- The equity-market sell-off that continued into 2022 brought renewed focus to firms that can weather the new macroeconomic environment. Such high-quality firms have historically fared well during market sell-offs.

- High-quality firms historically outperformed in both the growth and value segments of the market. This was consistent across the U.S., international and emerging markets.

- In light of this history, some fund managers, risk managers and other institutional investors may be remeasuring, reassessing and managing their quality exposure.

The start of 2022 sent a winter chill through stocks. Two years into the “pandemic rally,” global equities — particularly torrid growth stocks — finally cooled as rising inflation, looming interest-rate hikes and the war in Ukraine spooked equity investors.

High-quality firms, however, have been relatively resilient through the downturn. Does that mean Steve Jobs was right and that quality is the best business plan? Of course, there is no definitive answer to that question. But let’s examine the record.

Quality across the globe

First, it’s helpful to review what makes a high-quality firm and why it matters. We have found there is wide latitude in defining quality. In this blog post, we focus on a firm’s financial quality and use the MSCI FaCSTM definition, which captures several dimensions of quality that span a company’s financial statements.1

This matters because one unsung characteristic of quality firms has been their resilience to market and industry shocks. This has relevance for today’s backdrop of geopolitical risk and surging inflation.

We found that, for example, less than half of the firms that existed in the MSCI ACWI Index 25 years ago survive in the index today.2 What distinguished these long-lived, survivor firms from others? One key difference was their higher exposure to the quality factor.

The longest-lived firms were also higher-quality

Long-lived firms are those that persisted within the MSCI ACWI Index from December 1996 to February 2022. Quality exposure is the capitalization-weighted exposure as of December 1996.

Given this, we looked deeper at quality firms’ records across the three major equity markets — the U.S., non-U.S. and emerging markets (EM) — and within different segments of each, first splitting them into value and growth segments and then into high- and low-quality halves.3

High quality outperformed low quality across styles and markets

Returns are gross in USD from December 1996 to February 2022. Styles use the MSCI Value and Growth Index methodologies. Quality portfolios are equally sized, capitalization-weighted and rebalanced monthly.

The results (shown in the exhibit above) were clear-cut: Higher quality significantly outperformed lower quality over the past two decades. Equally important, they had a lower realized volatility. This outperformance spanned both the value-growth divide and our three market regions (note the log scale in the plot). Most relevant to current conditions, we found that higher-quality firms were especially resilient during periods of market stress, such as the 1998 Russian sovereign default, Sept. 11 attacks and 2003 Iraq invasion.

In an earlier blog post we noted that a high-quality’s firm’s flexibility during market stresses like inflation could be due to its high profitability and low leverage, which may better position it to pass on rising costs to its customers. Throughout the more recent period of our study, from late 2021 through today, high-quality growth stocks outpaced their low-quality counterparts by a wide margin in the U.S. and EM.

Higher-quality growth significantly outperformed lower-quality growth beginning in late 2021

Returns are gross in USD and relative to lower-quality growth stocks in each market. Results are from September 2021 to February 2022.

Wide moats are hard to cross

One reason for these results, over both long periods and short-term difficult ones, could be the durable business models and sustained competitive advantages of quality firms. In fact, high-quality firms tended to remain high-quality in our sample.

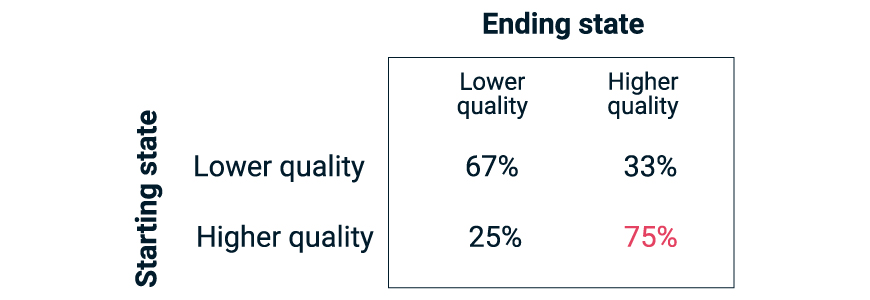

High-quality firms’ enduring quality

A firm’s quality ranking is measured each month, and then ten years forward. Percentages are the average transition over all months of firms in the MSCI ACWI Index from December 1996 to February 2012.

The exhibit above shows the historical likelihood of a firm’s transitioning from one quality cohort to another a decade later. Perhaps due to their wide economic moats or fortress balance sheets, 75% of the firms that began as high-quality remained that way. In contrast, only a third of the lower-quality firms were able to cross the chasm to higher quality after a decade.

Implications for today’s world

Firms with higher exposure to the quality factor outperformed across markets and styles, over the period in our study. Additionally, portfolio managers, risk managers and other institutional investors currently grappling with identifying the most resilient firms may be remeasuring, reassessing and managing their quality exposure.

The author thanks Abhishek Gupta for his contributions to this post.

1MSCI FaCS defines quality as a composite of profitability, low leverage, stable earnings, quality of earnings and limited balance-sheet expansion.

2Some common reasons a firm exits the index are acquisition, bankruptcy or failing to meet minimum investability criteria.

3Value and growth segmentation based on the MSCI Value and Growth Index methodologies.