- A majority of asset allocators are considering adding thematic investments in 2021. Questions remain on how much of an equity program may be dedicated to a thematic allocation.

- Funding a thematic allocation from a traditional growth allocation improved the innovation profile but introduced volatility to the equity program.

- Adding a low-volatility allocation helped reduce risk and balance the trade-offs between higher levels of innovation and risk.

A recent survey by private bank Brown Brothers Harriman found that 80% of ETF allocators are considering thematic investments in 2021.1 A question that could be top of mind for this group is how to incorporate thematic views into their existing equity program. How can they invest in potentially transformative — but historically more volatile — firms, while also seeking to control for valuation and total and active risk? Adding a thematic allocation within a traditional growth equity allocation has been one appealing approach. In this blog post, we explore that and others.

We first consider how a thematic allocation may interact with other common components of a hypothetical equity program. We then examine three allocation schemes that improved the portfolio’s “innovation profile” over the broad-market MSCI ACWI Index, while introducing only modest changes to the risk profile.

The (Efficient) Frontier of Innovation

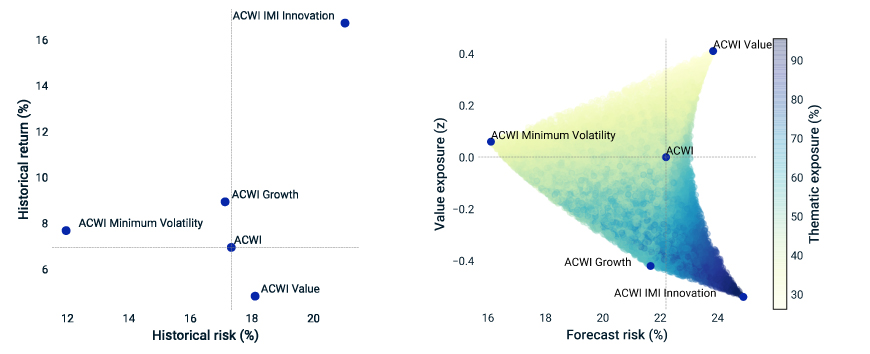

We use the multi-themed MSCI ACWI IMI Innovation Index as our example of a thematic allocation.2 As shown on the left side of the exhibit below, this index has historically outperformed other common equity indexes such as the MSCI ACWI, MSCI ACWI Growth, MSCI ACWI Value and MSCI ACWI Minimum Volatility Indexes, from June 2008 to February 2021. The outperformance has come, however, with higher risk.

Risk, Return, Valuation and Thematic Exposures of Equity Indexes

Left side: Returns are in USD from June 2008 to February 2021. Right side: Data as of Feb. 26, 2021. A higher MSCI FaCS value exposure implies a lower valuation. An index-level thematic exposure is the capitalization-weighted average of its constituents. A single thematic exposure for a firm is used, which is determined as its maximum from MSCI’s 17 themes. Thematic exposure is indicated by the shading. The frontiers of the plot are defined by correlations between the indexes shown. The risk and contours of the right plot are determined by the MSCI Global Equity Factor Model (GEMLT).

We show a variation on these relationships on the right side of the exhibit above, highlighting additional trade-offs. Namely, starting from a baseline of MSCI ACWI and increasing the weight to the MSCI ACWI Value Index resulted in less thematic exposure, lower valuation and higher risk. Similarly, we can measure the sensitivity that increasing the weight of any index had on thematic exposure, valuation and risk over the same period.

Measuring Index Sensitivity

| Index | Thematic Exposure | FaCS Value | Total Risk | Active Risk | |

| Value | ACWI Value | - | + | + | + |

| Low Volatility | ACWI Minimum Volatility | - | --- | + | |

| Growth | ACWI Growth | + | - | + | |

| Thematic | ACWI IMI Innovation | ++ | -- | ++ | ++ |

++ and – imply a high positive and negative sensitivity, respectively.

Two observations are worth noting. First, adding a thematic allocation increased the thematic exposure — as expected — but also increased total risk and active risk and meant richer valuations compared to traditional growth. Second, increasing the weight of low-volatility and value allocations could offset these effects.

