Extended Viewer

Investors Pessimistic on Eurozone Inflation

Investors will pay special attention to Wednesday’s flash estimate of eurozone inflation, released ahead of the European Central Bank’s policy meeting in early September. It is unlikely that peak inflation has been reached, and headline inflation in the bloc may have risen to double digits.

What does the market data say?

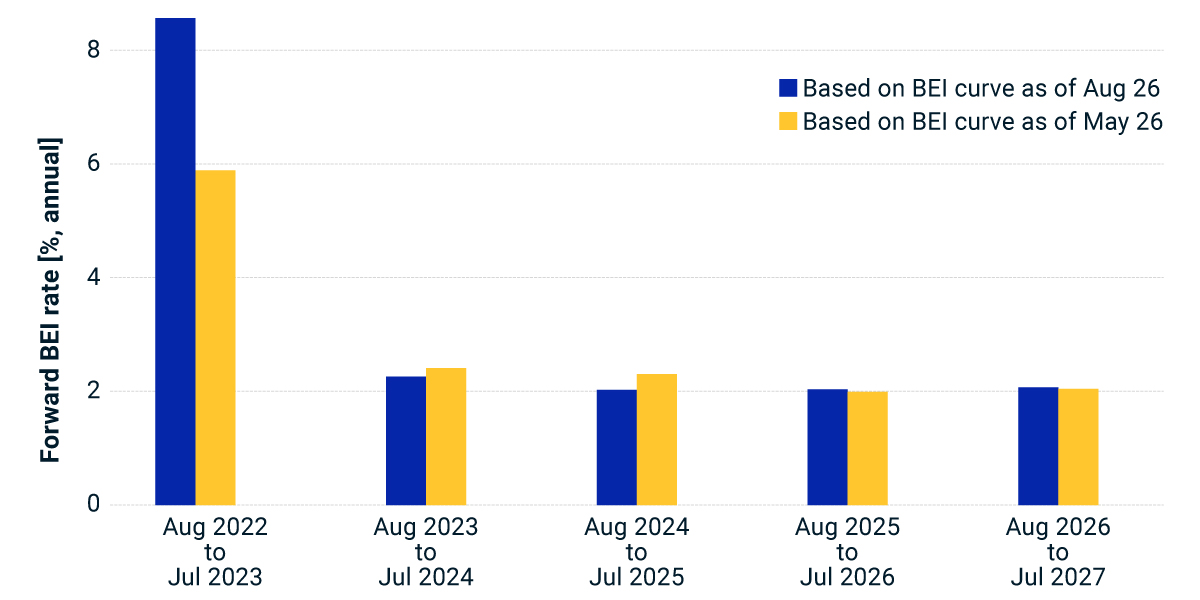

Inflation expectations based on swap-market data indicate 8.5% inflation for the year to come, which is 2.5 percentage points higher than the level prior to the ECB’s announcement of monetary-policy normalization on June 9 (as shown in the exhibit on the left below). This raises the question of whether investors are concerned that the current pace of tightening is not aggressive enough. In the following year, however, inflation is expected to plunge to levels close to the 2% target.

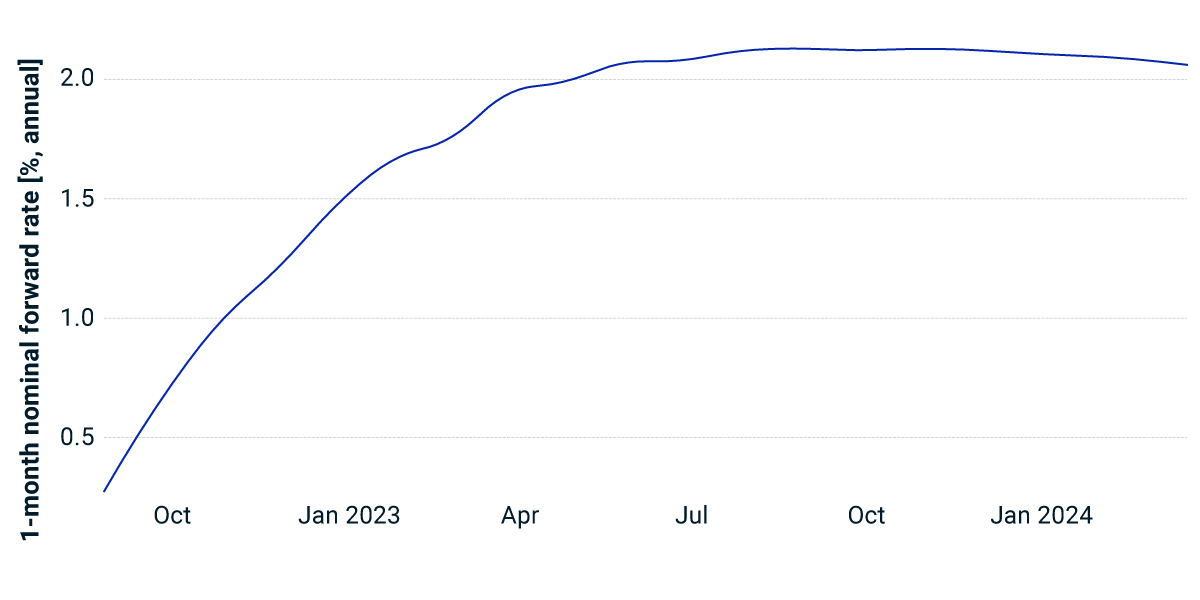

The inflation flash estimate will be a crucial input for the upcoming policy meeting, but the ECB has to balance high inflation and a weakening euro against recession risk and diverging sovereign borrowing costs. Market data points to a 50-basis-point hike in September and a further 100 basis points of hikes before the end of the year (see the right-hand chart below). Unlike in the U.S., where the market expects rate cuts in 2023, the eurozone short rates are expected to rise and stay above 2% in 2023. This is aligned with what ECB board member Isabel Schnabel signaled at the Jackson Hole conference: To prevent high inflation from becoming entrenched in expectations, central banks need to act forcefully.

Market expects high near-term inflation and aggressive rate hikes

Related Content

Will ECB Policy Hit Its Mark?

The ECB is facing inflation, the risk of diverging sovereign borrowing costs and the threat of gas shortages that could lead to another supply shock. Amidst this uncertainty, we revisit four scenarios about eurozone inflation and ECB monetary policy.

Read MoreHow Eurozone Inflation and ECB Policy Could Impact Markets

In a portfolio stress test, we consider the uncertainty around eurozone inflation and the European Central Bank’s policymaking. We outline four scenarios and their potential impact on the bloc’s economy and a hypothetical multi-asset-class portfolio.

Read the BlogDeteriorating Liquidity Complicates Fed Action

During the early days of COVID-19, Chair Powell partly justified the Fed’s asset purchase program as necessary to restore market liquidity. Today, it seems quite plausible that Treasury market liquidity may soon be worse than during the pandemic.

Explore More