The question of who wins or loses a U.S.-China trade war has more than two possible answers.

While much of the analysis has focused on China’s heavier reliance on exports to the U.S., American companies (and those who invest in them) actually have greater revenue exposure to China than the other way around. In fact, 5.1% of the revenues of companies in the MSCI USA Index come from China and may be at risk as a result of a trade war. In comparison, only 2.8% of the revenues of the companies in the MSCI China Index come from the U.S.

In a recent blog, we assessed the trade war’s impact on the global economy. Here we examine the effect that a trade war between the two biggest economies could have within specific sectors in those two countries, and others around the world.

Impact on sectors in the U.S. and China

Markets reacted quickly when the U.S. announced tariffs on Chinese imports across targeted industries, such as aerospace, machinery and technology, with cross-selling of equity and commodity markets around the globe. Not surprisingly, the directly affected sectors came under the greatest selling pressure.

However, this doesn’t tell the whole story for equity investors. To quantify the potential impact from an equity portfolio perspective, we examined the revenue exposure of Chinese firms to the U.S. and vice versa at a sector level, derived from the MSCI Economic Exposure database.

The exhibit below shows that China’s information technology and energy sectors are the most exposed to the U.S. economy. By way of contrast, the U.S. information technology, materials, industrials, consumer staples and energy sectors all have relatively high exposure to China’s economy. While an expanded trade war could lead to a “lose-lose” outcome, there could be greater impact for stocks in the U.S. Overall, they are more exposed to the Chinese economy than the other way around.1

U.S. and Chinese firms’ revenue exposure to the other’s economy

Based on MSCI Economic Exposure database as of March 22, 2018

Impact on sectors in other parts of the world

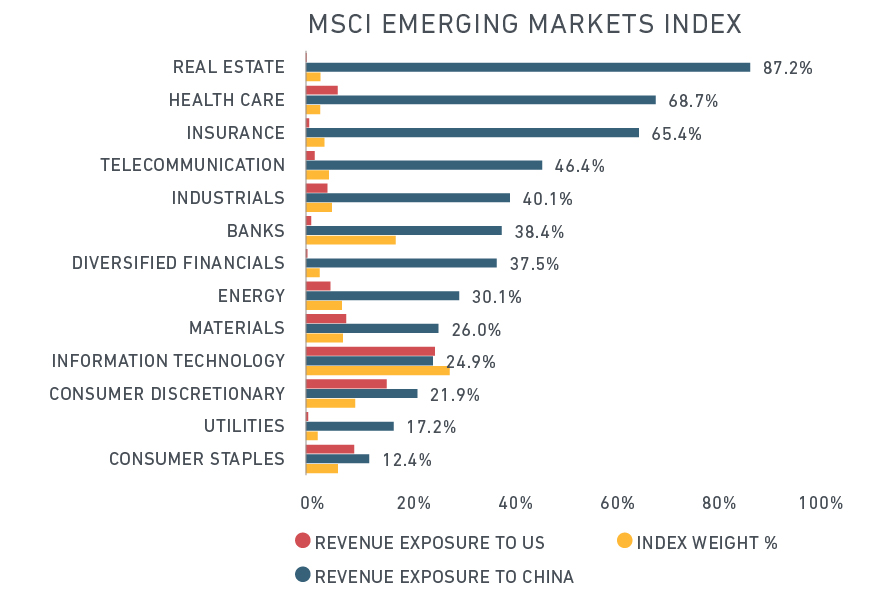

Of course, even a trade war that spreads no wider than the U.S. and China could have repercussions beyond the two countries. To quantify the potential impact, we looked at sector-level revenue exposure to China and the U.S. around the world using the MSCI World ex USA Index, the MSCI Emerging Markets Index and the MSCI AC Asia ex Japan Index.

The exhibit below shows that international developed markets have more exposure to the U.S., overall, especially within the healthcare and consumer discretionary sectors, though they are more dependent on China within real estate. Emerging markets and Asia ex Japan are more exposed to China by wide margins across all sectors, with the exception of information technology and consumer discretionary where the differences are smaller.

Whether these exposures result in greater risk, or in opportunity, as China and the U.S. place barriers on each other’s imports, depends on how events unfold. Regardless, it’s information equity investors may wish to consider when making geographic and sector allocations.

Global revenue exposure to the U.S. and China

Based on MSCI Economic Exposure database as of March 22, 2018

Drilling down to stock-level exposures

Exploring further, fundamental stock analysts could use stock-level revenue exposure data to identify potential bottom-up opportunities and risks for their stock portfolio. The following exhibit shows the fundamental stock view on the vertical axis (approximated by the average of the MSCI FaCS Value and FaCS Quality scores, standardized) and the stock-level revenue exposure of China stocks to the U.S. and U.S. stocks to China. As we saw when we looked at the sector level, many more U.S. companies have significant revenue exposure to China. Given the potential effects of a trade war, even high-quality stocks with attractive valuations that have such exposure may need to be reevaluated.

Revenue exposure and FaCS data may help identify potential risks and opportunities

Based on MSCI Economic Exposure database as of March 22, 2018

While it will be difficult for any portion of the global equities markets to insulate itself from the slowdown likely to come from a U.S.-China trade war, there could be degrees of “winning” or “losing” within specific regions, sectors and, of course, for individual stocks.

Further reading:

What if the U.S.-China trade war escalates?

Economic Exposure in Global Investing

Allocating to emerging markets: It depends on your view of the world

Built to Last – Two Decades of Wisdom on Emerging Markets Allocations

Insight into the Emerging Markets Rally

1 Please note: Our conclusions are based on the MSCI China Index, which does not contain many of the unlisted Chinese companies in affected sectors, or revenue exposure data for China A shares. Many of China’s exports to the U.S. are finished goods manufactured with supplies from companies outside of China, which is one reason the Chinese firms’ direct revenue exposure to the U.S. is not as high as suggested by the aggregate export figures.

2The average of the MSCI FaCS Value and FaCS Quality scores at single stock level quantifies a stock analyst’s view to pick stocks based on a combined assessment of valuations and the fundamental strength of firm financials. See Creating a common language for factor investing on definitions and case uses of MSCI FaCS.