Extended Viewer

Ownership Structures in Emerging Markets

Having a better understanding of the ownership structure of a firm and the various ownership control groups that may exist, can help international investors assess how loud their voices will be when the firm’s strategy and direction is being decided.

To help investors assess that potential impact, MSCI’s ESG Research team developed an ownership group classification framework. This classification rests on two dimensions:

- Owner classification: which group, if any, has effective control (largest percentage of voting rights). It covers three categories: controlling (>=30% of voting rights), principal (=<10 – 30% voting rights) and widely held (no shareholder has more than 10% of voting rights).

- Owner type: who is the dominant owner (founder, family, state and other)

We then combine the two dimensions to better describe the ownership structure and level of control for each group. For example, if a company is classified as “state owned entity (SOE) controlled,” it means that the state holds at least 30% of the voting rights, while if a company is classified as “SOE principal,” the state holds between 10% and 30% of the voting rights.

Latin America vs. other emerging markets

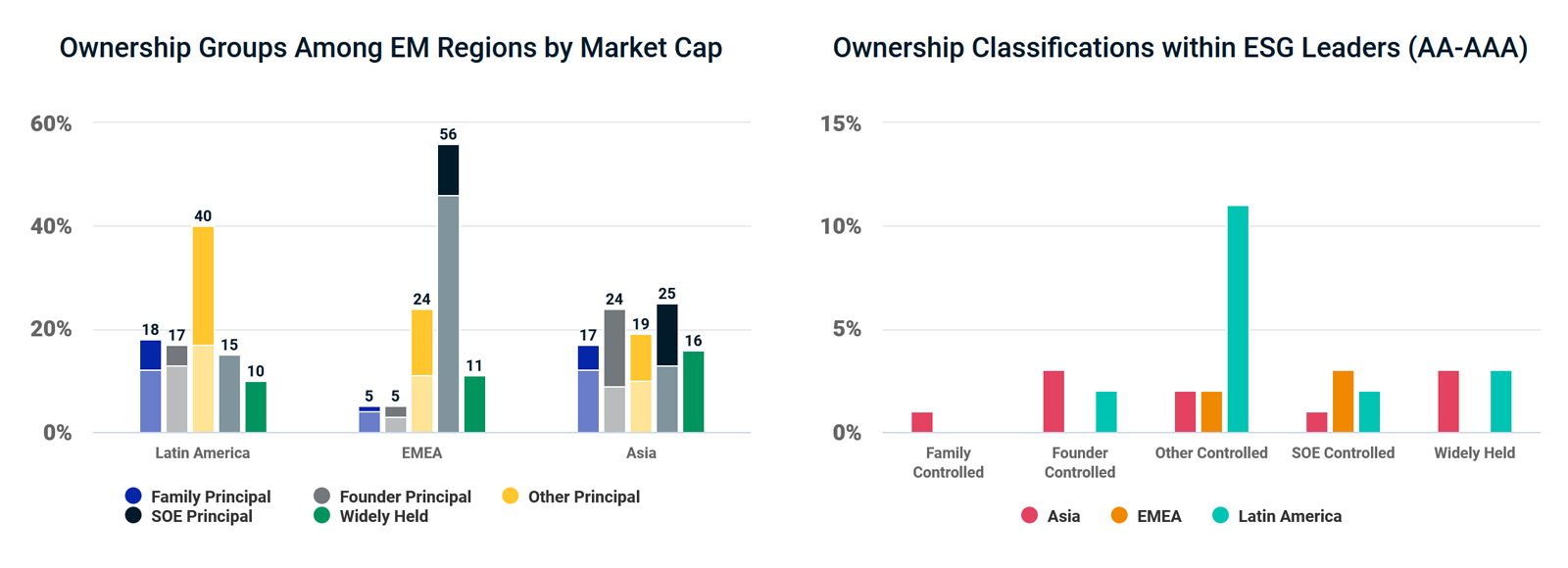

When we apply this framework to the companies in the MSCI Emerging Markets Index, we can see some stark differences between regions, as shown in the chart below. Latin America (LATAM), for example, had a different concentration of ownership groups compared with other emerging markets, especially when it came to SOEs controlled category: both EMEA and Asia have a much larger share of companies owned and controlled by the state.

Another differentiating factor in terms of ownership structure in LATAM, was the “other controlled” category. Companies in this category included a wide range of controlling investor groups, but excluded founder firms, family firms and SOEs. For example, it included companies that are publicly quoted and subsidiaries of publicly quoted firms. In Latin America, this category was concentrated in a few industries: steel (19% were “other controlled”), diversified banks (18%), hypermarkets and super centers (17%) and brewers (11%).

Latin America vs. other emerging markets

To take this analysis a step further, we sorted the companies classified as ESG Leaders (ESG rating AA to AAA) by ownership structure, as shown in below. We see that most Latin American ESG Leaders were in the “other controlled” category (11%), which was the highest share in this category across all regions. In addition, the second most common ownership structure in LATAM was “widely held.” At 3%, this was in line with ESG Leaders in Asia, but the EMEA region had no firms in this category.

All told, this unique market configuration provides a differentiated angle for assessing and comparing the effectiveness of corporate governance in Latin American companies to other regions.

Ownership structures in Latin America vs. other emerging markets

Related Content

Global Investing Trends

You’ll find insights provided in research papers, blogs and a Chart of the Week that succinctly puts topical issues in context.

Explore MoreLatin America: A Market with Unique Characteristics

Latin American stock markets have recovered strongly as the world starts to overcome some of the COVID-19 pandemic’s challenges — renewing interest in the region.

Learn MoreA Closer Look at Latin America’s Performance

Latin American markets have been historically more resilient during periods of financial distress such as the 2008 global financial crisis.

Read More