Extended Viewer

In the Eye of the Tariff Storm: Hazard Exposures of US vs Global Manufacturing

Extreme-weather events occur regardless of global economic policy, posing risks of infrastructure damage and production disruptions. As tariff policies evolve, damage or disruption, particularly from tornadoes and hailstorms, could place a greater strain on U.S. manufacturing sites compared to those outside the country.

We analyzed 102,759 global manufacturing sites (of which 73,170 are in the U.S.) across seven GICS sectors to determine the physical hazards that these sites are exposed to.1

Across all sectors, U.S.-based facilities face elevated risks from acute hazards such as tornadoes, hailstorms and wildfires compared to their global counterparts, as shown in the table. Higher tornado and hailstorm risks are particularly pronounced in the materials, consumer discretionary, consumer staples and energy sectors.

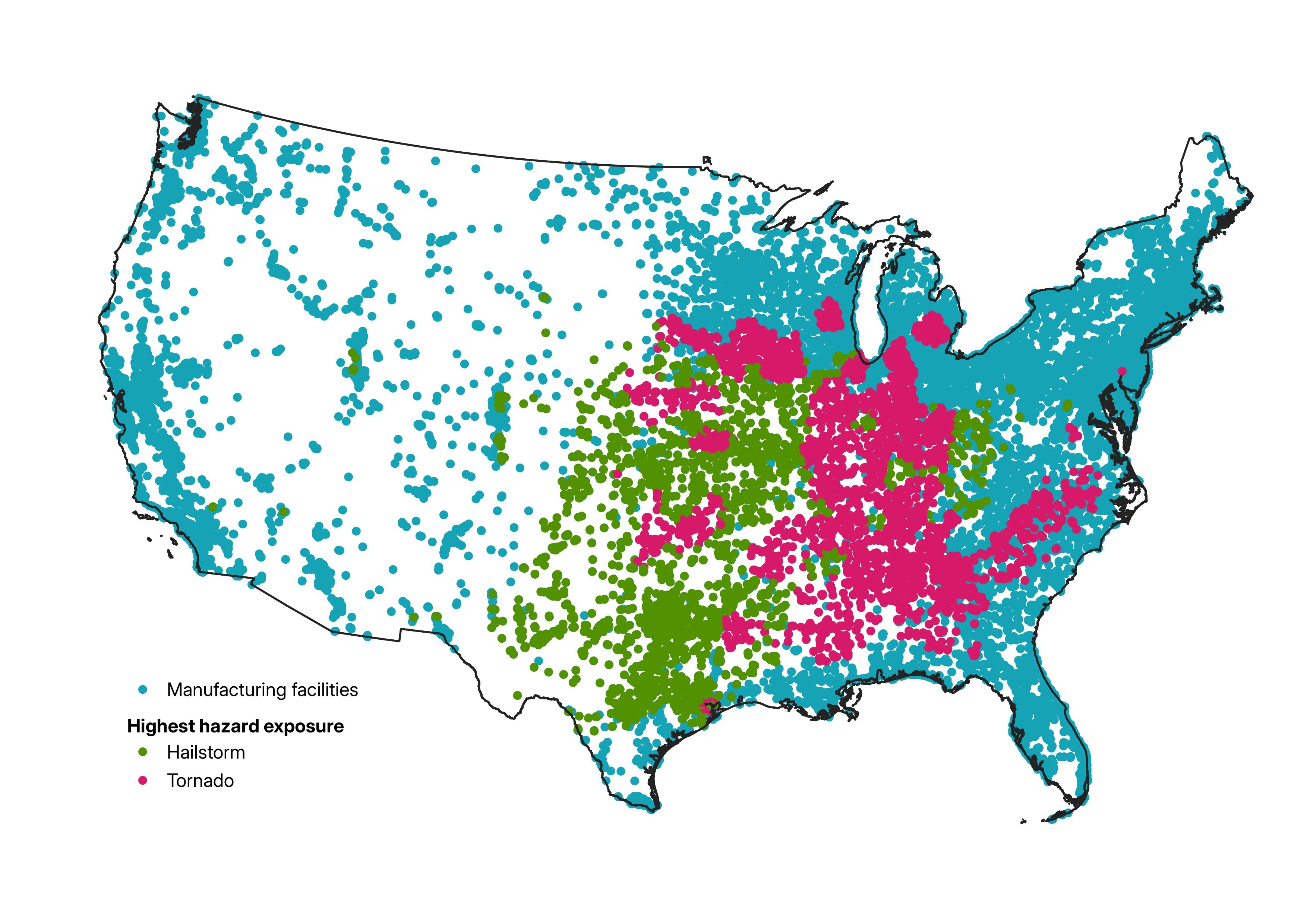

A geographic concentration of hailstorms and tornadoes

Identifying sectors where manufacturing facilities face heightened physical risk relies on assessing these risks at the location level. Over one quarter (28%) of U.S. manufacturing sites have greater exposure to tornadoes or hailstorms compared to any other hazard. As the map shows, these sites are heavily concentrated in the eastern two-thirds of the country, where such events are most frequent.

Reassessing the risks

Given the elevated exposure to acute hazards, investors may need to reassess the resilience of their investments in U.S. manufacturing sectors. Proactive risk management and strategic planning can help mitigate the adverse effects of these physical climate risks.

US manufacturing sites highly exposed to tornado and hailstorms vs. non-US sites

Tornadoes and hailstorms present highest risk to over 25% of US manufacturing assets

1 GICS is the global industry-classification standard jointly developed by MSCI and S&P Global Market Intelligence. GICS sectors analyzed for manufacturing facilities include consumer discretionary, consumer staples, energy, health care, industrials, information technology and materials.

Related content

Navigating Uncertainty: Tariff Implications

What global shifts mean for decision-makers.

Explore moreDouble Trouble: Exposing the Risks of Hurricanes Helene and Milton

Historic estimated losses from two recent hurricanes highlight the importance of understanding asset locations that face intensifying climate impacts.

Read the quick takeIt’s Getting Hot in Here: Assessing the Risks of Extreme Heat in the US

Chronic heat is causing stress on workers and driving the need for adaptations to current working conditions. Using geospatial intelligence, we assess the potential impact of heat at the asset level for U.S. constituents of the MSCI ACWI Investable Market Index.

Read the blog