- With increasingly strict sanctions impacting the ability to trade bonds, it has been getting harder for investors to manage their exposure to Russian credit risk.

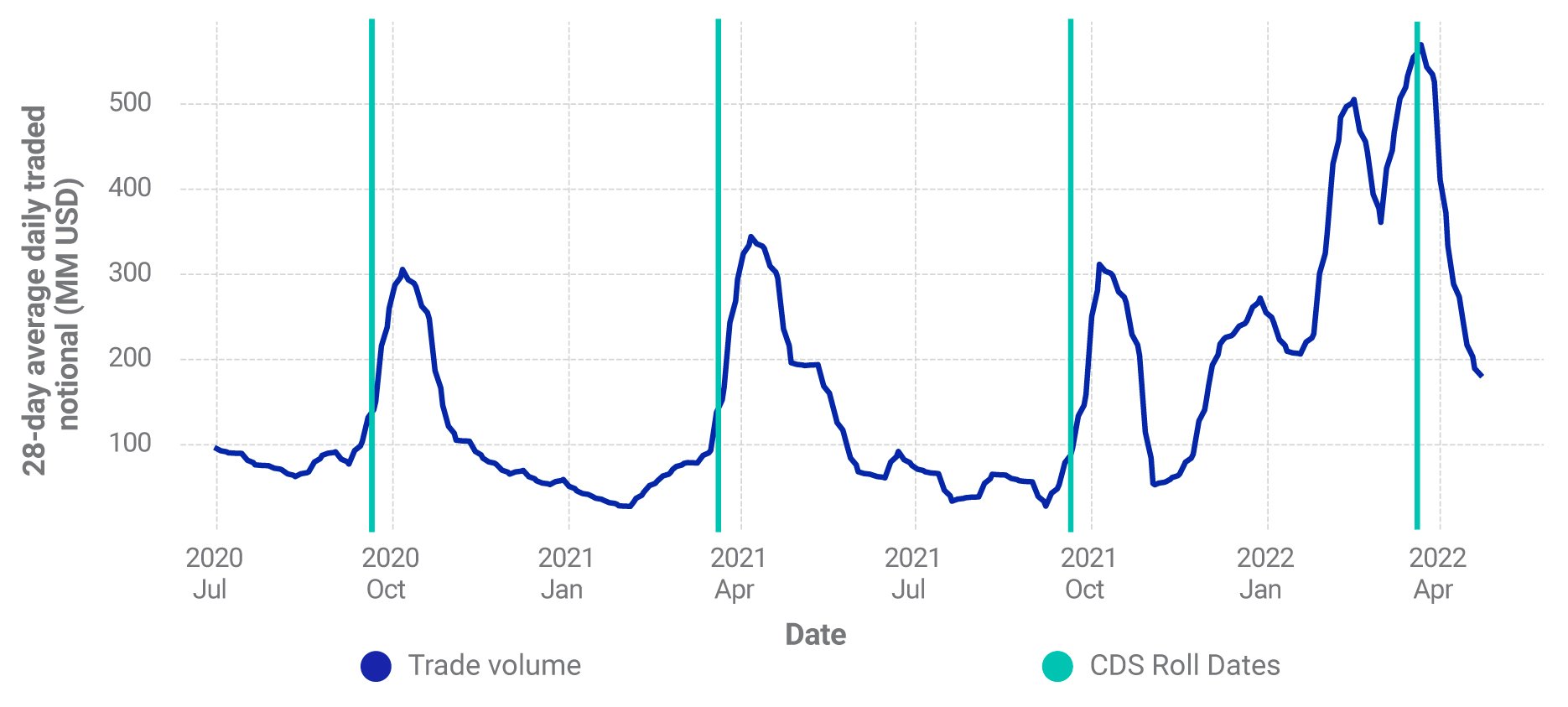

- Trading in credit-default swaps insuring against Russian sovereign default has surged to record volumes over the past few months, as their trading has not been directly affected by sanctions.

