- Demand and pricing for industrial commercial property got a boost from spiking e-commerce demand during the early part of the pandemic.

- Growth in e-commerce activity has slowed in recent quarters, raising questions about demand for industrial real estate.

- Longer-terms trends have offered a better signal on the performance of this asset type.

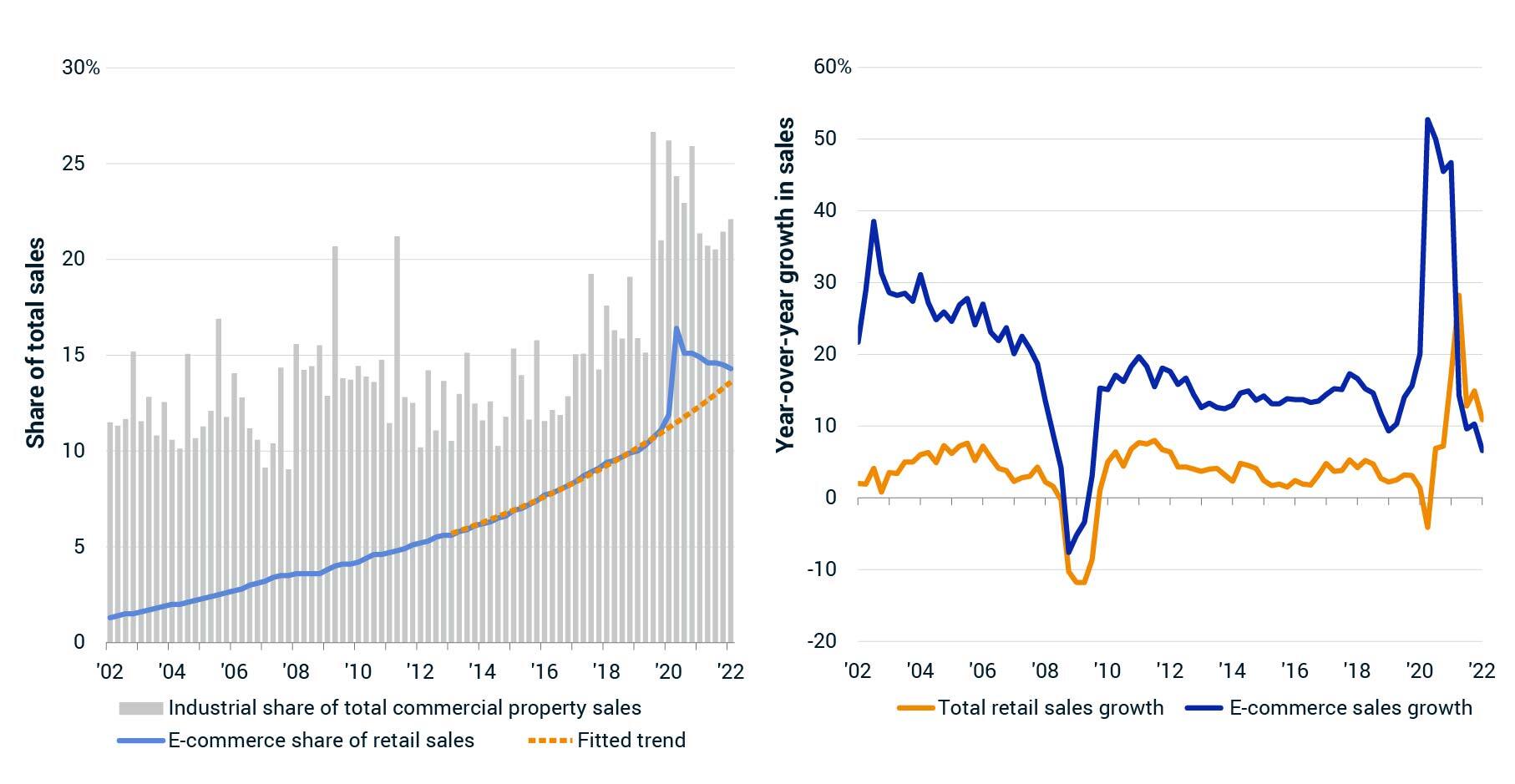

E-commerce sales grew at an exponential rate for most of the period from 2002 to 2019, and then got kicked into overdrive by the COVID-19 pandemic.1 As the U.S. moved past the tightest restrictions of the pandemic, however, the pace of growth in e-commerce sales slowed. Some may be tempted to set expectations for the future of e-commerce and industrial property demand and pricing from this recent inversion alone. But the shock of the pandemic continues to reverberate through economic and financial data, and looking past the noise to the longer-term trends may be a better guide.

