- A portfolio’s climate-transition risk, a major element of overall climate-change risk, is associated with the portfolio’s emission footprint.

- We investigate two approaches to reduce credit portfolios’ exposure to climate-transition risk: using either a decarbonization target as a constraint or a weighting scheme based on the securities’ climate profiles.

- Tractability, turnover and trading cost related to each method are crucial factors that may impact the performance of a portfolio and can help in deciding the approach to managing climate-transition risk.

Climate change may introduce a significant risk to credit portfolios. In a recent paper, we showed that the credit spread of corporate-bond portfolios could double from recent levels if climate risk materializes.

Are there ways that managers can take an active approach to systematically managing exposure of a corporate-bond portfolio to climate-transition risk? We investigate doing this via different approaches to decarbonization of a portfolio, i.e., reducing the portfolio’s total greenhouse gas (GHG) footprint.1

Given that companies in three sectors — energy, utilities and materials — contribute more than two-thirds of global emissions and these sectors score by far the highest carbon intensity,2 any approach which, in aggregate, underweights these sectors (and high-emitters in other sectors) can achieve a certain level of decarbonization. Whether it is adequate depends on sustainability and financial targets and the investment philosophy of the investors. We now examine different ways of decarbonizing corporate-bond portfolios.

-

Direct decarbonization target: In this approach, a minimum level of decarbonization is imposed as a constraint on the portfolio selection/construction process. Managing a portfolio with a mandated constraint, e.g., a minimum credit rating, is a familiar practice for managers of credit portfolios. Similarly, in this approach, a manager must achieve financial targets while maintaining a cap on emissions or any other measure of transition risk at the portfolio level. For one example of this approach, see Climate Transition and Bonds: Risk or Opportunity?

There are three considerations that might affect the outcomes in this approach: 1) a careful definition of the metrics measuring transition risk and decarbonization targets (level and path of decarbonization); 2) consistency between the decarbonization target and the emission profile of the investment universe; and 3) flexibility of other constraints to allow for a feasible investable universe.

A suitable metric would embed:

- Forward-looking information about the ability of a firm to manage the transition risk and its readiness to transform and improve its emission profile

- Differentiation between short- and long-dated credit securities, as the long-dated securities have a larger exposure to transition risk

An example can be found in the MSCI Fixed Income Climate Paris Aligned Indexes, which use MSCI’s Climate Value-at-Risk tool as a measure of climate-transition risk. Portfolios that aim to replicate these indexes may experience reduced tractability and potentially high turnover (and consequently, high transaction cost).

