- Futures linked to an index, such as the MSCI Climate Paris Aligned Indexes — as opposed to conventional market-cap futures — are one option for investors seeking to align exposures with net-zero strategies.

- Some investors have looked to futures to facilitate cash equitization as they work to transition to net-zero strategies in their portfolios.

- The MSCI World Climate Paris Aligned Index outperformed a pool of actively managed climate funds and MSCI World Index, while showing a lower implied temperature rise and lower emissions intensity (as of December 2021).

With the surge in commitments from governments and businesses around the world to achieve net-zero emissions by 2050, climate change has become the leading ESG issue among money managers in asset-weighted terms.1 As a result, institutional investors are increasingly looking for tools to implement net-zero strategies in their portfolios.

Futures linked to the MSCI Climate Paris Aligned Indexes are one option for asset managers and asset owners seeking to align exposures with net-zero strategies, which may not be achievable with conventional market-cap futures.

While futures can play a role in shorting strategies, here we investigate considerations for long-only investors, comparing them with active funds in terms of climate considerations.

Investors have used futures for:

- Transition management: The process by which assets or funds are moved from one portfolio strategy to another. A futures overlay creates a synthetic exposure to the target asset class and can be used to achieve an allocation shift immediately, eliminating the risk of holding cash.

- Derivative overlays: Asset managers often need to make adjustments in their holdings depending on asset-class performance and incoming/outgoing cash flows. In such cases, index futures may help in changing positions in a quick and cost-effective manner.

- Cash equitization: Maintaining adequate cash liquidity while achieving the desired equity exposure

Where do I stand today?

The first step for an institutional investor seeking to align a portfolio with sustainable-investing goals is to understand the portfolio’s climate profile. The exhibit below lists the average Scope 1, 2 and 3 greenhouse-gas (GHG) emissions intensity, defined as emissions per unit of economic output (as proxied by company sales) and enterprise value including cash (EVIC), for the MSCI World, MSCI World Climate Paris Aligned, MSCI Emerging Markets (EM) and MSCI EM Climate Paris Aligned Indexes and a pool of global actively managed climate mutual funds.2

The active climate funds’ emissions intensity was lower than that of the MSCI World Index, but higher than those of the MSCI World Climate Paris-Aligned Index.

Carbon-emission metrics across MSCI indexes and active climate funds

| MSCI World Index | MSCI World Climate Paris Aligned Index | MSCI Emerging Markets Index | MSCI EM Climate Paris Aligned Index | Weighted average climate Paris aligned benchmark | Active Climate Funds | |

| Emissions Intensity (Scope 1+2+3), tCO2e/Sales(M) | 752 | 391 | 1336 | 604 | 402 | 695 |

| Emissions Intensity (Scope 1+2+3), tCO2e/EVIC(M) | 275 | 113 | 623 | 171 | 116 | 283 |

| Emissions (Scope 1+2+3), Millions tCO2e | 40 | 18 | 50 | 15 | 18 | 18 |

| Implied Temperature Rise (ºC) | 2.9 | 2.0 | 3.8 | 2.5 | 2.0 | 2.6 |

Average greenhouse-gas emissions intensity (tons of CO2 equivalent per USD 1 million in sales) across different portfolios, as of Dec. 31, 2021. Climate funds classified based on relevant keywords in their names. MSCI implied temperature rise estimates how companies and investment portfolios align with the international goals to limit global warming, incorporating future commitments. Weighted average Paris-aligned benchmark is calculated based on a weighted average of the MSCI World Climate Paris Aligned and MSCI EM Climate Paris Aligned Indexes with weights of 95% and 5%, respectively. This has been used given the average exposure of climate funds considered for the analysis. Climate metrics have been calculated based on the index constituents as of Dec. 31, 2021, and did not take into account the decarbonization trajectory within the index methodology.

