- Three categories of Scope 3 emissions — purchased goods and services, use of sold products and investments — contributed over 70% of the total carbon footprint for constituents of the MSCI USA Investable Market Index.

- We found that constituents of the MSCI USA IMI that report GHG emissions to CDP also considered purchased goods and services and use of sold products to be relevant at rates of 78% and 43%, respectively.

- The financed emissions could be contentious. Only 2% of financial-sector companies report this category as relevant, while estimates indicate that it accounts for the largest share of GHG emissions for the sector (92%).

As we reported in an earlier blog post, the Securities and Exchange Commission (SEC) has proposed requirements for U.S. listed companies to disclose their Scope 1, 2 and 3 greenhouse-gas (GHG) emissions.1 Requirements to disclose Scope 1 and 2 emissions apply to all companies; but the SEC proposal would require disclosure of Scope 3, or value-chain, emissions only where material and for companies that have set a climate target that includes Scope 3 emissions.

But the SEC stopped short of defining a uniform “materiality threshold” and is consulting market participants on how to better address this issue. The options boil down to two approaches: one where a quantitative analysis guides a more uniform approach to materiality on Scope 3, or one where companies determine materiality for themselves.2

In this blog post, we evaluate the two approaches and their implications for transparency.

Approach 1: Quantitative analysis

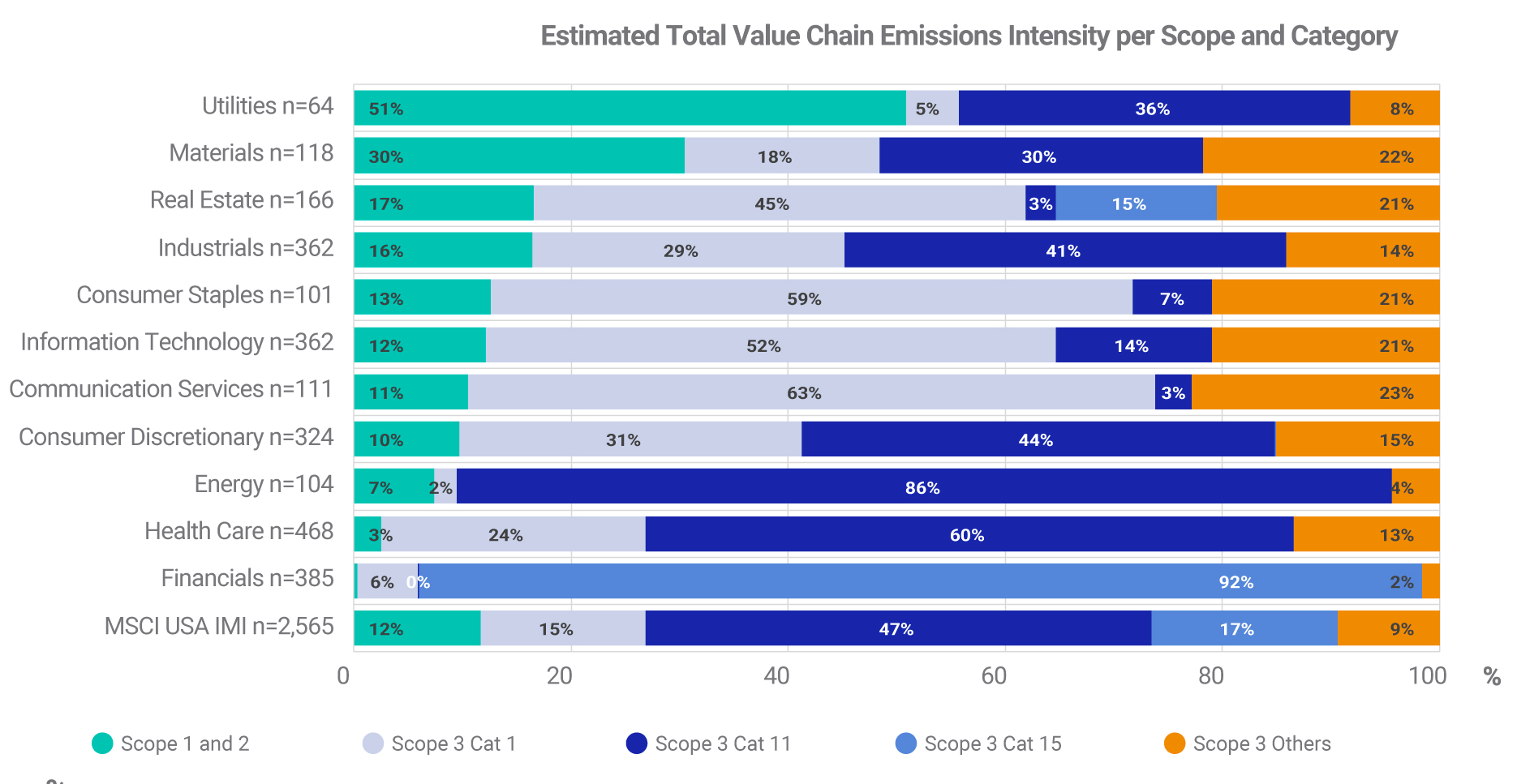

We compared the total carbon footprint per scope and category, using 2,565 constituents of the MSCI USA Investable Market Index (IMI) as a proxy for U.S. market registrants.3

