- ESG investing is growing quickly — but transparency is key to understanding what this expansion means.

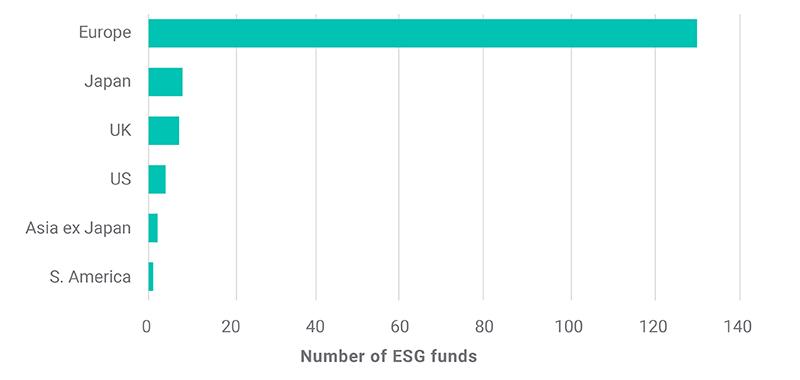

- The highest-rated ESG funds (AAA) are predominately based in Europe, followed by Japan. The U.S. and U.K. offer relatively few options.

- A sample of concentrated global equity funds did not always pick the top ESG-rated stocks in their highest-weighted sectors, based on their holdings.

Nearly USD 31 trillion in assets under management were invested in funds that consider environmental, social and governance (ESG) issues as part of their investing process as of January 2018, a 34% increase from two years previously.1

While numbers this size are routinely used to convince investors of the mainstreaming of ESG, they don’t say much about what is under the hood of the typical ESG fund. Where are the most highly rated ESG funds domiciled? How concentrated are top-ranked ESG strategies by sector? Do highly rated ESG funds invest only in highly rated companies?

We looked at patterns across a broad swath of funds, using MSCI ESG Fund Ratings and metrics that cover approximately 32,000 multi-asset-class mutual funds and ETFs globally, as of May 17, 2019. In the latter part of the analysis, we filtered this universe to 15 global equity funds to evaluate the sector and company breakdown of highly rated ESG funds with similar investment styles.

Europe remains strong

By domicile, there were 33 times more highly rated ESG equity and bond funds based in Europe than in the U.S., which has only four AAA ESG funds (see exhibit below). This is not surprising as European ESG funds are held to a higher standard by EU regulators,2 requiring those that claim to incorporate ESG into their investment process to meet a minimum standard of ESG that is stricter than what is currently represented in the U.S. market. So, the EU funds that adhere to the stricter requirements are inherently selecting from a pool of higher-ESG-quality companies. Also, European asset owners have long demonstrated demand for ESG funds, compared to their U.S. peers where demand has been more recent.3 Japanese managers also stood out as leaders in offering ESG funds – possibly spurred by the emphasis the Government Pension Investment Fund, the world’s largest asset owner, put on particular ESG investments starting in 2017.

In contrast, investors in other parts of the world have fewer top-rated funds from which to choose.4

Top-rated ESG funds by domicile

Source: MSCI ESG Research

The pieces matter

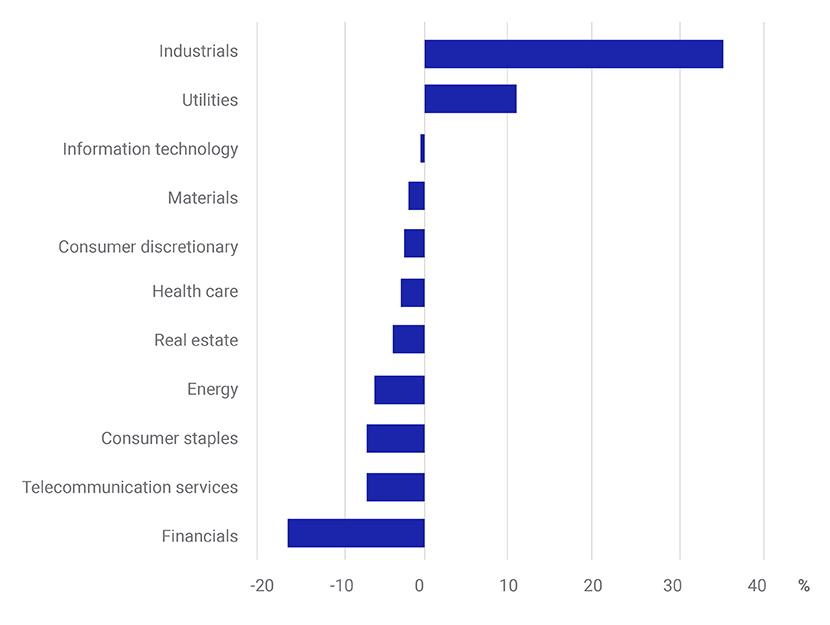

We focused our study on the 15 top ESG-rated funds (AAA-BBB) of larger active global equity managers with concentrated holdings, and with an ESG policy on record (“top active ESG funds”). We compared their holdings against the sector weights of the MSCI ACWI IMI, as of May 17, 2019.

