Extended Viewer

Micro-Cap Crowding and Liquidity Crunch in China Quant Funds

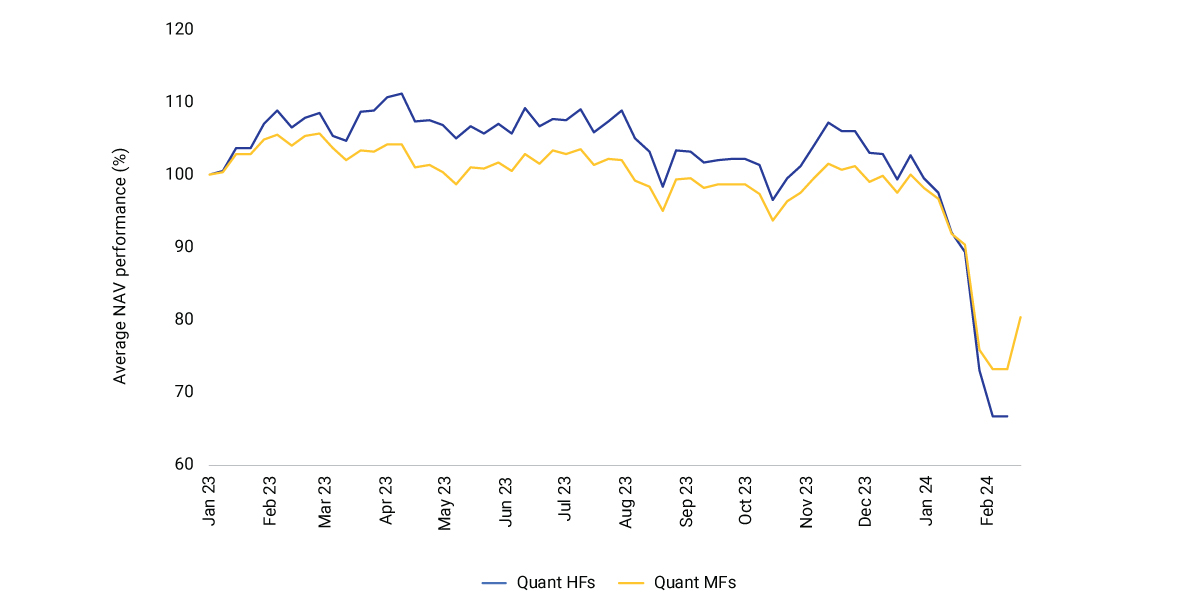

From January to mid-February, some quantitative mutual funds (MF) and hedge funds (HF) in the China-mainland market suffered drastic declines in net asset value (NAV). Meanwhile, the MSCI China A Index recorded a 1.2% YTD gross return in CNY, as of Feb. 23.

A mixture of forces — leverage, crowded long positions in small- and micro-cap stocks and an investor rush into large-cap stocks when the segment demonstrated signs of resilience — appears to have caused this mini liquidity crisis among some quant funds.

Measuring and monitoring crowding risk in China A shares

Comprehensive management of factor risk could help investors mitigate risks from market pressure. For example, using the MSCI Barra China A Total Market Equity Model for Long-Term Investors (CNLTL), we can see that, based on the latest complete holding disclosure as of June 30, 2023,1 that the worst-performing quant MFs’ most significant active factor exposure was in small caps relative to the MSCI China A Index. Based on the MSCI Multi-Asset Class Factor Model (MAC.L), small-cap exposure alone explained about 30% of the YTD NAV decline of the top quant-MF laggards.

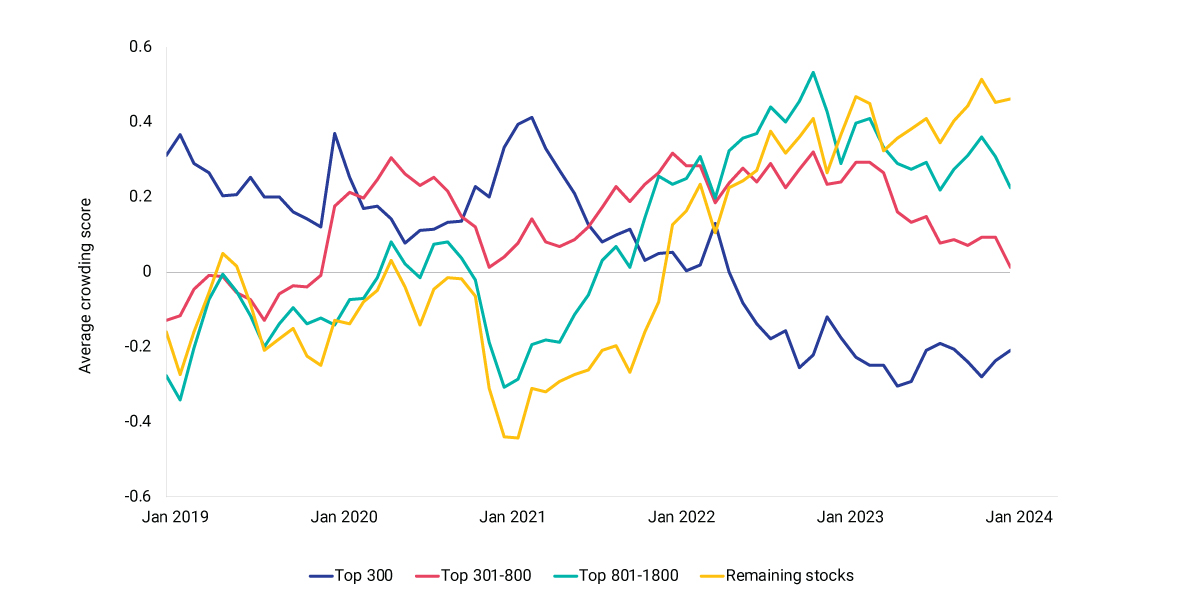

The MSCI Security Crowding Model monitors the crowding profile of stocks globally and can help alert investors to potential crowding risks. The integrated crowding scores — a combination of time-series and cross-sectional crowding metrics — of China stocks showed divergent crowding trends for size segments over the last five years.

Small- and micro-cap stocks have become more crowded over the past two years, while the large-cap space became less crowded. The smallest-stock group outperformed the largest-stock group by 2.6% in 2023. The integrated crowding score of the smallest stocks reached a five-year peak close to the end of 2023, illustrating the current looming crowding risk.

Average performance of top 50 laggards in quantitative funds

Integrated crowding score for MSCI China A International IMI stocks by size

1 Mutual funds in the China-mainland market typically release their annual year-end reports, which include the complete holdings list, in March.