“How long can industrial outperformance last?” That question has been frequently posed by investors in commercial real estate over the last year, as the RCA CPPI for industrial properties climbed to record highs. Investment in industrial properties increased with this surge in pricing, and the sector grew from a 15% share of the market before the pandemic to a level consistently above 20%, according to MSCI data. This surge in asset pricing was tied closely to the growth in e-commerce activity and tenant demand.

Pandemic trends in e-commerce sales veered from longer-term trends

Total property sales comprise office, industrial, apartment, hotel and development sites. Source: U.S. Census Bureau, MSCI

Growth in e-commerce activity has slowed of late, however, lagging growth in total retail sales for the last four quarters. The slowing growth in e-commerce affected Amazon.com Inc., which noted a miss in its first-quarter earnings release. Amazon cited, among other items, an excess of capacity built up during the worst parts of the pandemic.2

Of course, one quarter’s worth of missed earnings, or even four quarters of slowing e-commerce growth rates need not spell a sea change in the market. E-commerce sales as a share of total retail sales had been growing sharply from 2013 to 2019 then spiked to a 16.4% share in Q2 2020. Fitting a trend to e-commerce sales from the pace of growth from 2013 to 2019 would suggest e-commerce sales would have represented 13.6% of total retail sales in the first quarter of 2022. Instead, e-commerce activity represented 14.3% of all retail sales in the quarter. With the harshest restrictions of the pandemic lifted in the U.S., some return to previous patterns in consumer behavior should not be a surprise.

The pace of growth in total retail sales over this period appears to be an aberration, however, standing well above the long-run trend. In fact, growth in personal consumption into the first quarter of 2022 was higher than that of disposable personal income, a situation that is not sustainable.3 Households cannot spend at a higher pace than disposable personal income forever, without taking on ever-increasing levels of debt.

Conclusions drawn from near-term results may be a stretch

If you stretch a rubber band between your fingers, pull it back some distance and let go, it will not snap back immediately to the previous position. It will reverberate back and forth before settling into a steady state. We have seen that same sort of shock and response working through the retail sales and e-commerce data. The impulse of that initial shock from the onset of the pandemic, and soaring e-commerce activity, filtered through to higher levels of demand for industrial space as well.

Year-over-year growth in total retail sales had peaked in the second quarter of 2021, exactly one year after the worst parts of the COVID-19 pandemic in the U.S. Again, the rubber band snapping in the other direction. That pace of growth has generally retreated since, to a trend that pointed to a level closer to historical norms in the quarters ahead. Beyond the year-over-year growth effects, the increase in interest rates in 2022 may make it difficult for households to continue to exhibit stronger growth in consumption than income as the cost to finance that consumption will be rising.

The industrial sector also may face some challenges in the near term from this period of readjustment in the allocation of retail activity between e-commerce and in-store channels. The sale of industrial properties fell sharply in April following shocks to the 10-year Treasury and mortgage-financing costs. It remains to be seen whether the changing patterns of e-commerce demand may add fuel to that decline as potential buyers try to understand future tenant demand.

All told, more information, and a long-term view, has proven more valuable to real estate investors over time. Setting expectations for industrial tenants’ demand and ultimately asset pricing from the trends shown in a handful of quarters may not be a recipe for success.

1“Monthly Retail Trade.” U.S. Census Bureau.

2Dastin, Jeffrey, and Datta, Tiyashi. “Amazon results and outlook fall short as warehouse, fuel costs soar.” Reuters, April 28, 2022.

3U.S. Bureau of Economic Analysis.

Further Reading

US Commercial Real Estate Price Growth Slipped in April

Top Global Investors: Piling Into Apartment, Industrial in 2021