As we can see in the exhibit below, Scope 3 categories 1, 11 and 15 (i.e., purchased goods and services, use of sold products and investments, respectively) contributed a substantial proportion of total value-chain emissions (75%) across all the Global Industry Classification Standard (GICS®)4 sectors for constituents of the MSCI USA IMI. These three categories’ GHG emissions make them likely to be considered material in an SEC-defined threshold for disclosure. In using total value-chain emissions to set a threshold for materiality, the SEC would anchor its disclosure requirements on a quantitative rather than qualitative benchmark.

Estimated total value-chain emissions intensity per scope and category

Total value-chain emissions per scope and category were estimated based on MSCI’s model for estimating Scope 3 emissions and the average emission intensities per sales of the 2,565 companies in the MSCI USA IMI with a market cap larger than USD 75 million. Data as of March 22, 2022. Source: MSCI ESG Research

Approach 2: Company-determined materiality

Figuring out what companies consider to be material is more subjective, so, to do so, we compared the emissions-data estimates above with the Scope 3 categories that companies have reported to the CDP (formerly the Carbon Disclosure Project) as “relevant” (i.e., material for their business).5 For financial companies, for example, the emissions estimates show that their financed emissions (part of category 15) comprised an overwhelming proportion of the total carbon footprint. Yet, only one out of the 54 financial-sector companies indicated that they view these emissions as relevant.

The disparity for other sectors was not as stark, but there was still a lack of uniformity of opinion among companies. For example, if we look at the consumer-discretionary sector, we see that purchased goods and services (category 1) accounted for an estimated 30% of their total emissions footprint, but around 90% of the sector considers these emissions relevant. When it came to products sold (category 11), which accounts for 44% of the industry’s total GHG emissions, only 54% of companies saw it as relevant. If only 54% of companies in the sector disclose category-11 emissions and the rest deem them immaterial, this could seriously impede like-for-like analysis.

Comparison of Scope 3-emissions intensities and percent of companies that consider Scope 3-emissions categories relevant

This analysis looks at categories of Scope 3 emissions that companies consider to be “relevant” based on their CDP 2021 reports. The percentages represent the proportion of disclosing companies in each sector that consider categories 1,11 and 15 relevant, as specified in their CDP submissions. Sector-average % of emissions from specific Scope 3 categories are based on the MSCI USA IMI Index. Source: MSCI ESG Research, CDP

Greater transparency

If adopted, the SEC’s proposal for GHG-emissions disclosure represents a significant step forward for U.S. and global investors seeking greater transparency on their exposure to climate-related investment risks. Scope 3 emissions are an important proportion of total emissions for most sectors but their disclosure is currently contingent on self-assessed materiality. This research shows that this may lead to underreporting. Adding Scope 3 to mandatory reporting as for Scope 1 and 2 emissions or introducing a uniform materiality threshold would provide a far more comprehensive picture of a company’s total emissions exposure. Irrespective of which approach is ultimately adopted, companies will face a much higher bar for climate-change disclosure.

1Such requirements included the disclosure of direct emissions from business operations and indirect emissions from purchased electricity (Scope 1 and 2, respectively), along with indirect up- and downstream emissions from companies’ value chains (Scope 3). Scope 3 emissions are segmented into 15 different categories of emissions, which range from downstream emissions from the use of a company’s sold products such as diesel trucks (i.e., category 11) to those emitted through the transportation and distribution of products from its upstream suppliers (i.e., category 4). “Proposed rule: The Enhancement and Standardization of Climate-Related Disclosures for Investors.” Securities and Exchange Commission, March 21, 2022.

2The three options are: All companies under SEC jurisdiction should disclose Scope 3 emissions; a uniform materiality threshold should be established using GHG-emissions data or high emissions assessed by industry, with the highest respective GHG emissions reported; or companies define their Scope 3 emissions as material for investors. Gensler, Gary. “Statement on Proposed Mandatory Climate Risk Disclosures.” SEC, March 21, 2022.

3“Scope 3 Carbon Emissions Estimation Methodology.” MSCI, Sept. 20, 2021. (Client-only access.)

4GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

5Company view is based on the Scope 3-emission submissions of 554 companies in the MSCI USA IMI that reported to the CDP (formerly the Carbon Disclosure Project), as of October 15, 2021. Source: CDP 2021 Database.

Further Reading

Understanding the SEC’s Proposed Climate Disclosure Rules