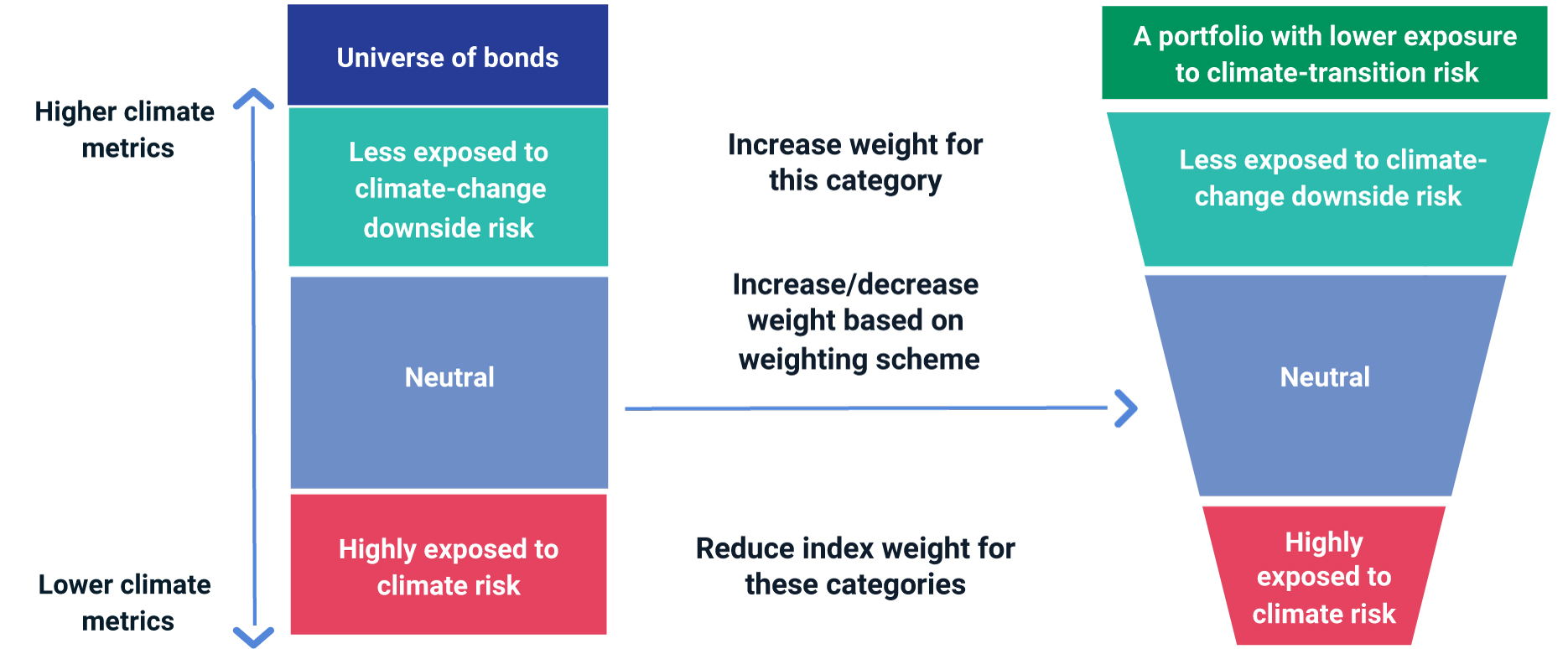

- Tilting portfolios toward constituents with better climate profiles: Intuitive attributions like ”total emission” or ”emission intensity”3 can be used for the weighting/selection scheme in this approach. But summary statistics like Climate Value-at-Risk, Low Carbon Transition Scores4 or Implied Temperature Rise5 aiming to capture a firm’s potential to manage its exposure to transition risk are more suited to be used in the weighting scheme for this approach. Despite its flexibility and tractability, this approach cannot guarantee a decarbonization path. The MSCI Climate Change Corporate Bond Indexes illustrate how an index can be tilted along these lines.6

Climate-profile-based portfolio construction

In some segments of the credit market, especially among investment-grade bond issuers, distribution of ESG ratings in the energy and materials sectors suggests that a greater number of these issuers have below-average ESG ratings. In these segments, a portfolio tilted toward constituents with overall higher ESG ratings would underweight companies in energy and materials and would aim to have an improved GHG footprint. Although it’s desirable to simultaneously improve both the ESG rating and carbon footprint of the portfolio, a consistent decarbonization of a portfolio across all credit segments may not be achieved.

As investors and asset owners vary in their investment philosophy and their sustainability targets, a combination of these approaches can be adapted to manage the exposure of the corporate bond portfolio to climate transition risk.

1One way to manage the climate- transition risk is to exclude companies with the highest greenhouse gas (GHG) emissions from the investment universe. While it is a simple strategy, the exclusion at the firm or sector level is a passive approach to decarbonization. It also reduces the potential upside of investing in firms as they transform to low-emitting companies.

2Mastouri, Afsaneh, Mendiratta, Rohit, and Giese, Guido. “In Transition to a New Economy: Corporate Bonds and Climate-Change Risk.” 2021. MSCI Research Insight.

Giese, Guido, Nagy, Zoltán, and Rauis, Bruno. “Foundations of Climate Investing: How Equity Markets Have Priced Climate-Transition Risks.” 2021. MSCI Research Insight.

3 Complexities of calculating economic value including cash (EVIC) for private companies and volatility market value of a firm makes “financed emission (emission/EVIC)” often a less suitable metric for credit portfolios.

4A measure of a company’s exposure to climate change risk and its capacity to manage this risk

5Implied Temperature Rise, which summarizes the cumulative projected emission of a firm versus its emission budget (based on geography, sector, etc.), measures the impact of a company’s emissions on the world.

6Although weighting scheme based on Implied Temperature Rise can potentially achieve a decarbonization consistent with a target temperature, it cannot guarantee a path of decarbonization consistent with a specific target at portfolio level.

Further Reading

In Transition to a New Economy: Corporate Bonds and Climate-Change Risk

Climate Transition and Bonds: Risk or Opportunity?

How Climate Change Could Impact Credit Risk

Aligning with the Paris Agreement: An Index Approach

Foundations of Climate Investing: How Equity Markets Have Priced Climate-Transition Risks