Extended Viewer

The Integration of China Onshore and Offshore Equities

While the MSCI China Index declined 21.8% in 2022 and underperformed the MSCI EM ex China Index by 3%, the return dispersion within the Chinese equity market was also noticeable. The MSCI China ex A Index underperformed the MSCI China A Index by 9% in first 10 months of 2022, but outperformed by 26% since November.

China equity-market landscape

China’s equity market is segregated into different listing locations resulting in many share types.1 Due to the nature of listed companies, some may be more vulnerable than others to the headwinds China faced since 2021. For example, P chips and overseas listed companies were more exposed to China’s domestic regulatory changes and delisting risk related to the HFCAA.

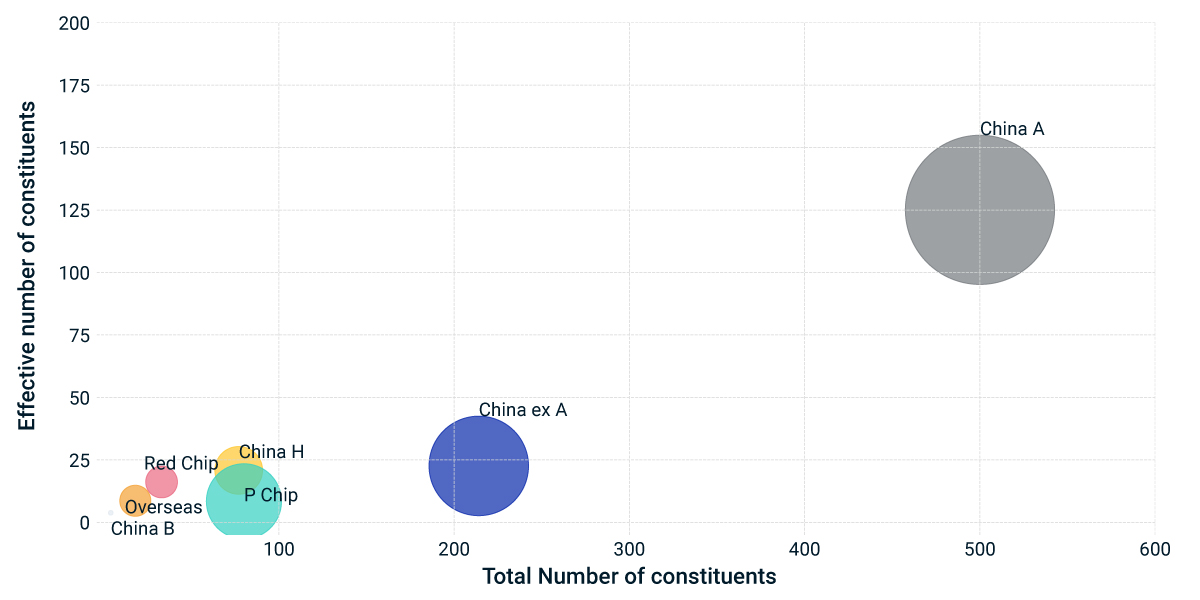

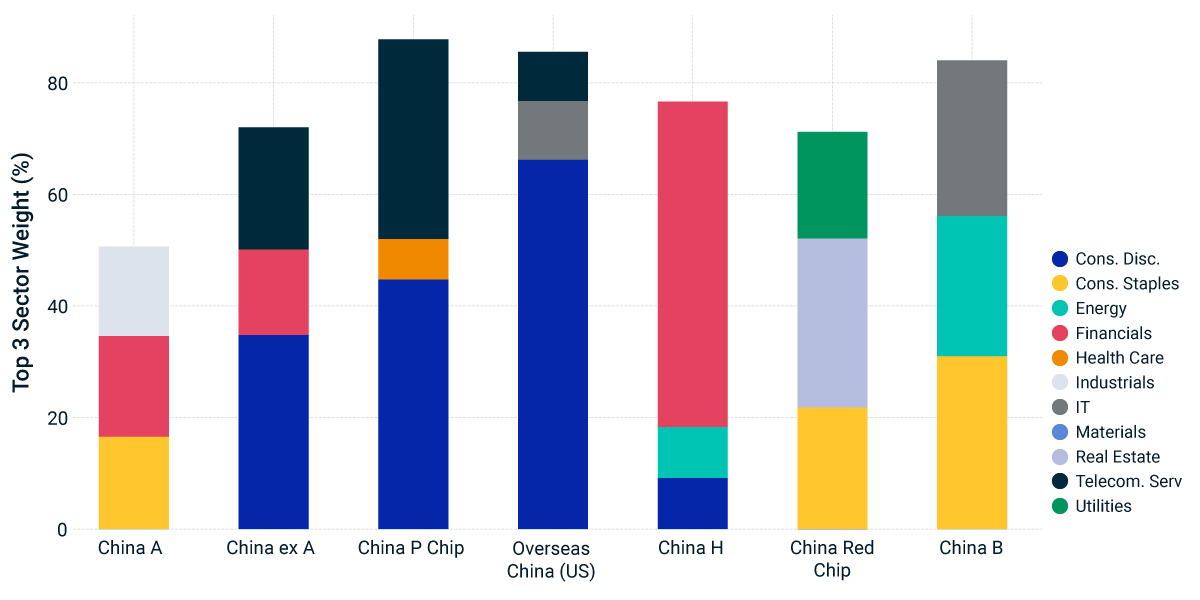

The onshore China A equity market is also larger, less concentrated, and more diverse than the offshore market. The market capitalization of the MSCI China ex A Index is only 44% of the MSCI China A Index, which had significantly more constituents and a lower concentration2 at year end (shown in the left chart). Each offshore-listed share type was dominated by the top two or three sectors, but with varied sector allocation profiles (right chart). The China onshore equity market has the potential to be balanced and resilient in market downturns, while offshore equities may possess greater sensitivity to market sentiment and sector rotation. For example, Alibaba and the MSCI P Chip Index jumped 8.7% and 3.3%, respectively, on Jan. 9 after news of Jack Ma’s stepping back on the same day.3 Thus, an integrated China equity opportunity set that includes both onshore and offshore equities may offer more diversified exposure to the Chinese economy.

Equity market size and concentration by share type

Top sectors by share type

1 A shares and B shares are listed in mainland China, denominated in CNY (A shares) or USD/HKD (B shares). H shares, Red chips and P chips are listed on the Hong Kong Stock Exchange, and refer to securities incorporated in mainland China, securities of state-owned companies incorporated outside of mainland China and securities of privately owned companies incorporated outside of mainland China, respectively. Overseas listed refers to securities (including ADRs) listed outside of mainland China and Hong Kong.

2 Concentration measured by effective number of constituents, which is calculated as the inverse of the Herfindahl-Hirschman Index (HHI)

3 Reuters, “Ant-linked firms' shares rise after news of Jack Ma ceding control; Alibaba jumps,” Jan. 9, 2023.

Related content

Markets in Focus: Investors Look to Capture Big Market Shifts

The MSCI ACWI Index was down 18% in 2022.

Learn moreDiversification for Home-Biased China Investors

The U.S. and China represent two of the largest and complementary global-equity markets.

Read moreChina at a Crossroads: Three Scenarios for Investors

After Chinese stocks declined considerably in the past months, Chinese authorities’ COVID-19 lockdowns have added another headwind to the world’s second-largest economy.

Explore more