Extended Viewer

Australian Deal Activity Strengthens in First Quarter

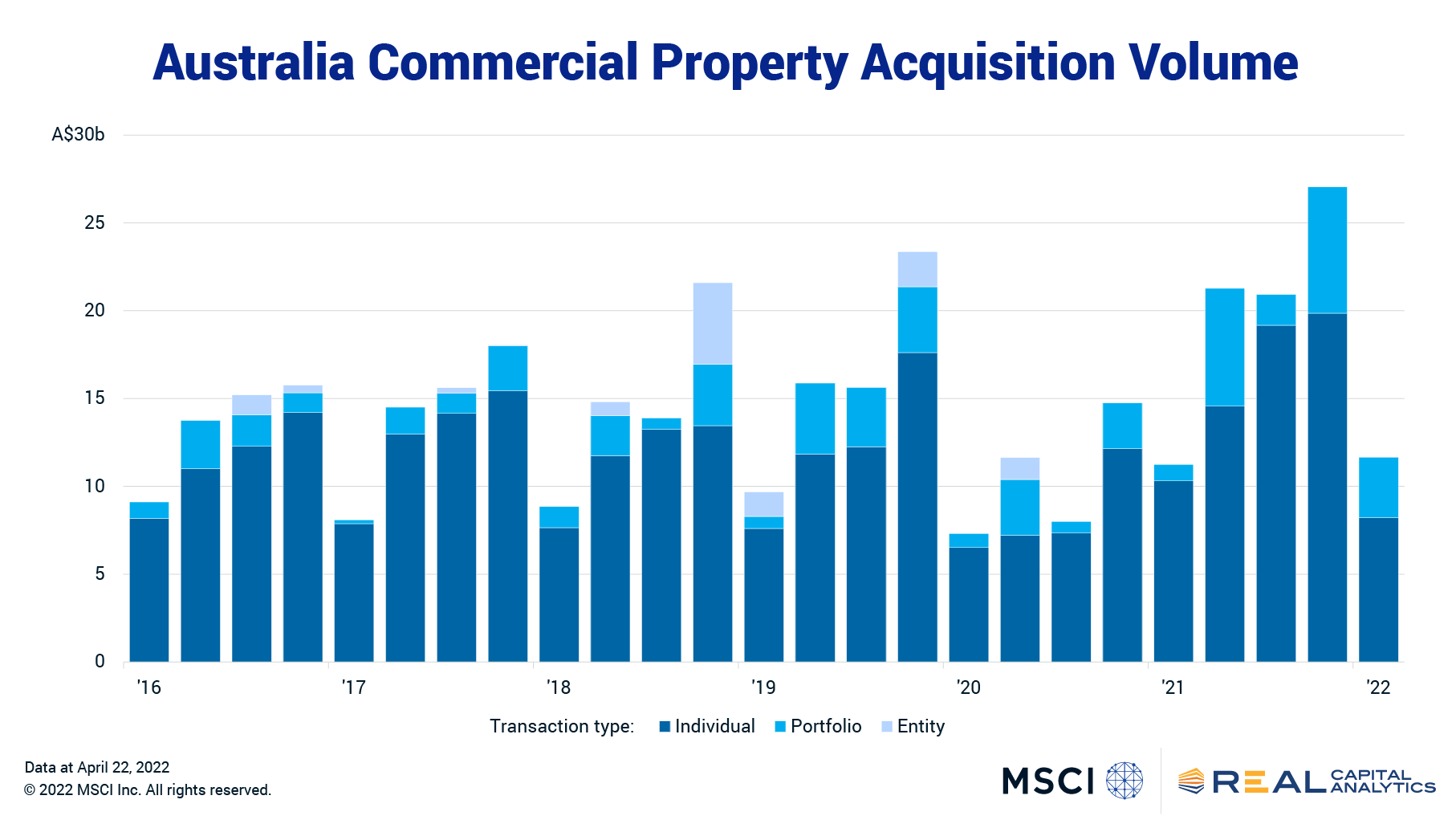

Australia’s commercial property market continued its strong run at the start of 2022, touching record volume for the first quarter of a year, the latest edition of Australia Capital Trends shows. Activity in the industrial and hotel sectors increased.

Deal volume rose 4% on Q1 2021 to reach A$11.7 billion ($11.7 billion). Australia had rebounded in 2021, posting a record year after Covid curtailed dealmaking activity in 2020. However, there were questions about whether the elevated transaction activity was simply due to deals from 2020 moving into 2021.

Of the core commercial sectors of office, retail and industrial, only industrial posted volume greater than the same period a year ago. The hotel sector recorded the strongest growth across the property types. After a bruising from Covid in 2020, the sector bounced back in 2021, and this momentum continued into 2022. Deal volume increased nearly 300% year-over-year as the sector recorded its strongest ever first quarter.

With travel restrictions easing, overseas investors have found it easier to execute transactions, which is reflected in the results for the first quarter. Overseas investors were involved in transactions amounting to A$4.7 billion, a year-over-year increase of 74%. Conversely, domestic investment declined 19% compared to Q1 2021 as these sources acquired just under A$7 billion worth of assets.

Related Content

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Explore More