- The SEC is considering a proposed rule that would curb the ability of small individual investors — so-called “nuisance investors” — to propose shareholder resolutions on corporate proxies.

- We found that many proposals authored by small individual investors won substantial support from 2015 through 2019.

- More than half of all proxy proposals targeted 85 of 2,353 companies we analyzed in this period, with only 12 large companies receiving four or more submissions each year.

Are shareholder proposals submitted by small individual investors a nuisance to be eliminated and unneeded? In a proposal to reform the proxy process, the U.S. Securities and Exchange Commission (SEC) appears focused on the costs borne by companies that have to include such proposals in their proxies.1 But such a change may disadvantage all shareholders, who have provided significant levels of support for these initiatives.

While some level of minimum standards may be helpful, these proposals are viewed as excessively stringent by many investors. According to Ken Bertsch, executive director of the Council of Institutional Investors, “The rule proposals are solutions in search of a problem.”2

These amendments would raise the holding period required to submit shareholder proposals to three years from one, impose tougher requirements for resubmitting proposals in subsequent years and limit submissions by the same person to one per year at the same meeting, limiting the use of skilled representatives hired to represent shareholders. The move has been widely opposed by investors3 and has generated a fierce debate about the importance of shareholder rights and engagement and even the differences between Main Street and Wall Street investors. The proposal, which was approved by a vote of 3-2, appears likely to be adopted by the same margin.4

Many individual-investor proposals won broad support

We decided to take a look at whether these shareholders were really “nuisance investors” — gadflies pushing their own agendas — or aided shareholders in general. In addition, we examined how many companies would have received fewer proxy proposals if the proposed rule changes were adopted.

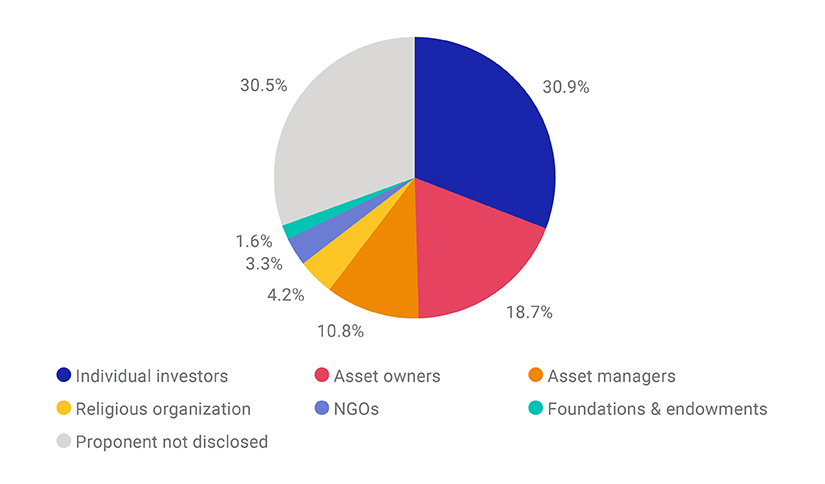

We looked at shareholder proposals submitted to a vote at 2,353 U.S. listed companies over the five-year period from 2015 through 2019 to understand who was filing proposals and which companies were receiving them. We found that 2,307 proposals had been submitted to a vote at 533 companies. Where the proponent’s identity was disclosed, we categorized them by type of proponent, as shown in the exhibit below.

US shareholder proposals submitted from 2015 through 2019, by proponent type

Source: MSCI ESG Research, based on an analysis of shareholder proposal submissions and voting results for 2,353 U.S. companies from 2015 through 2019.

Shareholder proposals submitted by individual investors did indeed comprise the largest proportion, at 30.9%. Was it time-consuming for companies to respond? Yes. But more than half of these proposals (55.3%) obtained significant support, defined as winning more than 30% of total votes cast.

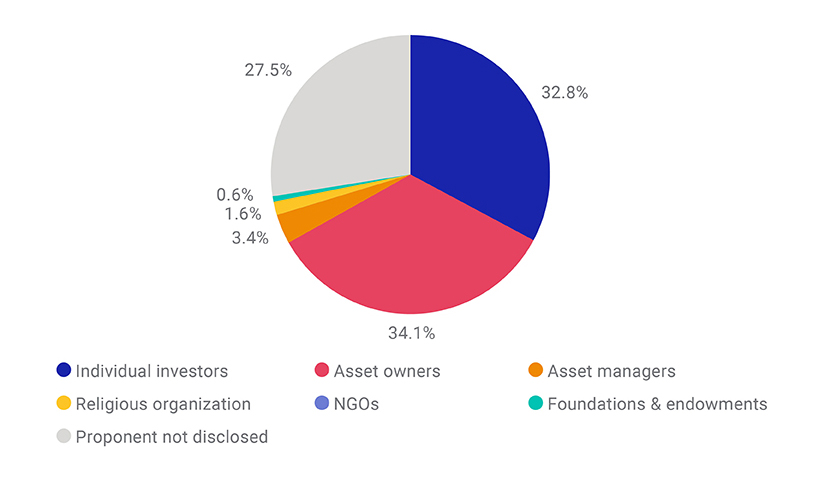

These proposals were also among the most successful — ones that won a majority of the total votes cast (32.8%), as shown in the exhibit below. Far from being a “nuisance,” individual investors have taken a lead in voicing concerns that were widely supported by other investors.

US shareholder proposals from 2015 through 2019 that won a majority of votes, by proponent type

Source: MSCI ESG Research, based on an analysis of shareholder proposal submissions and voting results for 2,353 U.S. companies over the five-year period from 2015 through 2019.

Who could benefit from the SEC’s proposal?

Just 85 companies accounted for more than half of all shareholder proposals submitted to a vote. A reduction in the number of proxy proposals could save these corporations a tidy sum. Only 12 companies — all very large, prominent ones — were regularly targeted, being subject to four or more proposal submissions in each of the five years examined. Of these 12, oil-and-gas behemoths Exxon Mobil Corp. and Chevron Corp. were two of the most frequently targeted, as were tech giants Alphabet Inc. (Google’s parent company), Facebook Inc. and Amazon.com Inc., banking leaders JPMorgan Chase & Co. and Citigroup Inc. and troubled airplane manufacturer Boeing Co.

In short, only a relative handful of very large companies would have seen any appreciable reduction in costs from a reduced number of shareholder proposals, had the SEC proposal been in effect.

Would other investors fill the gap? That remains unclear. But one thing that does seem clear is that these “nuisance” investors have played a much more important role in U.S. corporate governance than the size or duration of their holdings alone might suggest.

1“Procedural Requirements and Resubmission Thresholds under Exchange Act Rule 14a-8.” Securities and Exchange Commission, Nov. 5, 2019.

2“Leading Investor Group Blasts SEC’s Proposed Rules for Proxy Advice and Shareholder Proposals.” Council of Institutional Investors, Jan. 31, 2020.

3Malden, B. “SEC proposal highlights differences on shareholder proposals.” IR Magazine, Nov. 8, 2019

4Rasmussen, P. “Corp Fin Enters Brave New Shareholder Proposal World.” Bloomberg Law, Nov. 26, 2019