Minimum volatility strategies have historically delivered above-average returns with below-average risk, especially in volatile market environments as have occurred in recent years. During this period, the world also has experienced low interest rates.

Now that the Federal Reserve is expected to increase rates as the U.S. economy recovers, some institutional investors have asked whether it is time to retreat from min-vol strategies. This question stems from a view that lower-volatility stocks historically tended to behave more like bonds and could potentially underperform in a rising-rate environment.

Our finding: While not indicative of future performance, minimum volatility has not always underperformed during a rising-rate cycle but it has delivered a persistent risk-reduction benefit.

Let’s break up the return of a minimum volatility strategy into an equity premium, a bond premium, cash yield (risk free-rate) and other return components. To capture a full interest-rate cycle, we combine two series to represent a minimum volatility strategy: We use the MSCI USA Minimum Volatility Index from 1975 to 2017¹ and the lowest-volatility quintile portfolio from the Fama-French data library from 1963 to 1975.² The equity premium is defined as the difference between cap-weighted benchmark return and the cash yield, and the bond premium is the difference between the total return of a U.S. Treasury bond portfolio and the cash yield. 3 4

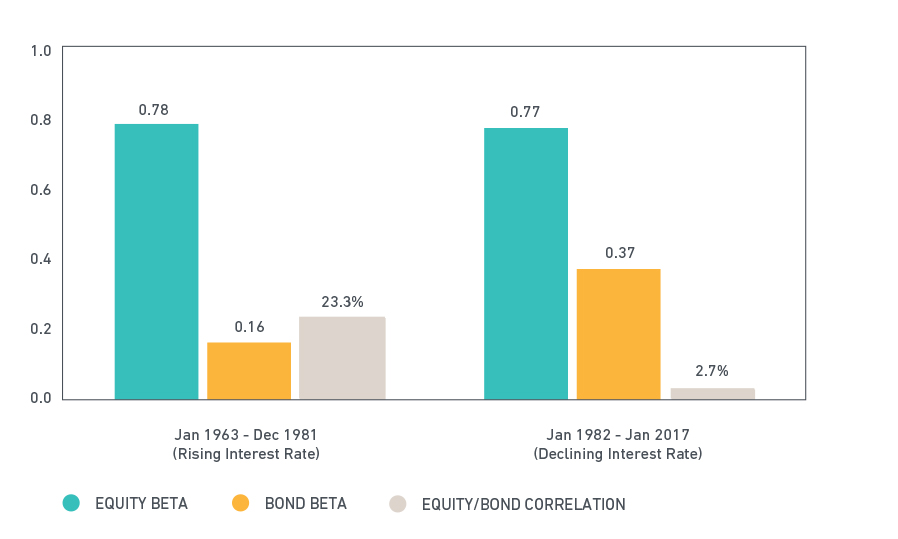

We found that the minimum volatility strategy’s exposure to the equity factor was generally stable: It remained around 0.77-0.78 across varying interest-rate regimes. Interestingly, its exposure to the bond factor when rates rose was less than half of the exposure when rates declined (0.16 vs. 0.37). This implies that the minimum volatility strategy was less sensitive to interest-rate changes in a rising rate environment.

Equity and bond exposures of the minimum volatility strategy

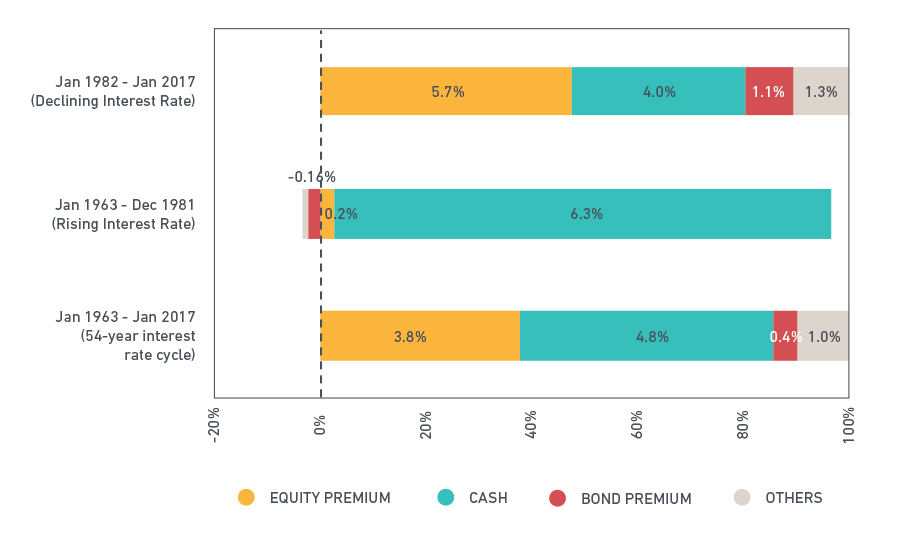

Attributing returns to the various factors further illustrates that minimum volatility strategy responded differently during periods of declining and rising interest rates. We found that the bond factor contributed about 1.1% of positive performance to the minimum volatility strategy during a declining rate regime but caused only a negligible performance drag of -16 basis points per annum during a rising-rate regime.

Asymmetric bond exposure explains part of minimum volatility’s historical return premium

Return decomposition of the MSCI USA Minimum Volatility Index

When we look at returns, the minimum volatility index outperformed the cap-weighted benchmark by 54 bps annually, while interest rates declined from 1982 – 2016.

