- Mandatory TCFD-based climate disclosures have become increasingly common across jurisdictions, and meeting requirements can be challenging.

- As climate metrics become increasingly sophisticated, using the same metrics for emissions reporting and in building more complex climate models may be important for achieving internal consistency.

- Financial institutions can leverage metrics used in disclosures for additional functions, such as integrating climate into risk-management frameworks and informing net-zero strategies.

In the U.K., large asset managers, life insurers and pension providers recently completed their first mandatory climate disclosures based on the requirements of the Financial Conduct Authority (FCA). The reporting rules are based on standards from the Task Force on Climate-related Financial Disclosures (TCFD).1 This marks the latest development in the growing number of jurisdictions adopting climate into legislation.

With growing sophistication in TCFD reporting, it is worthwhile reflecting on how climate data can be best used to make disclosures consistent and meaningful across different parts of a business. This blog post presents three current topics that are relevant to the evolution of TCFD reporting for financial institutions: choice of metrics, internal consistency and cross-functional applications.

Choice of metrics

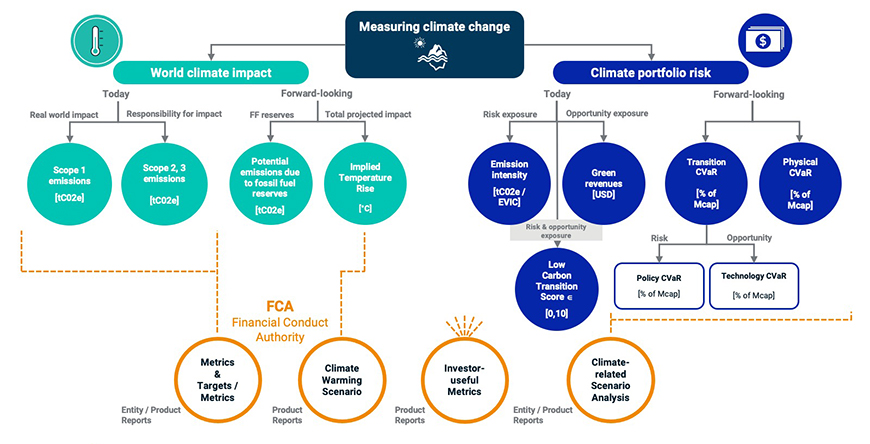

There are many climate-related metrics available to disclosing institutions, and the number continues to grow. MSCI has more than 2,000 data points on climate alone — not including the wealth of available ESG and biodiversity data. For example, in addition to reported-emissions factors, MSCI provides emissions-estimation approaches (including for Scope 3) to support financial institutions in their carbon footprinting. The range of options gives users the power to match appropriate data points to required disclosures.

What’s more, variations in metrics, such as different carbon metrics for carbon footprinting, provide users with nuanced insights. For example, financed emissions can be used to describe the impact of investments on climate change, and carbon intensity by revenue can be used to identify exposure to climate-change risk. In short, choice and variation of metrics can help produce appropriate disclosures and manage climate impact and risk.

MSCI’s climate-metrics decision tree and relevance to FCA TCFD-based disclosures

Source: MSCI ESG Research

Internal consistency

Methodologies used to produce climate signals may differ, even when aligning to global standards. More complex climate solutions, such as MSCI Implied Temperature Rise for portfolio temperature alignment and MSCI Climate Value-at-Risk for scenario analysis, build on reported data points (or estimated data, in the case of lack of disclosures) such as carbon emissions and emissions-reduction targets. Using the same data points for emissions disclosures and as inputs into sophisticated climate solutions (and the resulting reporting) generates an internal consistency that is useful beyond reporting requirements. It enhances interpretability, clarity and usability.

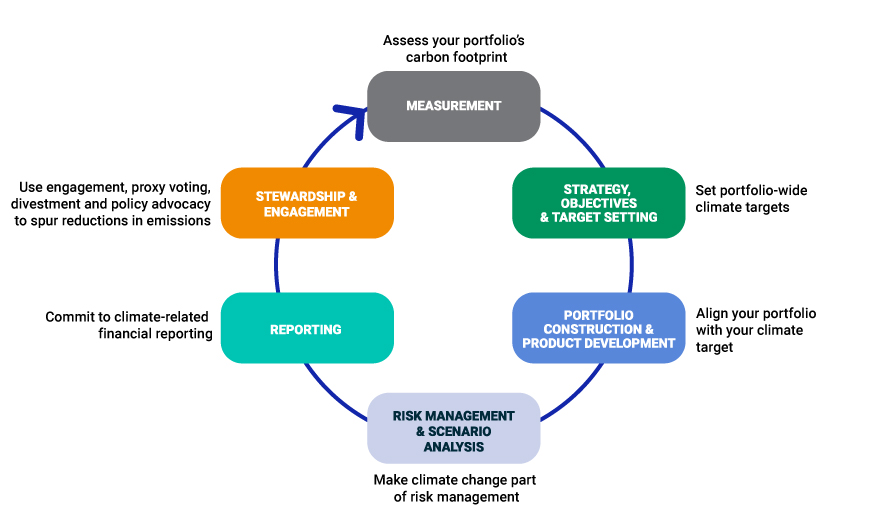

Cross-functional applications

Financial institutions are already looking for the best approaches to integrate climate data into investment processes such as portfolio construction and risk management. For example, the same data points used for disclosing temperature alignment (e.g., implied temperature rise) can be used to screen and help optimize portfolios to support decarbonization goals; and data points used for scenario-analysis disclosures (e.g., climate value-at-risk) can be used for bucketing portfolio positions into risk categories to help portfolio managers assess climate-change risk and opportunities. The number of use cases across financial institutions continues to grow — a trend that will likely persist as the U.K. regulatory environment around sustainable finance continues to evolve with the expected finalization of the FCA’s Sustainability Disclosure Requirements (SDR) and the Transition Plan Taskforce (TPT).

The climate investment process

Source: Manish Shakdwipee, Guido Giese and Zoltan Nagy. “Understanding MSCI’s Climate Metrics.” MSCI Research Insight, Jan. 10, 2023.

Four potential benefits for financial institutions

Mandatory climate disclosures have become a catalyst for the wider adoption of climate metrics into business functions across financial institutions. As disclosures require increasingly sophisticated climate metrics, maintaining internal consistency across metrics is likely to become increasingly important. In addition, growing familiarity and comfort with climate metrics will allow financial institutions to (1) benefit from their integration into existing disclosure frameworks, (2) better assess, and thus better work toward minimizing climate-change risk, (3) seek opportunities from a low-carbon transition and (4) manage progress toward decarbonization commitments.

1“PS21/24: Enhancing climate-related disclosures by asset managers, life insurers and FCA-regulated pension providers.” Financial Conduct Authority, December 2021.

Further Reading

The Climate Transition Is Increasingly About Opportunity

Understanding MSCI’s Climate Metrics