- The ability to settle CDS contracts if Russia defaults introduces a new form of recovery risk. It might be impossible to hold an auction of the sanctioned Russian government bonds — the deliverable obligations for the CDS.

While liquidity in the Russian cash-bond market has deteriorated dramatically since the start of the war in Ukraine, the market for credit-default swaps (CDS) derived from Russian sovereign bonds remained alive and well, with volumes surging to the highest levels of the past four years.1 Sanctions have not affected CDS contracts directly, but the settlement process following a default would rely on delivering and auctioning the sanctioned bonds. This poses additional sources of risk for investors. Here, we examine this new form of recovery risk.

As Russia got closer to default, bond liquidity dried up

Dealer-quoted Russian-government-bond prices observed since March indicated that investors may be giving up hope of recovering their investments in Russian hard-currency sovereign debt. At the same time, the probability of a Russian default (implied by CDS prices) reached 95% after the U.S. Treasury Department’s decision to block payments to holders of two USD-denominated Russian sovereign bonds. Russia is still within a 30-day grace period to find a way to make the payments that were due in early April.

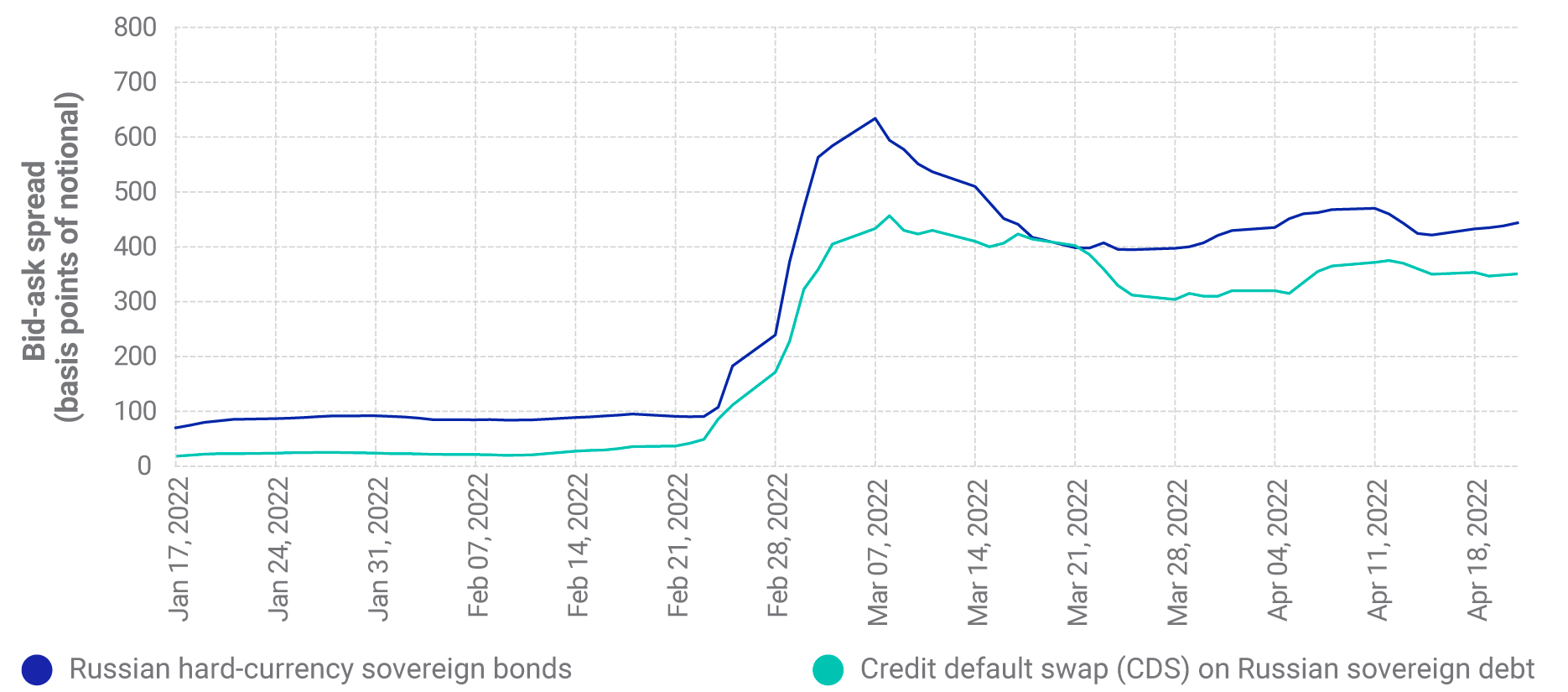

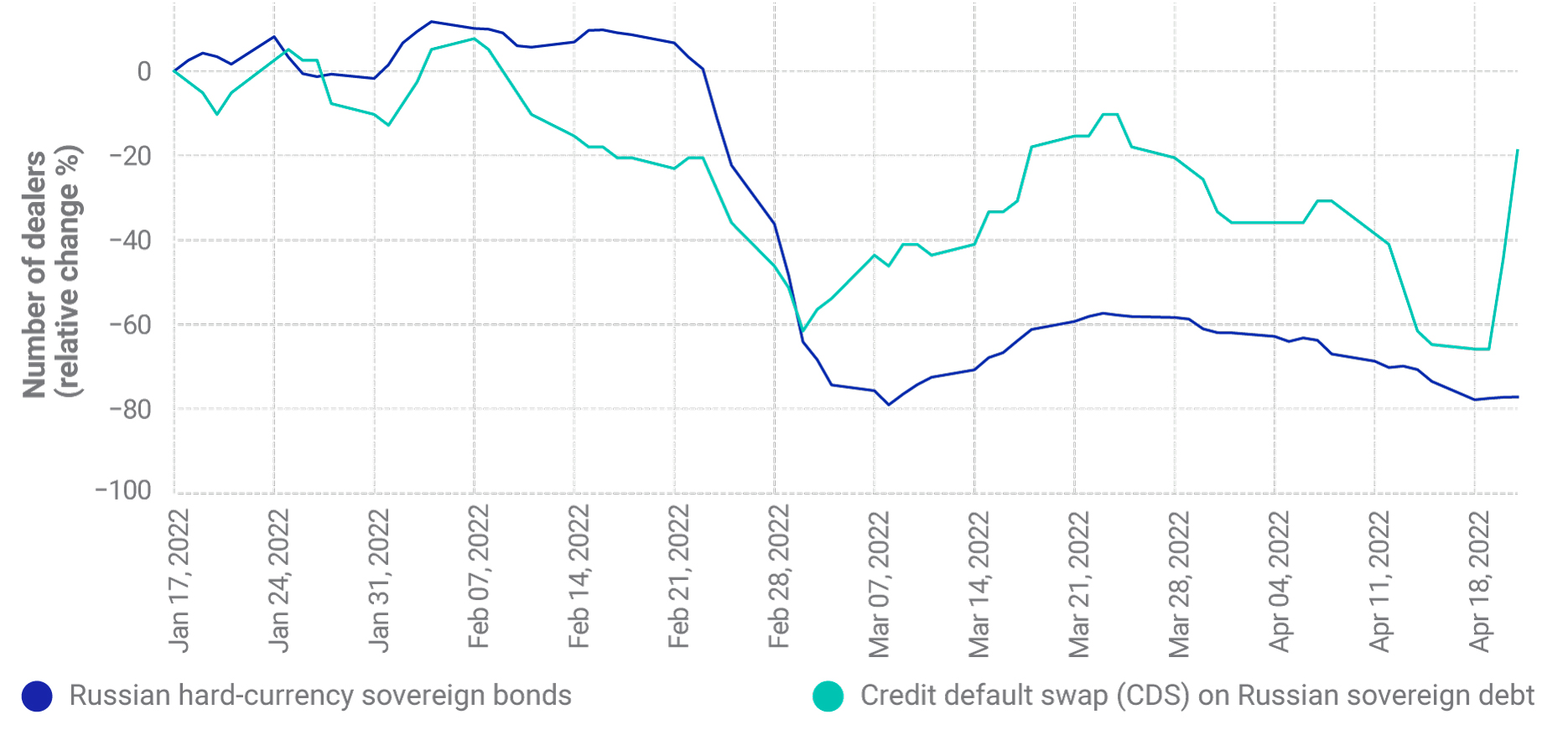

