Over the last decade, asset owners have implemented factor investment programs with a focus on domestic markets. Increasingly, they are also funding equity factor programs in international markets. Two catalysts are driving this trend. First, there has been a steady erosion in asset owners’ home biases, leading to more indexed and active international mandates. Second, investment committees and boards of trustees have become more comfortable with using factors as a complement to core indexed and traditional active allocations.

But have factors behaved the same way outside the U.S.? The upshot is mixed: We find that factors such as minimum volatility and momentum are “global factors.” Fundamental factors, however, such as quality, dividend yield and size, have demonstrated little correlation to their U.S. counterparts. Allocators may look to defensive factors as either hedges in their international equity programs, or as complements to their active managers.

We examine the behavior of factor indexes based on the MSCI World ex USA benchmark. This benchmark includes developed market equities, excluding those domiciled in the U.S. We first review risk and return characteristics of various factor indexes compared to their parent index. We then address if factors can act as hedges when international markets underperform. Lastly, we study the relationship between international factors and active managers.

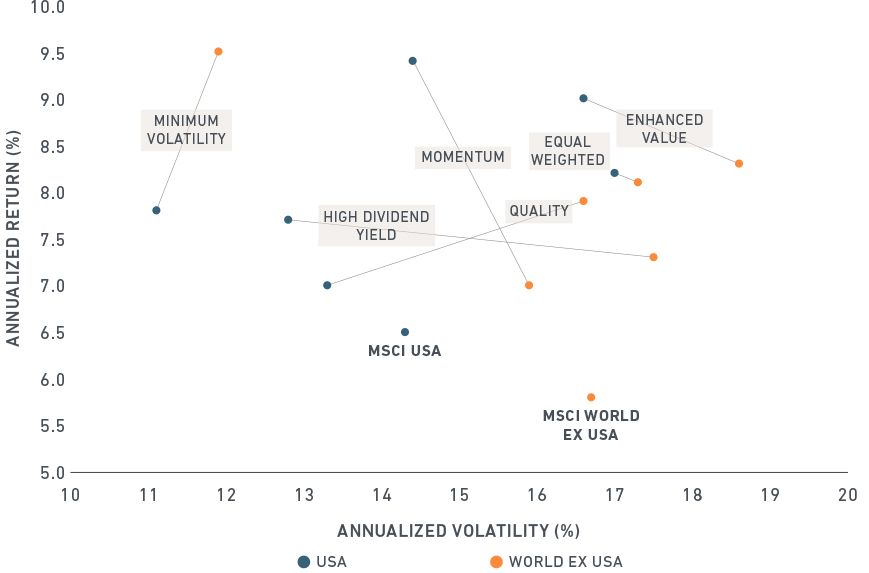

The exhibit below shows the long-run risk and return for six key equity factors MSCI has identified.1 These are low volatility, size, momentum, quality, dividend yield and value. All six factors (yellow marks) historically have outperformed the broad international market during the 16-year period studied. However, there are some notable differences compared to the U.S.

Minimum volatility has been generously rewarded, and with lower volatility than the broad market over the 16-year period studied. The reason? The extended slow growth period in Europe and Japan following the 2008 financial crisis provided a boon to lower-risk equities. Over the full period, momentum was not rewarded internationally as it was in the U.S. — largely due to Japanese equities, where momentum as a style has historically not fared as well as dividend yield and value. In the first three quarters of 2017, however, momentum has provided the largest outperformance of all the six international factors.

Risk and return of international and US factors

Gross returns in USD, annualized from May 2001 to September 2017, for both MSCI USA and MSCI World ex USA derived indexes. Quality refers to the MSCI Sector Neutral Quality indexes.

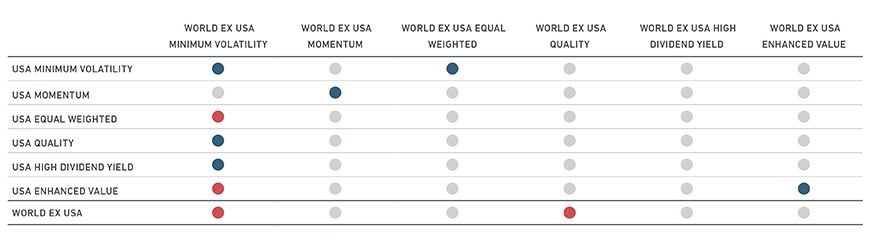

Asset allocators often ask if international factors are similar to their U.S. counterparts, and if any have protected against downturns in international markets. The next exhibit shows the correlations between the active returns of international factors and U.S. factors, each relative to their parent.

