Extended Viewer

Global Price Growth Ticks Lower on Weaker European Increase

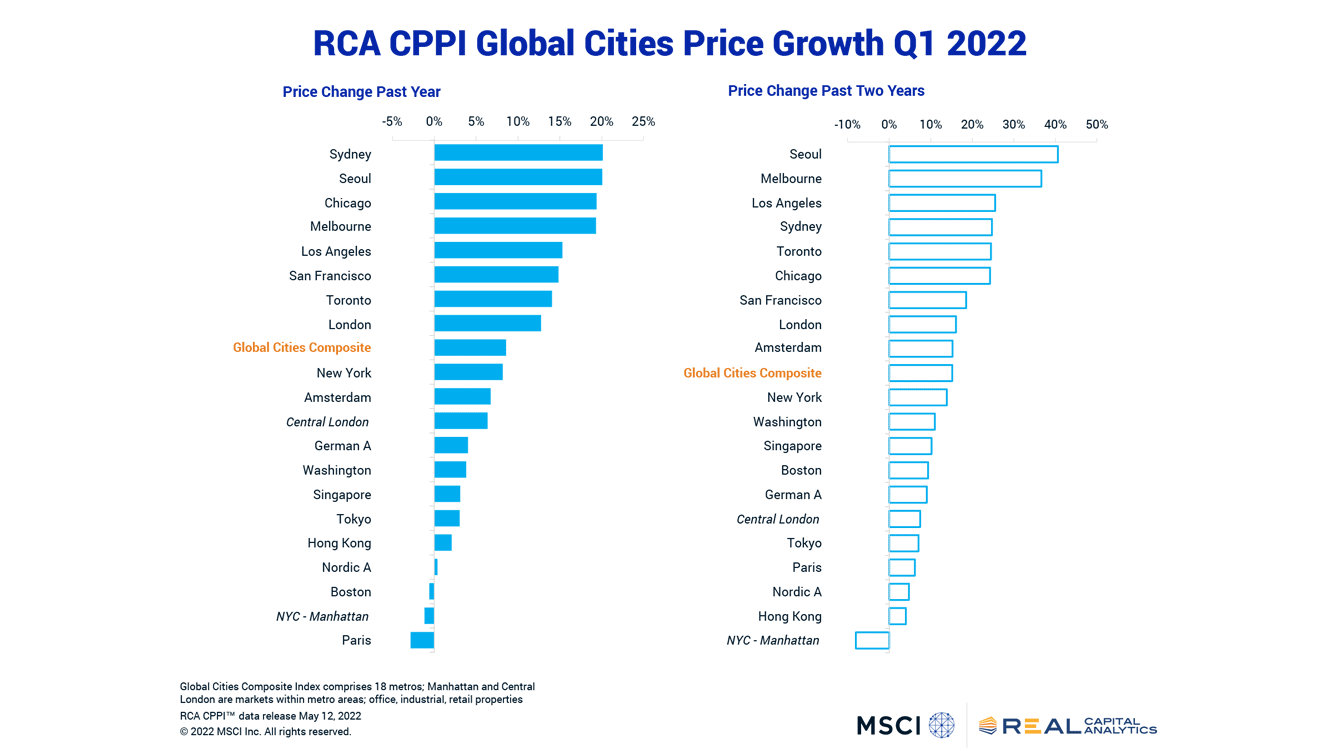

Global commercial real estate price growth eased slightly in the first quarter of 2022, as double-digit price increases in North America and Asia Pacific were countered by weaker headline growth in Europe, the latest RCA CPPI: Global Cities report shows. The Global Cities Composite reached 8.6%, lower than the 9.5% rate seen at the end of 2021.

Among the global cities, Sydney edged Seoul to the top of the rankings of annual price growth. Both cities notched a 20.1% rate, but Seoul’s increase was stacked on a similar gain in the prior 12-month period, making it the city with the biggest price gain since the start of the Covid era. Melbourne also posted a strong price increase over the past year, aided by robust trading of logistics properties.

North American cities were well represented within the top 10. Like Sydney, Chicago and San Francisco were late bloomers, with price growth picking up much more quickly in the past 12 months than the year before that. Both Los Angeles and Toronto exhibited a much more consistent pace of growth over the past two years, buoyed by their industrial markets.

Despite Europe’s more subdued rate of growth, there was one bright spot: London. Commercial pricing increased by 12.7% over the past year, just ahead of the Global Cities Composite average, off the back of a resurgence in cross-border capital inflows. At the other end of the spectrum, reduced deal activity in Paris’s office market has hurt pricing, resulting in a 2.8% year-over-year drop.

==

If you are a Real Capital Analytics client you can access RCA CPPI reports and conduct your own pricing analysis in the Trends silo of the Real Capital Analytics website.

© 2022 MSCI Inc. All rights reserved.

Related Content

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Explore More