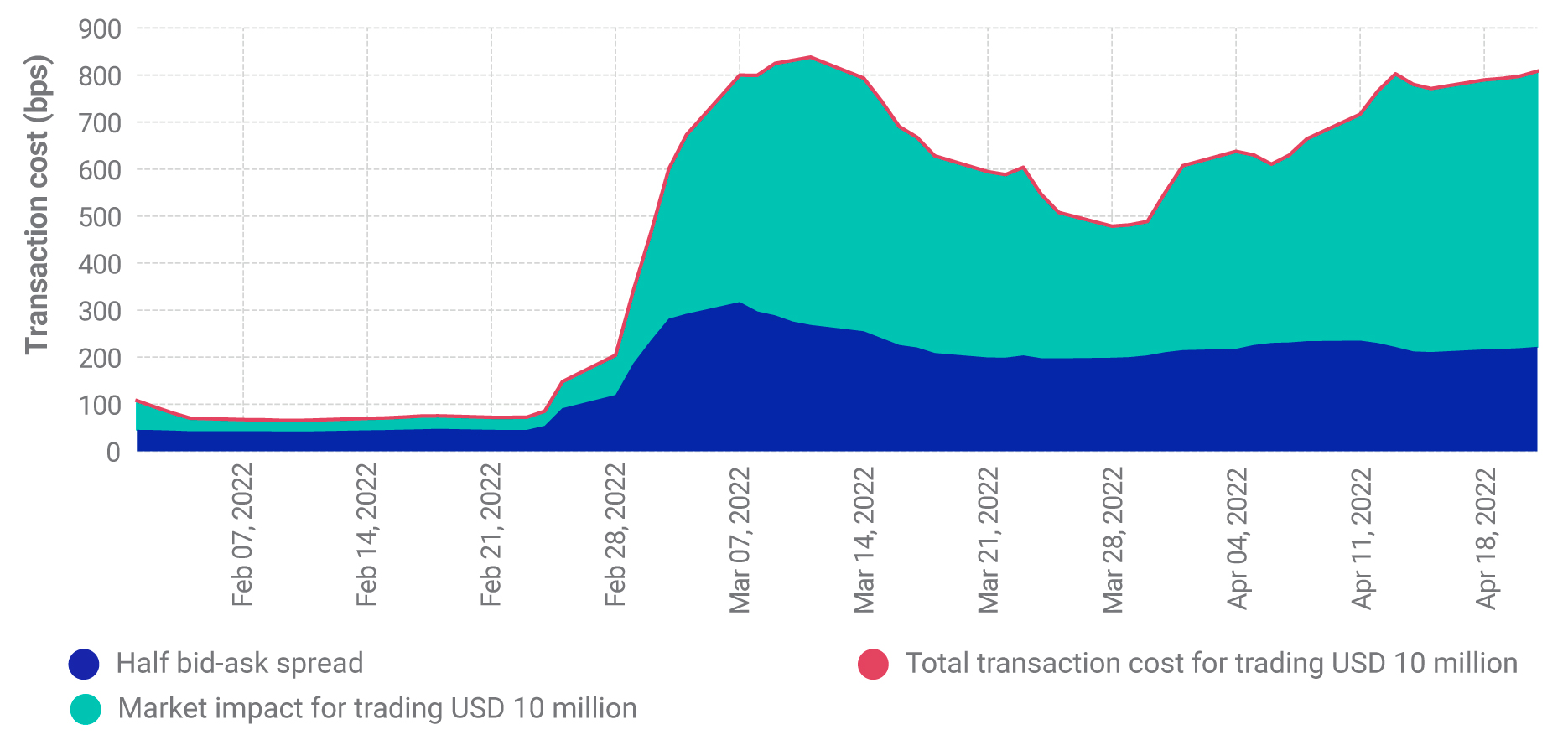

It has been getting increasingly difficult, however, for investors to express views on whether Russia will succeed. At the end of February, the liquidity of Russian hard-currency government bonds started to deteriorate rapidly and drastically: Bid-ask spreads increased sharply and the number of dealers quoting these bonds dropped markedly, according to MSCI based on data from S&P Global Market Intelligence. Typical quote sizes also decreased; and by March, investors executing larger trades (e.g., USD 10 million notional) may have also incurred significant market-impact cost (which measures the excess transaction cost due to the size of the trade above the typical quoted size).2

Bid-ask spread of Russian sovereign bonds and CDS increased

Source: MSCI and S&P Global Market Intelligence

Number of dealers quoting Russian sovereign bonds and CDS dropped

Source: MSCI and S&P Global Market Intelligence

Transaction costs for trading Russian hard-currency sovereign bonds rose

The CDS market remained alive and well

While CDS trading activity has generally been declining since 2008,3 CDS referencing Russian sovereign debt traded at record volumes in the first quarter of 2022. As with the cash-bond market, liquidity conditions in hard-currency Russian sovereign CDS have also deteriorated, but by a lesser amount. This relative difference in liquidity may