Global factors, such as minimum volatility and momentum, were more closely linked across the two markets. This relationship is intuitive. Investors seeking out lower risk or upward-trending stocks are generally not regionally constrained.

Fundamental factors, such as quality, dividend yield and size (represented by “equal weighted” in the exhibit below), tended to have little correlation to their U.S. counterparts. They also had little correlation to the global factors. This behavior also is intuitive. Some factors – size and quality for example – are considered compensation for a firm’s sensitivity to the local economy. We would expect the fundamental factors to be more local, showing more heterogeneity across regions.

The bottom row (boxed) shows the correlation between the active returns of international factors, and the active return of international markets relative to the U.S. That is, international minimum volatility and quality have tended to outperform when international markets underperformed the U.S. (negative active correlations). These correlations may have implications for U.S. asset allocators who seek to further reduce their sensitivity to their home market.

Correlation of international factors to US factors

Correlations are active and based on gross returns in USD from May 2001 to September 2017, for both MSCI USA and MSCI World ex USA derived indexes. Blue and red circles indicate strongly positive and negative correlations, respectively. Gray circles indicate little to no correlation.

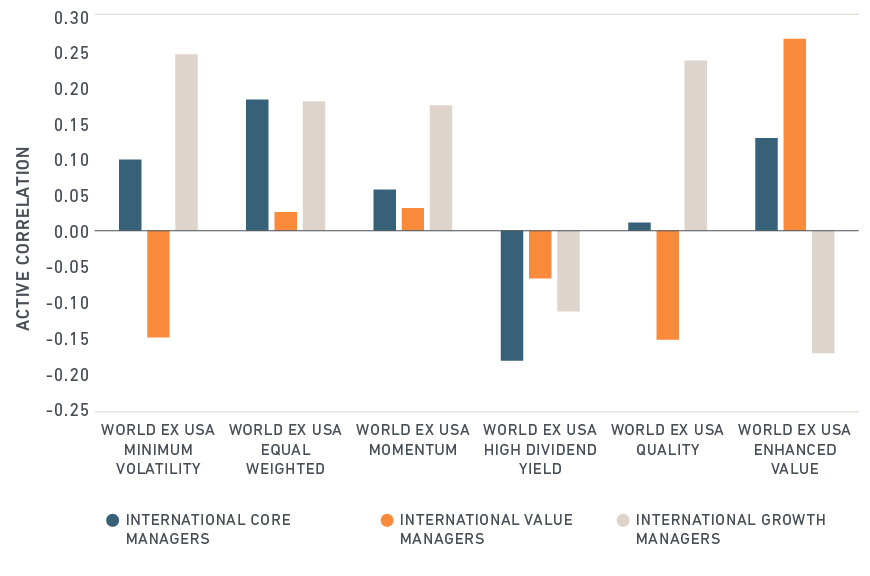

The last exhibit shows the relationship of international factors to active managers. Value managers, on average, held cheap stocks of poorer quality, larger size and higher volatility than growth and core managers. An allocation to minimum volatility would have provided greater diversification benefits to an asset owner whose managers were value-oriented than growth-oriented. An allocation to quality could have complemented core managers, who tended to hold smaller-capitalized, cheap stocks. Lastly, international managers tended to not hold dividend-paying stocks: An allocation to dividend yield could also have been complementary.

Correlation of international factors to active managers

Correlations shown are the average of each manager style. Correlations are active and based on the GEMLT risk model as of September 2017. Manager holdings and their classifications are sourced from MSCI Peer Analytics. There are 88, 50 and 72 managers in the Core, Value and Growth classifications, respectively. Only managers with a Lipper Geographical Focus of ”Global ex US” are included. Benchmark for managers and factor indexes is the MSCI World ex USA Index.

As asset owners have moved into international markets, factor investments have gained traction. Factors traditionally identified by investors as defensive have fared well internationally, and many of these factors are uncorrelated to their U.S. counterparts. Allocators can consider these as standalone investments in their international equity program, or as complements to their active managers.

1 We use factor index performance as proxies for factor returns and risk

Further reading:

Measuring the impact of factors

Bridging the gap: Adding factors to indexed and active allocations