Investors who aim to understand what drives returns over the long run might look to the Land of the Midnight Sun.

Norway, which for years has enjoyed substantial inflows to its sovereign wealth fund from oil and gas revenues, is undergoing a transition that over the coming decades aims to replace income from extracting hydrocarbons with income from financial assets – a challenge not unlike the one faced by individuals investors who plan in retirement to replace income from earnings with financial income. “Going forward… [the fund’s] growth will be determined primarily by returns in the international financial markets,” the Ministry of Finance wrote recently in its annual report to parliament.

The importance of dividend yield and growth

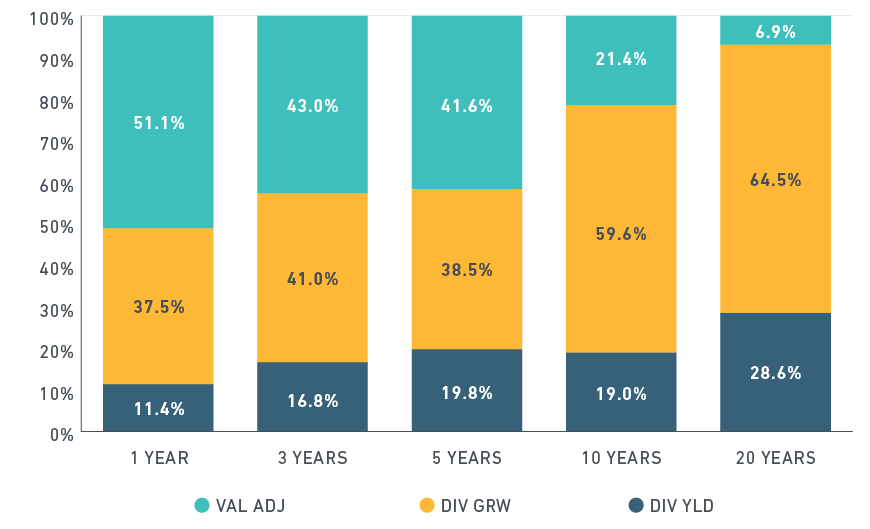

MSCI contributed to the ministry’s analysis by examining the contribution of cash flows (in the form of dividends) to the total return of an equity portfolio. We decomposed the historical performance of global equities into three components: dividend yield, dividend growth and changes in valuation. Looking at those components over different holding periods can illuminate sources of return over time, at least historically.

Returns in global equities over the short and long terms

Source: MSCI Research, decomposition of MSCI ACWI Index total return, analysis over period Dec 1994 to Sep 2015

If you hold securities over the short term, say, for a year, valuation changes matter a lot. Over the period analyzed, such changes contributed to more than half of the returns, on average, for equities held up to 12 months. But over much longer periods, up to 20 years, the picture changes dramatically. In the long run, dividend yield and dividend growth contributed 93% of returns, compared with roughly 7% for changes in valuation.

Viewed that way, investors who have a horizon measured in decades may want to focus on understanding the exposure of their portfolios to long-term economic growth and drivers of growth at the sector and company level rather than looking primarily at fluctuations in valuation.

Capital management and governance

Because the financial cash flows generated by companies need to return with a minimum of leakage back to shareholders in the form of dividends, the strength of companies’ governing practices, especially companies’ ability to manage capital, matter.

Dividend growth reflects return on equity and dividend payout ratio. In turn, return on equity is driven by profitability and leverage. Companies are more likely to address in earnest the main components of their capital – the dividend payout ratio and the level of leverage – when governance practices are strong.

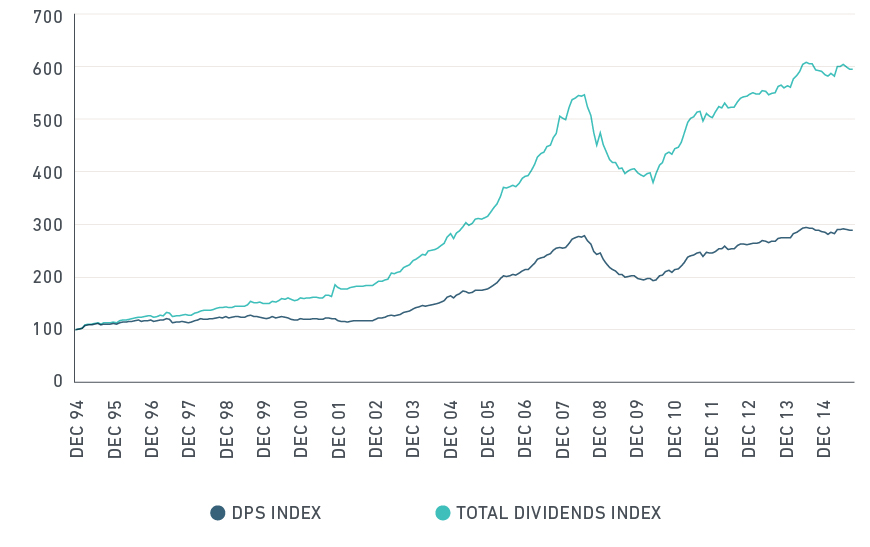

Consider also that capital raises and increases in the number of outstanding shares via initial public offerings tend, in aggregate, to dilute the amount of cash that flows back to shareholders. Of course, dilution can be offset by share buybacks. The chart below illustrates, for the universe of global equities, the extent of dilution that occurs as measured by the gap between dividends generated by companies and dividends per share that actually accrue to shareholders.

MSCI ACWI - Dividend Growth

Source: MSCI Research

Between December 1994 and September 2015, dilution of dividends was roughly 3.7% worldwide, though dilution dropped to -0.2% between December 2010 and September 2015. In general, U.S. companies used capital more efficiently over the longer period compared with companies globally, with an overall level of dilution of 2.4% annually.

Further reading:

Study for the Ministry of Finance of Norway

Raising Minimum Governance Standards: Selecting Quality Companies for the Long Term