Extended Viewer

Mediating High Outflows in China’s Stock Connect

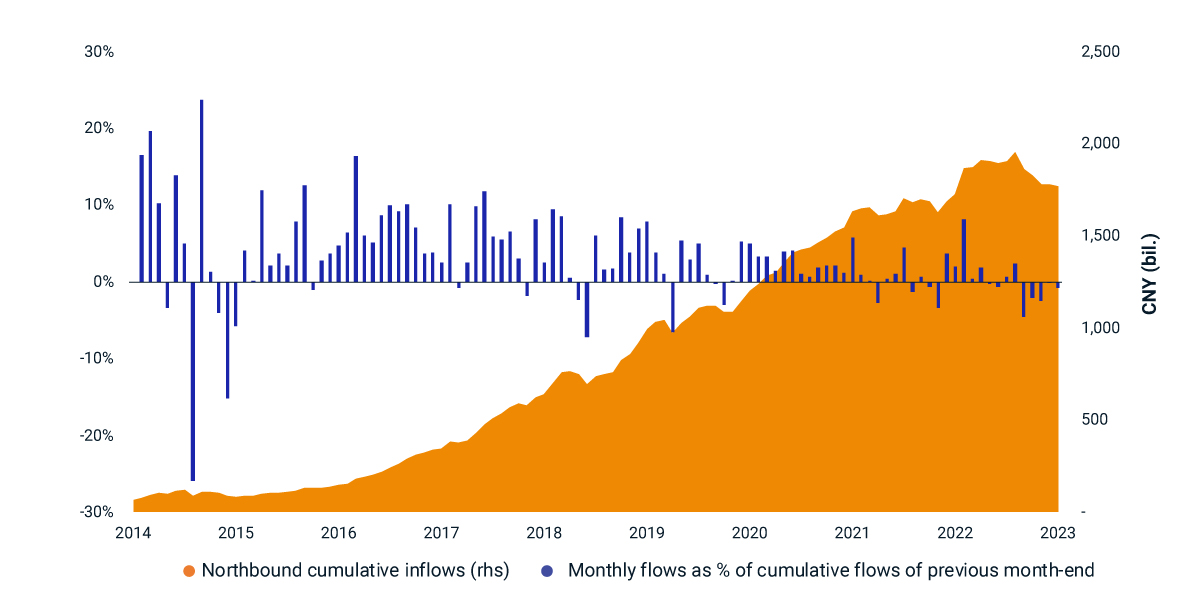

China’s Northbound Stock Connect — a major channel for Hong Kong and international investors to trade in China A shares — had a total net outflow of CNY 187 billion (USD 26 billion) from August to December 2023. These outbound flows were 9.5% of the channel’s cumulative net inflows since the launch of Stock Connect, in November 2014, through July 2023. Although the duration and absolute size of the outflows set a record, the monthly magnitude relative to cumulative net inflows was comparable to previous outflows. One such outflow was in May 2019, a time of rising trade concerns and shifting economic policies in China.

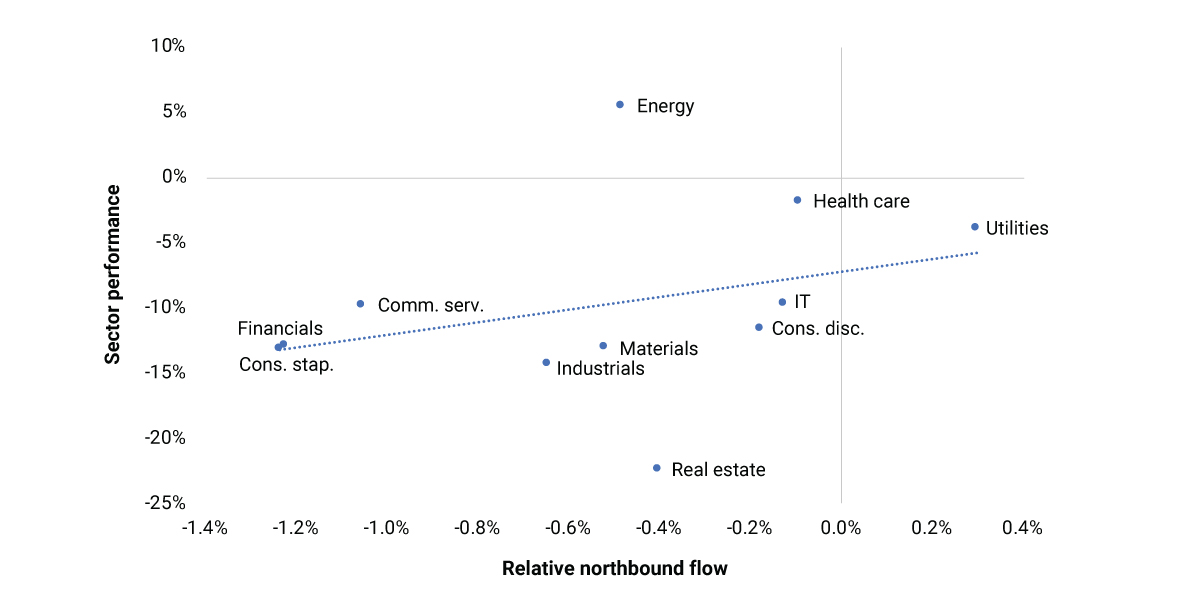

Our analysis shows that the latest round of northbound net selling was most concentrated in the financial, consumer-staples, industrial and materials sectors, which also were among the top-weighted sectors of the MSCI China A 50 Connect Index. These four sectors also underperformed in the five months ending December 2023. Measured by net flows as a percentage of the sector’s free-float market capitalization in the MSCI China A Onshore Investable Market Index (IMI), financials and consumer staples, under strong selling pressure, underperformed sectors facing less selling pressure, such as health care and utilities.

Over the August-December 2023 period, the MSCI China A 50 Connect Index closely tracked the broader MSCI China A Index with a correlation of 95% and beta of 1.04. The average selling pressure on the 50 companies in the MSCI China A 50 Connect Index was more than three times the average selling pressure across the large-cap universe, as measured by the MSCI China A Large Cap Index.

Some investors, concerned about sustained market outflows and fickle sentiment, may have managed these portfolio risks in the past with instruments such as index-linked futures and options or used index-linked ETFs to hedge outflow pressure.

Stock Connect northbound flows

Sectors with highest outflows had higher price pressure

Related content

Using Derivatives to Scale China and Emerging Markets ex China

China’s large share of emerging-market (EM) equities and its falling correlations with EM are leading some investors to allocate separately to the two universes. A tactical overlay of futures and swaps could be used to adjust regional exposures.

Read the postChina’s Role in Supply-Chain Strategies

Are parts of the global supply chain more reliant on China than other parts? We explore which industries and themes may be more dependent on China from a manufacturing-ecosystem and raw-resources perspective.

See the articleMSCI China A 50 Connect Index

MSCI China A 50 Connect Index is designed to enable international and domestic investors to track China’s sector leaders, get exposure to leading stocks in key sectors, and serve as the basis for index-linked ETFs and ETNs and other financial products.

Read more