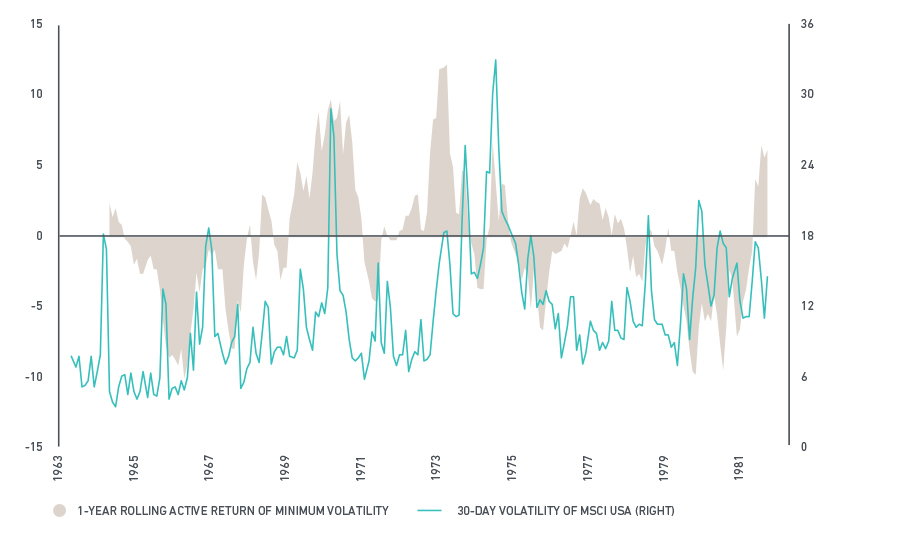

However, the strategy did not systematically lag the market, even during the rising-rate environment: There were periods of under- and over-performance linked to market volatility. Overall, the strategy was largely in line with the market, returning a negligible -12 bps from 1963 – 1981 (when 10-year U.S. Treasury yield rose by an average of 63 bps per year). 5

Market volatility and rolling 1-year active return of minimum volatility in a rising-rate regime

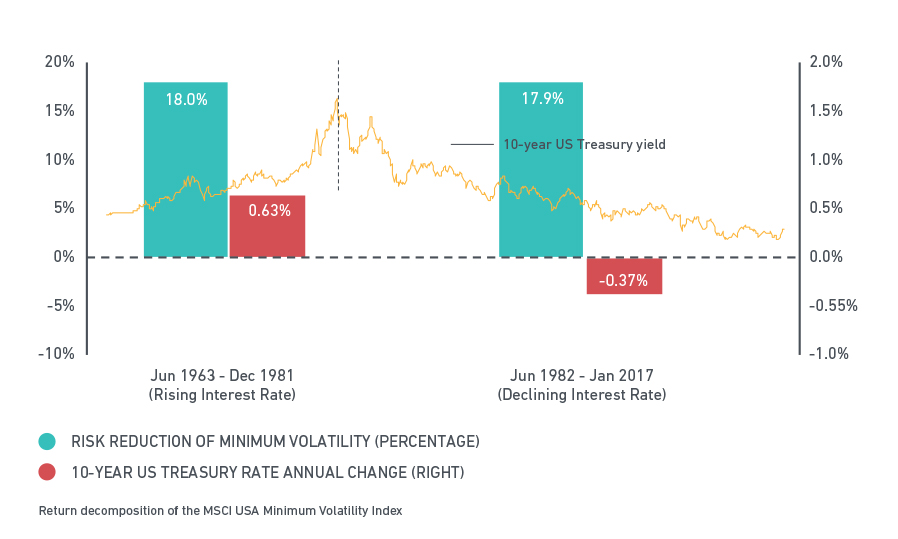

The existence of market volatility in both rate environments is a critical reminder for institutional investors who attempt to time the strategy. Investors who see the minimum volatility strategy as a long-term allocation may note that the risk-reduction benefit of the minimum volatility strategy has prevailed throughout the 54-year interest-rate history. It reduced risk in both interest-rate regimes by an average of 18%, versus the cap-weighted benchmark, fulfilling the primary investment objective for this strategy.

Minimum volatility: Persistent risk reduction during rising and declining rate regimes

¹ The USA Minimum Volatility Index was simulated by a low volatility tilt strategy based on 100 lowest vol stocks from the MSCI USA index from November 1975 to May 1988

² During 1953 – 1981, 1-month and 10-year U.S. Treasury rates rose from 3% and 4%, respectively, to nearly 16%. From 1982 – 2016, these short- and long-term rates declined to 0% and 1.5% lows, respectively.

³ We simulate the bond portfolio by an equally weighted monthly rolled 1-, 3-, 5-, 7- and 10-year constant-maturity U.S. Treasury par-coupon bonds based on Federal Reserve data. Applying other weighting schemes yields similar results.

4 The analysis was done via a multi-variate regression analysis. We regressed minimum volatility index excess returns against the equity premium factor and the bond premium factor to derive the equity beta and bond beta exposures.

5 In addition to the multi-decade structural rising-rate cycle during 1963 – 1981, we also analyzed more recent rising interest-rate cycles (intermediate-cycles within a structural declining rate cycle) and reached similar conclusions. During April 1993 – April 1995 and June 2003 – February 2007, the 1-year U.S. Treasury yield rose from 2.64% to 6.48% and from 0.81% to 5.24%, while the MSCI USA Minimum Volatility Index delivered 0.26% and 0.43% annualized active returns, respectively.

Further reading:

What valuations tell us (and don’t tell us) about future factor returns

Constructing low volatility strategies

Brexit shows (again) the benefits of minimum volatility