Extended Viewer

ESG and Climate in Focus: Balancing Climate and Financial Goals in Fixed Income

In a time of volatile fixed-income markets and expectations for “higher for longer” rates, MSCI Investment Grade Corporate Bond Climate Indexes remain largely correlated with their parent indexes. But how did they perform in terms of climate objectives, including change in carbon footprint, green versus fossil-fuel-based revenues and implied temperature rise?

To answer this question, we analyze these indexes from two aspects:

1. Emissions profile

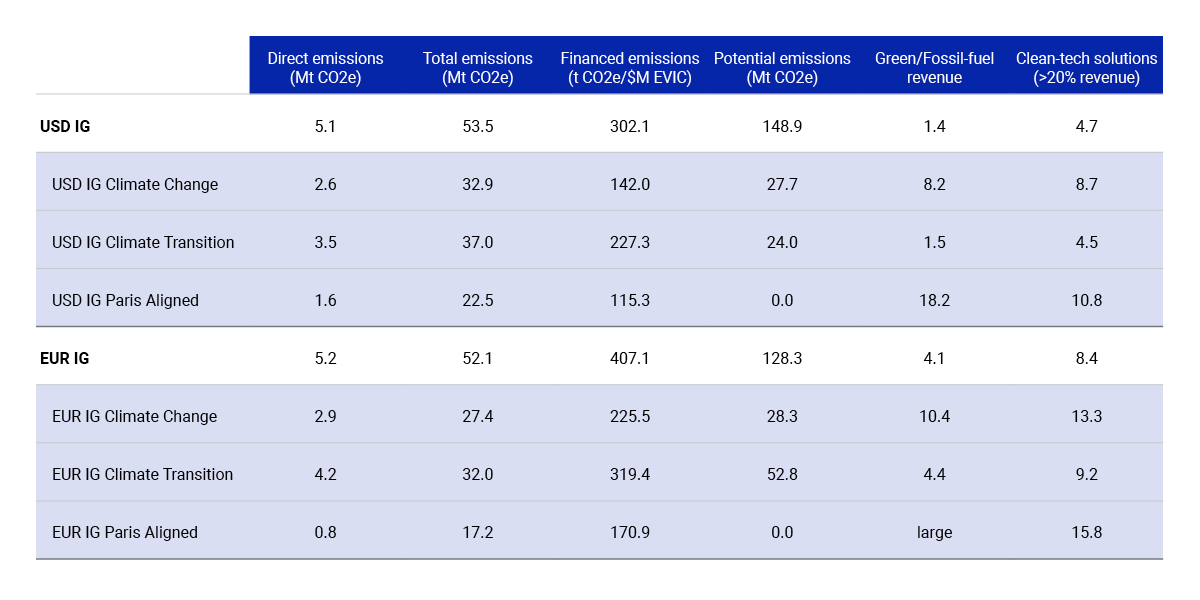

Comparing the carbon footprint of different climate indexes, we observe that almost all achieved a significant reduction in emissions intensity, potential emissions and weight of fossil-fuel-reserve holding companies compared to their parent indexes.

Looking at exposure to green technology, for example, the MSCI Paris Aligned Indexes had the largest green-to-fossil-fuel-based-revenue ratio owing to the explicit methodology criteria of maintaining a ratio 4x higher than the parent indexes. The MSCI Climate Change Indexes also showed a notable degree of improvement in this ratio versus that of the parent indexes and were in line with the parent indexes in terms of exposure to green technology.

2. Impact and risk

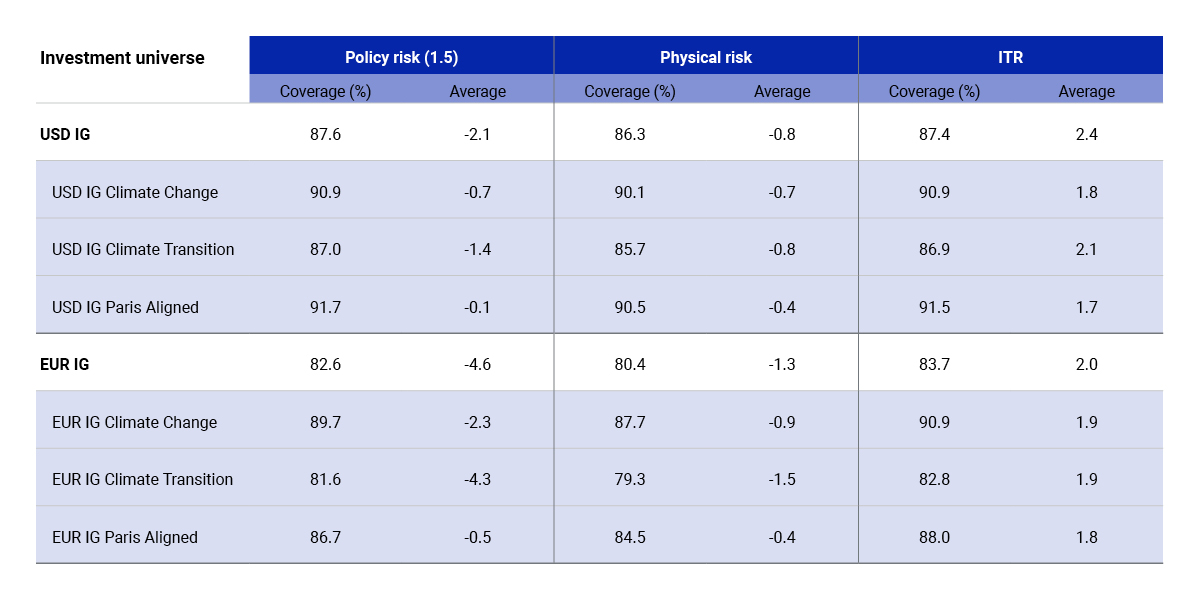

Examining MSCI Climate Value-at-Risk (Climate VaR) for policy and physical risk, as well as MSCI Implied Temperature Rise (ITR) measures for all the parent and derived climate indexes, we observed that average policy risk and ITR were lower than the parent indexes across all the climate indexes.

In short, the answer to our question is that the MSCI Climate Indexes performed well in terms of improved carbon-emissions profiles and climate impact. From a return perspective, the discrepancies observed compared to the parent indexes can be largely attributed to deliberate underrepresentation of higher-emission sectors and issuers, such as energy and utilities. And the variety of climate fixed-income solutions based on these indexes may allow investors to strike a balance between their climate and financial objectives.

Index emissions profile and climate exposure

MSCI Climate VaR and Implied Temperature Rise of corporate bond indexes

Related content

In Focus

Get the whole picture and stay on top of global markets. Quarterly insights bring macro-level investment trends, ESG and climate investing and the equity and fixed income markets In Focus for investors.

Explore moreESG and Climate in Focus webinar

We invite you to our upcoming webinar, the 3rd edition of ESG & Climate Indexes in Focus series, where our experts will delve into the latest research on developed-market climate corporate bond indexes.

Learn moreFixed Income Markets in Focus: Weighing Bonds in a Tense Market Environment

Hear Andy Sparks, Managing Director and Head of Portfolio Management Research, at MSCI, discuss this and more in the quarterly Fixed Income Markets in Focus.

Read more