Companies that use carbon credits typically outperform non-users in disclosing and reducing their own emissions, setting targets and investing in low-carbon technologies.

That’s the finding of an analysis by MSCI ESG Research that examined the emissions performance of listed companies and their use of carbon credits across a range of climate-performance metrics.

Material users materially better for the environment

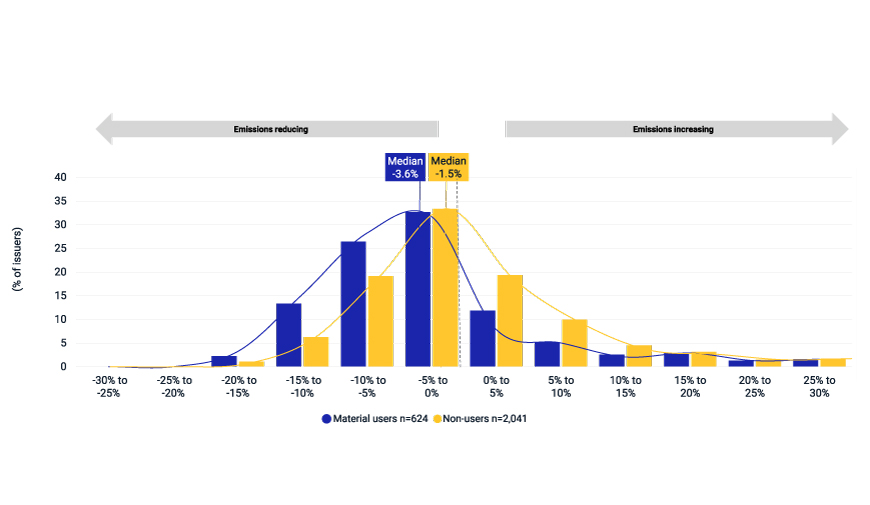

Companies that used at least 1,000 tonnes of carbon dioxide equivalent (CO2e) of carbon credits (material users) reduced their absolute Scope 1 and 2 emissions at a rate more than twice as fast (median of 3.6% annually compared with 1.5%) as non-users over the five years ending in 2022. The analysis also found that 75% of material users reduced their emissions in absolute terms over the same period, compared with 60% of non-users.

The findings, which are statistically significant, expand on a previous study of corporate emissions performance by Trove Research (now MSCI Carbon Markets) and contradict the notion that companies that spend money on carbon credits commit fewer resources to reducing their own emissions.

“The data slams the door shut on the idea that carbon credits are a get out of jail free card for companies,” Guy Turner, head of MSCI Carbon Markets, told leaders from across capital markets at a gathering hosted by MSCI during Climate Week NYC. “There is no evidence that companies are trading off reducing emissions when they buy carbon credits.”

Distribution of annualized change in company-reported gross Scope 1 and 2 emissions for material credit users and non-users, 2017-2022

Material users of carbon credits were more likely to have set a climate target than non-users (92% vs. 52%), and those targets were more likely to meet commonly accepted credibility criteria such as external validation by a third party, the inclusion of short-term or interim targets and a demonstrated record of achieving past targets, the analysis finds.

Credit users also reduced their Scope 1 and 2 emissions intensity (emissions per USD of revenue) faster than non-users (5.6% per year for material credit users compared with 4.4% per year for non-users) and, in nine of 11 sectors, earned a larger share of revenue from low-carbon solutions such as renewable energy or green buildings.

Promising signs of integrity

The integrity of carbon projects — a prerequisite for the viability of carbon-credit trading — is improving, finds a report by MSCI Carbon Markets published in the run-up to Climate Week NYC.

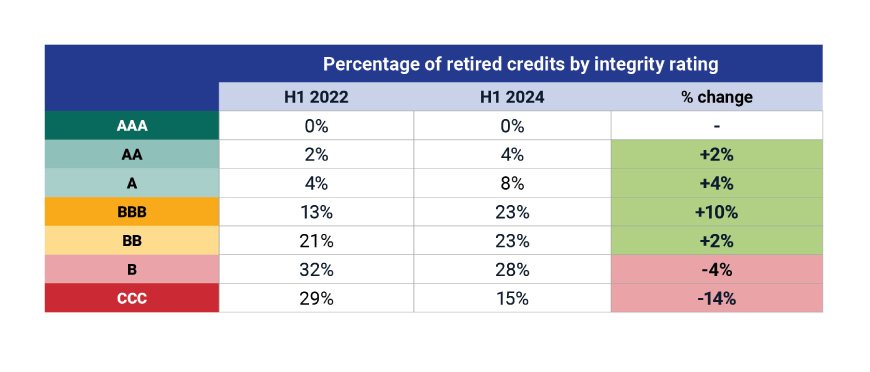

MSCI Carbon Project Ratings assess both the emissions impact and implementation approach of projects against six different risks. These are combined and weighted to create a composite carbon-project rating that ranges from AAA to CCC.

The analysis shows a gradual shift in retired credits moving toward higher-integrity projects. The share of credits with the lowest two ratings (B-CCC) fell by 18 percentage points in the first half of this year compared with the same period two years ago, while the use of the four highest-integrity credits (BBB to AAA) increased by 16 percentage points. Among other key findings:

- Projects in the pipeline are rated more highly, reflecting both improving underlying quality and a shift in project-type mix toward carbon removal; nearly 40% of removal projects have received A to AAA ratings from MSCI, compared with roughly 6% of reduction projects.

- Integrity is among many drivers of carbon-credit prices: On average, a 1-point improvement in a project’s overall integrity score (1 to 5) is associated with an 8% increase in the spot price of a project’s credits.

- Projects that create co-benefits attracted a premium price for their credits, equivalent to USD 1.50/ per tonne of CO2e for each 1-point increase in their co-benefits criterion score over the past two years.

Proportion of retired credits by integrity rating, 1H22 compared with 1H24

“We see a clear shift to higher integrity from lower integrity projects,” said Tristan Loffler, who leads MSCI’s carbon projects and integrity team. “If higher integrity projects command higher prices, then the incentive for developers is that if you develop projects based on standards for integrity you will be rewarded.”

The higher integrity ratings, on average, for pipeline projects reflect the tendency of such projects to follow best-practice improvements and techniques in their methodologies, assumptions and implementation design, Loffler noted.

The trend toward improvements in integrity contributes to the growth of the voluntary carbon market by increasing the confidence of investors that each carbon credit actually represents the reduction or removal of one tonne of CO2e emissions.

“When you have integrity in place, you have liquidity in the market,” Turner added. “No one questions the concept of exchanging emissions rights. We just have to make sure the underlying asset has credibility.”

Conclusion

A key challenge for carbon markets has been the view that companies purchasing carbon credits have dodged the hard work of decarbonizing. Our research shows the opposite: that credit users have, on average, outperformed non-users both in reducing their absolute Scope 1 and 2 emissions and on a series of climate-performance metrics. Our research further shows that integrity in the market appears to be improving gradually, both in the credits being retired and among new projects starting to be developed.