Extended Viewer

Tariff Uncertainty Clouds Outlook for Low-Carbon Capex

Global trade policies, higher interest rates and inflation can create short-term challenges for companies and investors focused on decarbonizing their asset portfolio. For investors, companies in the utility sector1 tend to be a defensive play, yet their exposure to tariff-related risks depends on individual business models.2 Despite the near-term headwinds, our previous research finds that carbon emissions are a top sustainability factor for the market outperformance of these companies over the long term.3

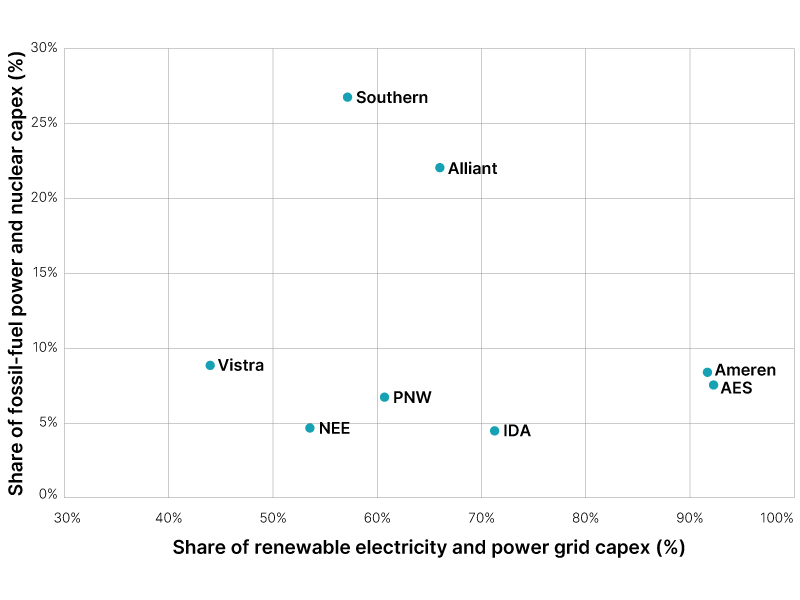

U.S.-based utilities with a high proportion of planned investments in renewable energy and networks may come under greater pressure to scale down such plans in the coming years. By contrast, peers with a greater share of fossil-fuel-related investments (mostly focused on gas infrastructure) may be less exposed in the short run.

For U.S. utilities, higher tariffs and trade barriers may hinder their ability to meet rising electricity demand from data centers and curb ambitions to transition to cleaner energy sources.4 Despite robust domestic U.S. manufacturing for electrical components, a rising demand-induced shortage has forced U.S. utilities to source equipment such as transformers, circuit breakers, switchgears and gas turbines from abroad.5 For solar, wind and batteries, supply-chain reliance on China and Europe as well as power-project investment inflows from European and Canadian utilities may all be affected by uncertainty around tariffs.6

US utilities’ investment by type

1 Sectors refer to the Global Industry Classification Standard (GICS®) sectors. GICS is the industry-classification standard jointly developed by MSCI and S&P Global Market Intelligence.

2 Potential avenues of exposure include higher costs for clean-energy equipment, higher borrowing costs and a volatile economic and policy environment affecting regulatory considerations. Utility companies often operate in a regulated environment; thus if regulators adjust their prioritization of affordability, reliability and sustainability of energy, utilities may need to change their resource planning and thereby adjust their earnings outlooks.

3 Over a 12-year period from September 2012 to August 2024, better performance in the carbon-emissions key issue was observed to have the highest stock-specific contribution to long-term performance among all MSCI ESG Ratings key issues for constituents of the MSCI ACWI Investable Market Index’s utility sector.

4 U.S. average annual load growth was 3% in 2024, after over two decades that averaged 0.6-0.7% per year. Demand is expected to increase by 16% from 2024 levels through 2029, largely driven by data-center growth forecasts. Source: John D. Wilson, Zach Zimmerman and Rob Gramlich, “Strategic Industries Surging: Driving US Power Demand,” Grid Strategies, December 2024.

5 Simon Casey, “GE Vernova CEO Sees Order Backlog Stretching Into 2028,” Bloomberg, March 11, 2025.

6 China plays a dominant role globally in supplying batteries, solar panels and other clean-tech equipment and critical minerals. Source: “Current and projected geographical concentration for manufacturing operations for key clean energy technologies, 2022-2030,” International Energy Agency, May 11, 2023. Europe- and Canada-based companies are major investors in U.S. clean-energy infrastructure (e.g., Brookfield Renewable Partners, Fortis, Algonquin, RWE, Iberdrola, EDP and National Grid). Canadian utilities (e.g., BC Hydro, Hydro Québec and Ontario Power Generation) are major exporters of clean power to the Northeast U.S. (e.g., Eversource, Avangrid and Consolidated Edison).

Related content

Navigating Uncertainty: Tariff Implications

What global shifts mean for decision-makers.

Explore the hubWho’s Enabling the US Energy Transition?

Since the introduction of the U.S. Inflation Reduction Act, there has been an influx of investments from companies upstream from the power-generation value chain. Understanding these energy-transition trends could be key in identifying opportunities.

Read the quick takeIRA Boosts US Utilities’ Plans to Grow Renewables and Storage

U.S. utilities are increasing investments in solar, wind and battery installations. Investors can learn more about a company’s transition strategy from these energy-generation plans than from tracking past performance on emissions.

Read the blog