavily focused on Sydney, with 46% of all overseas capital deployed to Australia’s largest market. The lion’s share went into the Sydney office sector, with notable transactions such as Blackstone’s acquisition of a 50% stake in Grosvenor Place and M&G Real Estate partnering with Mirvac to acquire a 50% share of the EY Centre.

The Sydney industrial market also garnered a significant amount of overseas investment, at A$3.6 billion, as several assets housed within the large portfolios that transacted were located in Sydney. The Melbourne industrial market was the second most popular sector with overseas investors as they spent A$3.9 billion. In total, Australia’s two most populous cities garnered 75% of all overseas capital deployments as investors stuck to core offerings in core markets.

Acquisition levels, of course, only tell part of the story, so it is important to look at how these segments performed over the year. According to The Property Council of Australia/MSCI Australia Annual Property Index, of the four markets with the highest overseas investment, the Melbourne industrial sector came out on top with an annual total return of 32.5%. This result was almost entirely driven by an increase in the underlying asset value, resulting in a capital return of 26.6%. Similarly, the Sydney industrial market recorded a total return of 30.5% and a capital return of 25.1%. It is safe to say that investors in these markets were acquiring assets on a steep pricing upswing.

Conversely, the office sector markets saw relatively modest returns as value increases were quite muted compared to the industrial sector, and significantly both the Sydney and Melbourne markets underperformed the overall office return. But does this mean that investors saw some relative value in these markets and expect strong growth over the next few years? It does seem that way as overseas investors have already exchanged on over a billion dollars’ worth of Sydney office acquisitions so far in 2022.

Related Content

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Explore More