Finding a Fit for Thematics

We next explore three possible combinations that increase thematic exposure while controlling for the other outcomes found above.

Our “Base” is identical to the allocations of MSCI ACWI. “Barbell” funds the thematic allocation from exactly half the growth allocation, whereas “Aggressive” fully funds the thematic allocation from the growth allocation. Lastly, “Risk Reducing” funds the thematic allocation from growth, but introduces a low-volatility allocation funded from core.

Note, we assume no view on value and fix its weight throughout to help moderate the valuation and active risk of the total portfolio. The latter is due to its negative correlation with the growth-oriented portion.

Introducing a Thematic Allocation into the Total Portfolio

As seen in the exhibit below, the Barbell combination improved thematic exposure the least, by approximately 7 percentage points, while introducing 160 basis points of active risk. Total risk was similar to the Base allocation. The Aggressive combination increased thematic exposure by the highest amount, but also resulted in the greatest total and active risk.

Risk Reducing’s impact on thematic exposure was between these two extremes: It lowered total risk and drawdown compared to the Base, and did so while maintaining similar active risk to that of the Aggressive combination. In this sense, this combination lowered overall risk, but increased benchmark-relative risk — a characteristic feature of low-volatility equity investing.

Backtesting the Combinations

| Base | Barbell | Aggressive | Risk Reducing | |

| Total Return (%) | 6.9 | 8.3 | 9.6 | 9.5 |

| Total Risk (%) | 17.3 | 17.6 | 18.1 | 16.8 |

| Max Drawdown (%) | -54.6 | -53.1 | -51.5 | -49.0 |

| Active Return (%) | -- | 1.4 | 2.7 | 2.6 |

| Active Risk (%) | -- | 1.6 | 3.2 | 3.0 |

| Thematic Exposure Increase (%) | -- | 6.8 | 13.7 | 11.0 |

| FaCS Value Active Exposure (z) | -- | -0.03 | -0.07 | -0.08 |

Simulation is from June 2008 to February 2021. “Thematic Exposure Increase” indicates improvement over the Base allocation and is calculated from December 2016 to February 2021, the longest possible history.

The Edge of 17 (Themes)

We also found that each combination’s improvement over the Base’s thematic exposure was relatively consistent throughout their recent history, and that we did not require dynamic changes to index weights to maintain exposure improvement. Among the 17 themes targeted by the MSCI ACWI IMI Innovation Index, the improvement was concentrated in themes such as disruptive technologies or genomics.

Combinations Improved the Thematic Exposure over the Base

Analysis from December 2016 to February 2021 for which there are historical thematic exposures. An index-level thematic exposure is the capitalization-weighted average of its constituents. The left plot uses a single thematic exposure for a firm, which is determined as its maximum from MSCI’s 17 themes.

Further, the outperformance of each combination versus the Base was due to overweighting the most innovative firms. In the exhibit below, the active return is attributed to firms based on their thematic exposure. “Pure-play” innovators — those with greater than 75% of operations devoted to a single theme — had the largest overweights and the highest level of outperformance.

Return Concentrated in Pure-Play Firms

Vertical axis is both weight and return contribution in percent. Horizontal axis is the thematic-exposure groupings. All values are relative to the Base allocation and are from December 2016 to February 2021 for which there are historical thematic exposures. A firm’s overall thematic exposure is determined as above. Brinson attribution is performed with MSCI’s Barra® Portfolio Manager.

Beware the Ides of March?

In our examples, the different components of an equity program helped balance the trade-offs between higher levels of innovation and risk — useful information for investors who view events, such as March’s correction in technology stocks, as an opportunity for a growth remix: rebalancing growth allocations and incorporating thematics.

The authors thank Stuart Doole, Neeraj Kumar, Vishad Bhalodia and Wei Xu for their contributions to this post.

1“2021 Global ETF Investor Survey Results.” Brown Brothers Harriman, March 8, 2021.

2The MSCI ACWI IMI Innovation Index includes firms with revenues associated with autonomous technologies, financial technologies, internet-based products and services and genomics.

Further Reading

The Pace of Fast Change: Growth vs. Thematic Investing

A Thematic Lens for Portfolios

Bridging the gap: Adding factors to indexed and active allocations