On an asset-weighted basis, the two largest sector overweights were in industrials and utilities (see exhibit below). Of the highly rated ESG funds available to investors, a large portion of the fund’s exposure (relative to the benchmark) were in companies such as Xylem (industrials) and American Water Works (utilities).

How top ESG-rated global equity funds were weighted by sector

Source: MSCI ESG Research

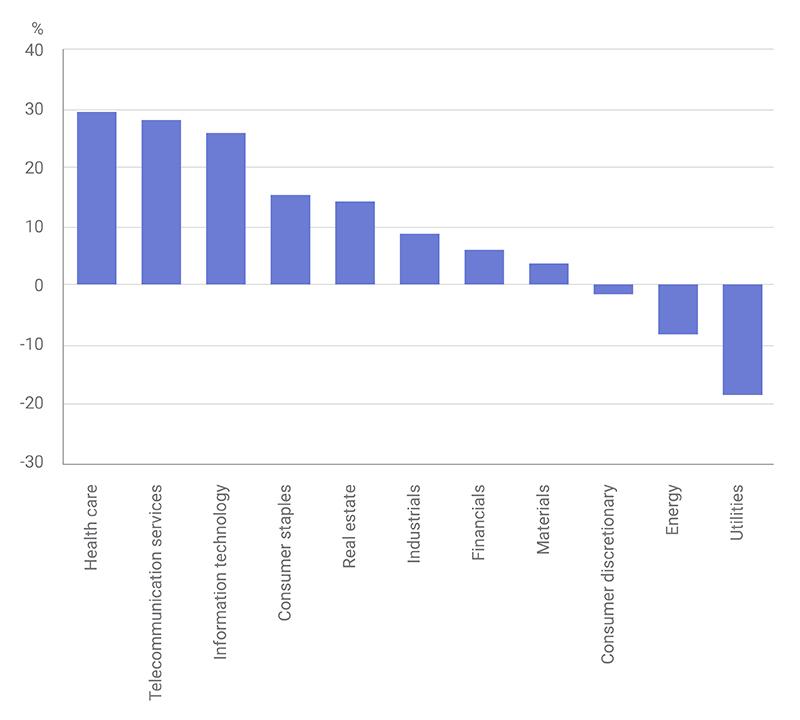

But, if we delve deeper, have the funds invested predominately in the highest-rated companies in these sectors?

Not really. We found that the funds had a slight overweight to the highest-rated (AAA-AA) companies in the industrials sector, but it was an entirely different story for the utilities sector. Our sampled funds had a 19% underweight to the available highest-rated companies in the utilities sector relative to the global benchmark (see exhibit below), as well as an 8% underweight to the highest-rated companies in the energy sector. Instead, the funds tended to overweight “average” rated (A-BB) utilities and energy companies. This disparity may be driven by asset allocation or geographic decisions that aren’t totally obvious. What was apparent, however, was that the top active ESG funds tilted away from holding any companies rated below BB.

Top ESG-rated global equity funds’ sector weights by ESG ratings

The makings of an ESG fund

As ESG investing continues to grow in importance, so too will the need to understand how each fund interprets and implements ESG criteria. At present, it can be difficult to know whether and to what extent an ESG analytical process has been put into practice, even when “ESG” has been used in a fund’s investment prospectus or name. Investors need the right tool to look under the hood, and better differentiate between ESG funds.

1 Bradford, H. “Global sustainable assets hit $30.7 trillion in 2018 — report.” Pensions & Investments, April 1, 2019.

2 Lee, L.-E. and Moscardi, M. “ESG Trends to Watch 2019.” MSCI Blog, Jan. 22, 2019.

3 “Charting a Sustainable Advantage.” 2018. RBC Global Asset Management.

4 “Japan’s GPIF expects to raise ESG allocations to 10 percent: FTSE Russell CEO.” Reuters, July 14, 2017.