Concerns about a recession faded during 2023, as the U.S. economy showed surprising resilience and inflation rates steadily decreased. The much-talked-about economic “soft landing” seems increasingly attainable: A recent survey revealed that the majority of polled economists believe there is only a small chance of a recession in 2024.[1] This view is aligned with our soft-landing scenario, under which the value of a diversified portfolio of global stocks and U.S. bonds could gain 4%. Downside-risk scenarios, such as “hard landing” and “inflation resurgence,” could result in 1% and 8% losses, respectively. Our most optimistic scenario, assuming a positive productivity shock potentially driven by AI, could lead to a portfolio gain of 12%.

Adapting to the new normal

In our recent paper, we explored five key investment themes for 2024. These include strategic developments like global power shifts, the widespread deployment of AI and the ongoing energy transition, all anticipated to gain momentum this year. The macro backdrop will continue to drive short-term investor concerns, however. We revised our four scenarios for 2023, accounting for updated economic forecasts and recent market prices. While high long-term bond yields are somewhat at odds with the high valuations of equities, the potential for productivity increases from large-language-model-based innovations, along with the resilience of economic growth in 2023, might justify current equity prices. But geopolitical conflict remains a risk factor, as escalating conflicts could result in rising energy prices and increased inflationary pressures.

We used the MSCI Macro-Finance Model to assess one-year expected returns under the soft-landing scenario in which the Federal Reserve successfully gets inflation under control while avoiding recession. We then compared the returns to the historical model-implied baseline expected returns. The exhibit below shows that U.S. fixed income has become significantly more attractive compared to the past 25 years. Equities’ expected returns slightly decreased compared to the previous quarter’s forecast, further narrowing the gap between equities and bonds.

One-year expected returns for major US asset classes under the baseline soft-landing scenario

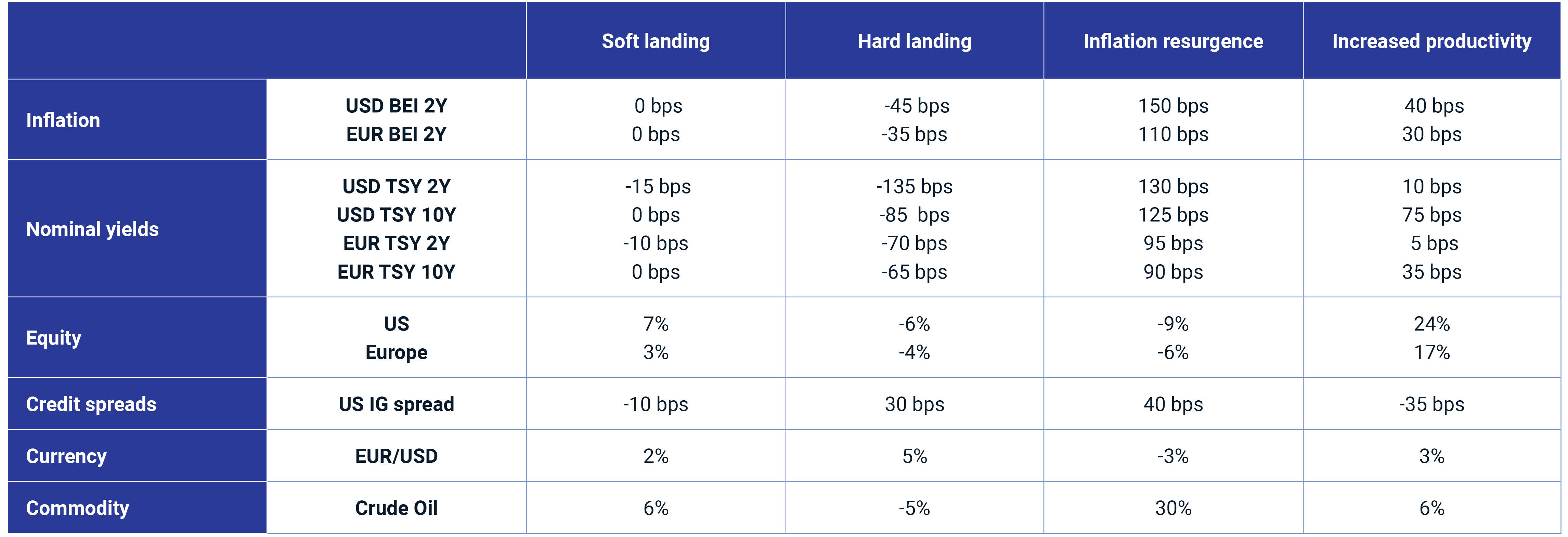

In addition to updating the soft-landing scenario, we also revisited the risk-factor shocks for three alternative scenarios, two reflecting downside and one upside risk:

- Hard landing: Overaggressive monetary policy effectively curbs inflation but at the cost of a U.S. recession in 2024. The Federal Reserve slashes rates to try to correct course. Slowing demand puts downward pressure on oil prices.

- Inflation resurgence: Central-bank policy does not tame inflation, eroding central banks’ credibility. Inflationary pressures resurface, and oil prices surge. High prices and interest rates weigh on growth for an extended period.

- Increased productivity: Productivity growth — potentially fueled by AI — leads to robust economic expansion without strong inflationary pressures. This scenario assumes AI’s downside risks are avoided.

The full scenario definitions, complemented with other regional and asset-class assumptions, are shown in the exhibit below.

Our scenario assumptions

Potential implications for financial portfolios

To assess the scenarios’ impact on multi-asset-class portfolios, we used MSCI’s predictive stress-testing framework and applied it to a hypothetical globally diversified portfolio, consisting of global equities, U.S. bonds and real estate.[2] The portfolio’s value gained 4% under the soft landing. Under the more bearish hard landing, the portfolio’s value dropped by 1% as rallying bonds offset the sell-off in equities. The inflation-resurgence scenario hurt the portfolio most, with an 8% loss, as bonds and equities traded down simultaneously. Our most optimistic scenario, assuming AI’s positive impact, gained 12%. The interactive exhibit below shows more-detailed results.