A growing body of research shows that having three women on a corporate board represents a “tipping point” in terms of influence, which is reflected in financial performance. Our analysis from last year looked at a snapshot of global companies in 2015 with strong female leadership, finding that they enjoyed a Return on Equity of 10.1% per year versus 7.4% for those without such leadership.

This year, we analyzed U.S. companies over a five-year period (2011-2016). U.S. companies that began the period with at least three women on the board experienced median gains in Return on Equity (ROE) of 10 percentage points and Earnings Per Share (EPS) of 37%. In contrast, companies that began the period with no female directors experienced median changes of -1 percentage point in ROE and -8% in EPS over the study period (see below exhibits).

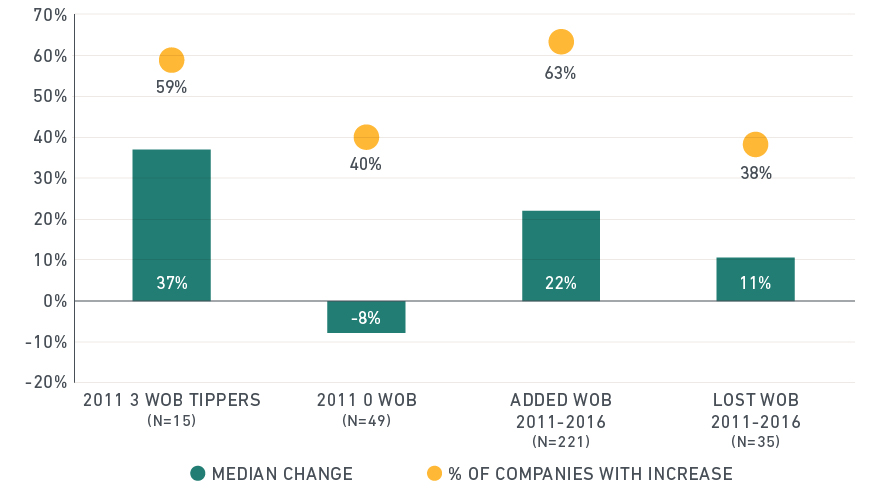

Five-Year Earnings Per Share (EPS) by Number of Women Directors

Source: MSCI ESG Research

The chart compares the five-year EPS performance of four groups of companies: 1) those that reached the “tipping point” of three women on the board (WOB) in 2011; 2) those that had zero women on the board in 2011; 3) those that added any number of women between 2011-2016; and 4) those that lost any number of women between 2011-2016.

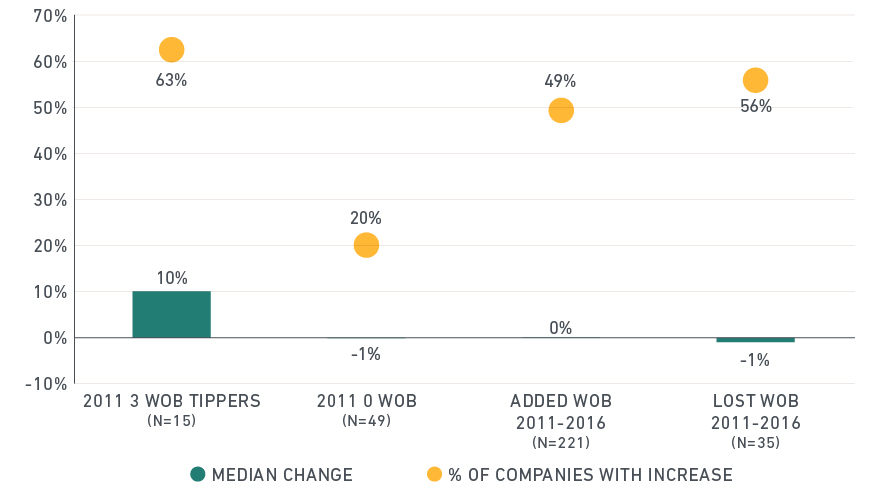

Five-Year Return on Equity (ROE) by Number of Women Directors

Source: MSCI ESG Research

The chart compares the median five-year ROE change (in percentage points) of four groups of companies: 1) those that reached the “tipping point” of three women on the board (WOB) in 2011; 2) those that had zero women on the board in 2011; 3) those that added any number of women between 2011-2016; and 4) those that lost any number of women between 2011-2016.

Such superior performance from companies with at least three female board members may derive from better decision-making by a more diverse group of directors, as some studies hypothesize. But outperformance may also be tied to greater gender diversity among senior leadership and the rest of the workforce, which has been correlated with reduced turnover and higher employee engagement.

Globally, we found that large multinational companies that had a critical mass of female directors tended to have more gender-diverse leadership teams and were more likely to have a female CEO. We also found that such companies were more effectively tapping available female talent supplies throughout the organization. Thus, the presence of at least three women directors may be seen as a doubly positive indicator: of a better-performing company and of a more functional organization overall. In short, having more women directors may lead to a virtuous cycle.

The author thanks Meggin Thwing Eastman, Damion Rallis and Gaia Mazzuchelli for their contributions to this post.

Further reading:

The Tipping Point: Women on Boards and Financial Performance: 2016 Women on Boards Report

Women on Boards: Global Trends in Gender Diversity 2015

Women on Boards at MSCI:

In the photo accompanying this blog, the women shown are (from left to right):

Wendy E. Lane, Chairman, Lane Holdings, Inc. and Board of Directors, MSCI

Alice W. Handy, Founder and CEO, Investure and Board of Directors, MSCI

Kathleen Winters, Managing Director, Chief Financial Officer and Executive Committee member, MSCI

Diana Tidd, Managing Director, Head of Index and Executive Committee member, MSCI

Linda H. Riefler, Former Chairman of Global Research and Chief Talent Officer, Morgan Stanley and Board of Directors, MSCI

Catherine R. Kinney, Former President, New York Stock Exchange and Board of Directors, MSCI

Linda-Eling Lee, Managing Director and Global Head of Research for ESG, MSCI (also the writer of this blog)