Extended Viewer

Factor Performance amid Concentration Shifts

Growing concentration in leading U.S. stocks since mid-2015 has created a headwind for many investment strategies, factors included. In the past 50 years, only two other periods have had concentration levels as high as at the end of July 2023: the industrial automation of the 1970s and the technological revolution of the late 1990s. Both periods paved the way for an extended regime in which concentration nearly halved.

Historically, as concentration levels have changed, factors’ performance has too

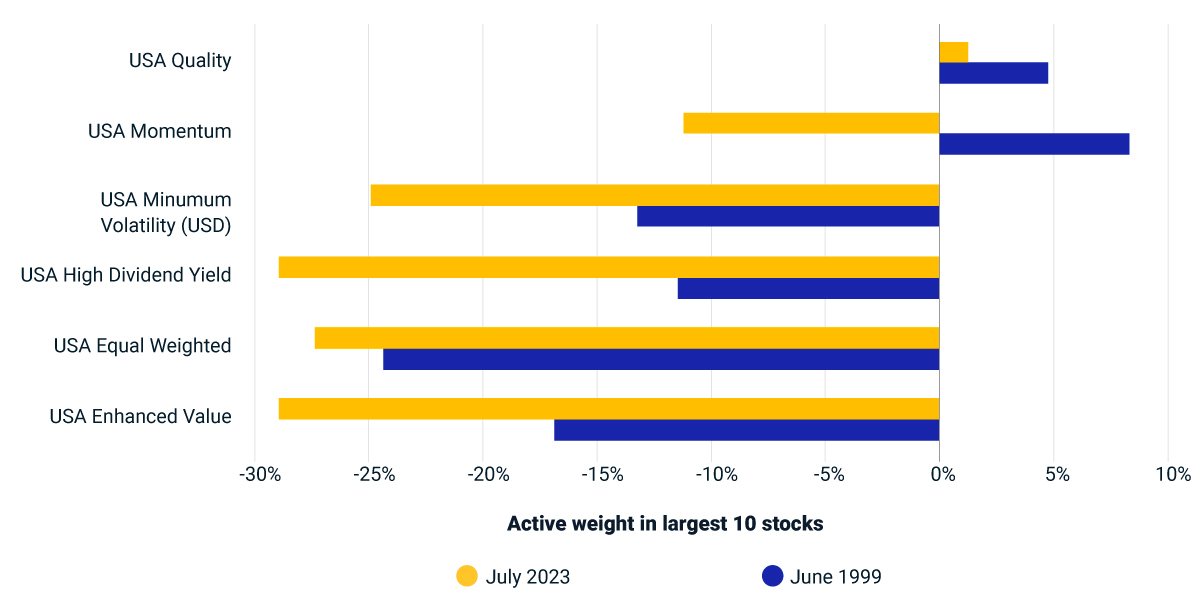

We draw a parallel between today’s technology- and AI-driven concentration and its most analogous counterpart, the late 1990s’ tech boom. As of July 2023, five of the six factor strategies we analyzed have similar or larger underweights in the top 10 MSCI USA Index constituents compared to June 1999, the last peak in concentration. Quality is the only exception, with an overweight in both periods.

An over- or underweight in these stocks can be explained by the stock’s factor characteristics or by the factor’s portfolio construction (e.g., equal weighting and minimum volatility both aim to lower concentration). Of import is the impact their weighting has had on the factor’s performance.

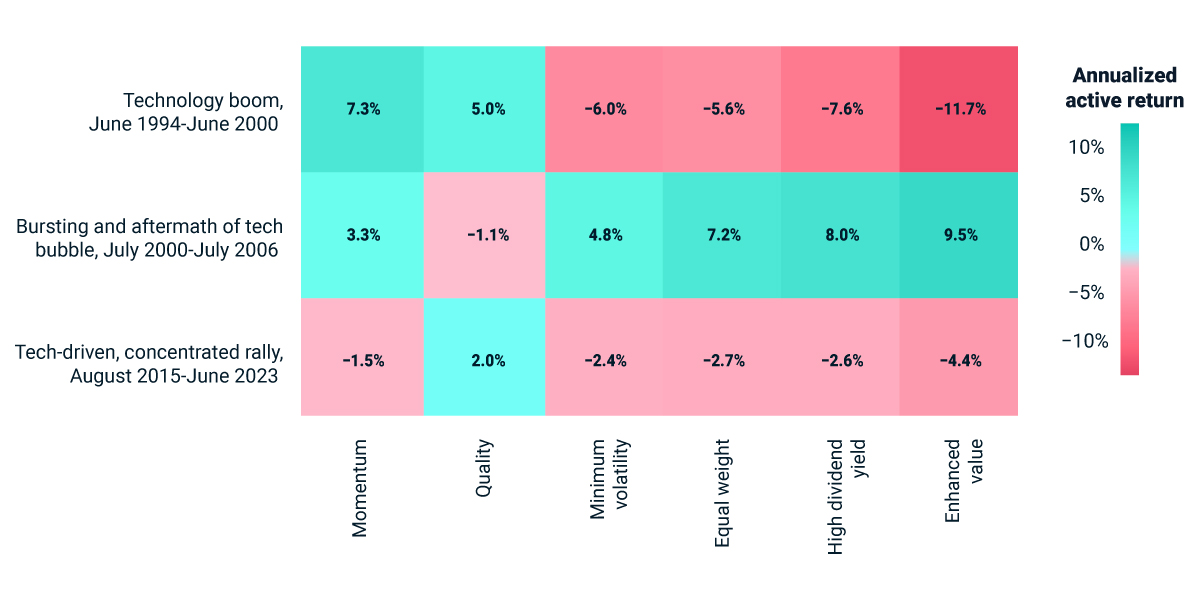

During the tech bubble of the late 1990s, as equity-market concentration rose, quality’s performance eclipsed the performance of most other factor strategies, as has been the case since August 2015. But as the technology bubble burst in the early 2000s, the concentration level declined and quality underperformed the other five factors in our analysis. Over the same period, the performance of the other factors, led by value and yield, strengthened. How concentration evolves from here will be crucial in building expectations around factor-strategy performance.

Five factors have similar or larger underweights in the top 10 stocks today vs. June 1999

As concentration levels declined in the early 2000s, value and yield outperformed other factors

Related content

Insights from Past Concentrated Rallies and Thematic Opportunities

The rally in global equities in the first half of 2023 was highly concentrated, with 10 stocks producing 53% of the MSCI ACWI Index’s return.

Explore moreAI’s Moment and Insights from Themes Past

The AI-driven rally has pushed today's market concentration to levels not seen since the 1970s, emphasizing the impact that a few large firms have had in shaping recent market returns.

Read moreQuality Time: Understanding Factor Investing

The past decade's market turbulence, rising inflation and fluctuating rates, has emphasized the importance of high-quality firms. This update to earlier research examines the quality factor’s role in navigating an ever-changing landscape.

Learn more