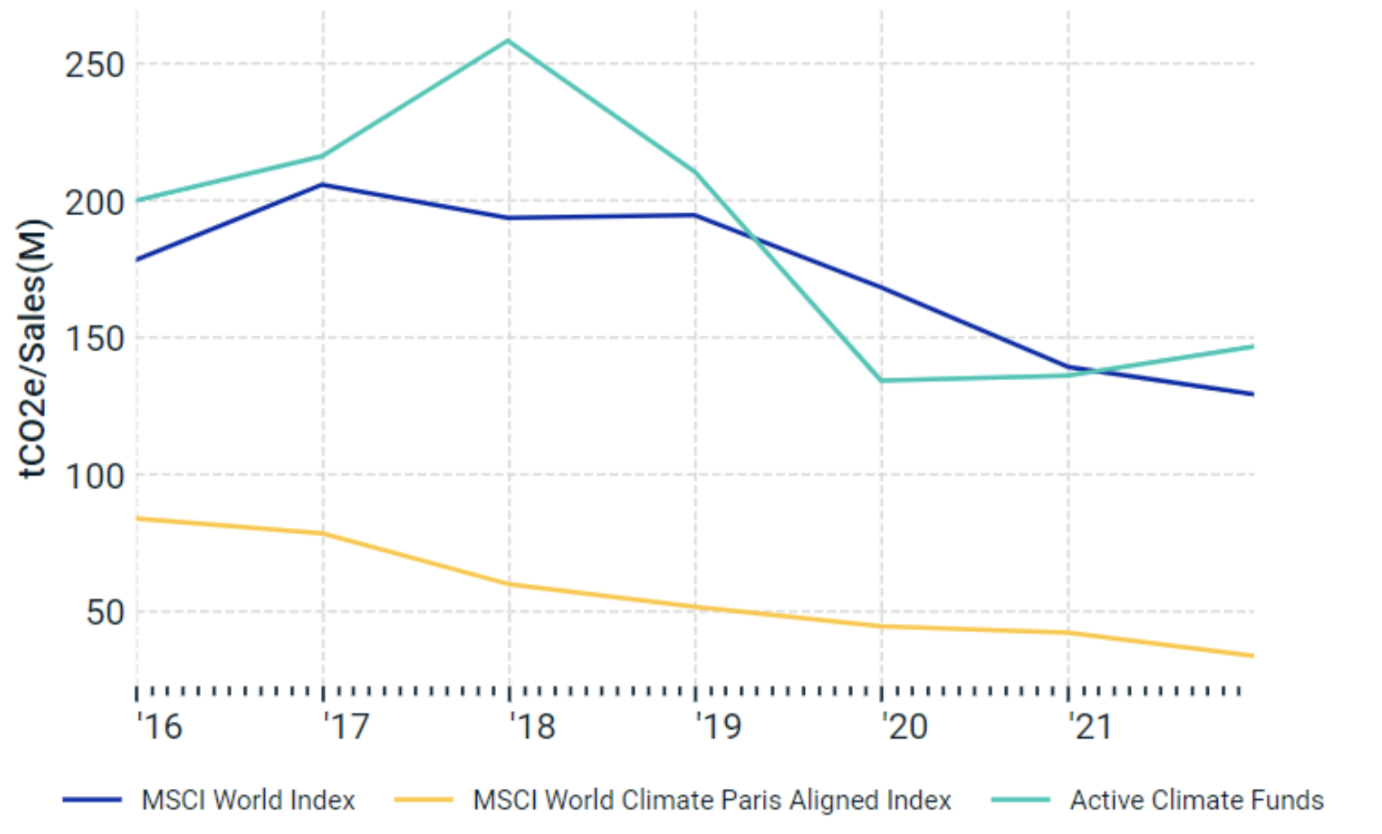

Getting more specific — looking at Scope 1 and 2 emissions only — we can see in the exhibit below that the MSCI World Climate Paris Aligned Index had significantly lower emissions intensity throughout its history, relative to the active climate mutual funds, as well as the MSCI World Index.

Scope 1 and Scope 2 emission intensity over time

Year-end total direct GHG emissions intensity (Scope 1 and 2) in tons of CO2 equivalent per USD 1 million in sales from 2015 to 2021. Source: MSCI ESG Research LLC

We recognize that assessing a pool of funds based on averages may not reflect the distribution of climate metrics across those funds. The following exhibits position the MSCI World and MSCI World Climate Paris Aligned Indexes within the distribution of the selected active climate funds. We found:

- The MSCI World Climate Paris Aligned Index had lower emissions intensity than all the active funds.

- The MSCI World Climate Paris Aligned Index exhibited an implied temperature rise of almost 1 degree Celsius lower than its parent MSCI World Index, through decarbonization and fossil-fuel-based exclusions, as well as higher exposure to companies assessed to have a credible decarbonization pathway.

The active funds had a high degree of dispersion in emissions and an implied temperature rise close to that of the MSCI World Index, indicating the importance of evaluating them on an individual basis before making specific decisions.

Distribution across active climate funds

As of Dec. 31, 2021. Source: MSCI ESG Research LLC

A blended approach

One option for investors looking to transition to sustainable investing and strive toward net-zero commitments is to blend their management strategies with indexed investing, or investing in climate funds to seek a target exposure. Futures linked to indexes, such as the MSCI Climate Paris Aligned Indexes, could serve these transition-management needs, as investors seek to bridge the gap between climate considerations and market exposure.

The exhibit below shows the historical risk-return profile of the MSCI World Index, the active climate funds and the MSCI World Climate Paris Aligned Index, as well as a combination of active and index-linked approaches, from January 2015 to December 2021. Both the active climate funds and the MSCI World Climate Paris Aligned Index outperformed the MSCI World Index over this sample period. The active climate funds did so with greater risk, whereas the risk of the MSCI World Climate Paris Aligned Index was in line with the MSCI World Index.

Historical risk-return of MSCI World and MSCI Climate Paris Aligned Indexes and active climate funds

Annualized return is calculated on a net-total-return basis, and annualized risk is calculated from monthly net total returns.

Looking back and looking forward

Derivatives linked to climate are still in the early stages of product innovation and investor adoption. As a growing number of investors recognize the risk of climate change and strive for net-zero portfolio solutions, the range of index-linked climate derivatives available to manage those exposures is likely to become more extensive — combining more traditional backward-looking metrics with those that seek to capture forward-looking emissions targets and projections.

1The sustainable-investing assets in five major markets, Europe, the U.S., Canada, Japan and Australia and New Zealand, stood at USD 30.7 trillion at the start of 2018, according to the Global Sustainable Investment Review by Global Sustainable Investment Alliance (GSIA).

2From the universe of globally focused funds (7,895), climate funds (55, including ETFs) were identified as those having a defined set of keywords in the fund name — “climate,” “green,” “fossil,” “carbon,” “warming,” etc. ETFs and index-tracking funds were dropped from the analysis to obtain actively managed funds (48). Actively managed climate funds were then selected with additional filters based on sufficient data availability for their constituents in the MSCI ESG Research database. Funds with less than 80% coverage, missing the latest holdings data (within 1 year) or where the accumulated weight of missing constituents’ data is greater than 10% are dropped from the analysis. We get a universe of 21 actively managed climate funds with global exposure (on average 95% exposure to developed markets) for the analysis. Total emissions and emission intensities for these funds have been calculated using the weighted average of the data, whereas implied temperature rise has been calculated using the methodology for portfolio-level implied temperature rise.

Further Reading

ESG and Climate Derivatives in Equity Exposure Management

What Implied Temperature Rise Means for Funds