be a contributing factor to the pickup in CDS trading. In addition, as derivative instruments, CDS don’t require either side of the contract to own the bonds. This may streamline the counterparties’ sanctions-review process and reduce reputational risk.

Increased trading activity in Russian sovereign CDS

Source: MSCI and S&P Global Market Intelligence

CDS pay upon default — but how much?

The presence of sanctions poses major challenges to the traditional CDS auction process. Typically, in the event of default on a CDS contract, an auction is organized by the International Swaps and Derivatives Association (ISDA) where a CDS recovery rate is determined as the price of the cheapest-to-deliver bond out of the deliverable obligations,4 and the payout of the CDS is based on 100 minus the recovery rate. The auction process will generally result in a recovery rate that is uniform across different swap contracts that may be cleared by different clearing houses.

In the current situation, it’s unclear whether sanctions will allow ISDA to hold an auction and, if it is allowed, whether market participants will be willing to take part. If an auction cannot be held, it is possible that an alternative process could be created to ensure a uniform recovery rate.5 Alternatively, holders of the CDS may need to rely on the outcomes of dealer polls. This could result in multiple recovery rates and lead to losses for market makers or investors who thought they were hedged with offsetting positions.6

Summary

With significantly higher costs to trade Russian government bonds, and falling numbers of dealers quoting these bonds, liquidity in the Russian bond market has deteriorated drastically since the invasion of Ukraine. The CDS market, however, has offered relative liquidity to credit investors. Looking forward, CDS investors may want to watch how sanctions may affect the settlement and auction process in case of default.

1Credit-default swaps are bilateral contracts offering default protection to the buyer while exposing the seller to credit loss in exchange for premium payment.

2Based on the MSCI RiskMetrics® LiquidityMetrics® model.

3This is also true for CDS referencing emerging-market sovereign debt.

4For a detailed discussion of the auction process, please see: “Credit Event Auction Primer.” Credit.fixings.com.

5Bartholomew, Helen. “CDS users mull ‘uniform’ price as Russia fallback.” Risk.net, April 8, 2022.

6Investors might get less cash from their protection-buyer positions than what they need to pay for their protection-seller positions, as they might be cleared at different clearing houses, or some may not be cleared at all.

Further Reading

CDS Fading as a Measure of Value in Emerging Markets

Russian Bonds: The 100-Year Storm?

Markets May Be Vulnerable to Stagflation from Russian Invasion