The falloff in the price of a barrel of oil that began in June 2014 has highlighted how such fluctuations can affect economies and asset prices worldwide.

While low oil prices driven by oversupply generally benefit consumers and equity markets, prices that stay too low for too long can stress oil-producing nations, push energy companies toward default, and strain the global financial system.

With that in mind, MSCI has modeled three possible scenarios for the price of oil that investors can use to stress test their multi-asset class portfolios. Note that each scenario below aims to assess the impact of various shocks. Investors can use MSCI’s RiskManager or our Macroeconomic Risk Model and Scenario Analysis Service to apply others.

A year of oil at $10 a barrel

This scenario assumes that major oil producers do whatever it takes to maintain market share, even if that means driving crude benchmarks to $10 a barrel for roughly a year and destroying the profitability of drilling for all but a handful of producers worldwide. A wave of defaults by energy companies and credit losses to banks that result causes the U.S. financial sector to lose as much as half its value and increases systemic risk worldwide.

The scenario also assumes that growth declines by 3.1% in developed economies and by 4.9% in emerging markets over the period.1

Consumer prices globally would fall by 0.4%. The decline in energy prices may be accompanied by further declines in interest rates.

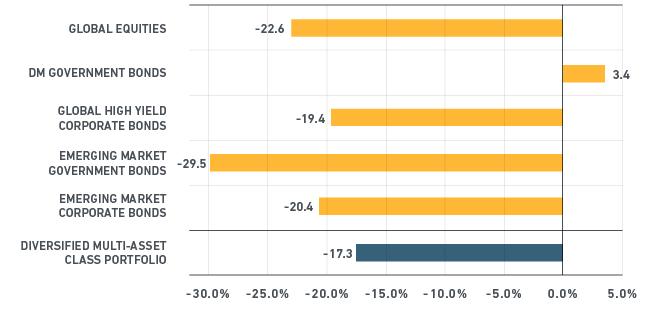

As the chart below shows, a multi-asset class portfolio invested globally could lose 17.3% in this scenario, according to MSCI’s Macroeconomic Risk Model.

The plunge could cause global equities to fall nearly 23%. Investors may seek assurance in developed market government bonds, which could gain 3.4%. By contrast, emerging market government bonds could fall nearly 30%. An index of corporate bonds could fall 19.4% globally and 20.4% in emerging markets.

Oil at $10 a barrel

A year of oil at $35 a barrel with an uptick in systemic risk

This scenario assumes that the price of a barrel of oil hovers at $35 for a year, and that the benefit to consumers in the form of lower prices partially offsets an increase in systemic risk posed by the danger of defaults among energy companies.

The scenario further assumes that growth slows by 0.25% in developed markets and 1% in emerging markets, while consumer prices fall 0.2% worldwide.

In this scenario, a multi-asset class portfolio invested worldwide could lose 5.1%.

Global stocks could lose 6%. An index of developed market government bonds could gain 0.7%, while a similar index in emerging markets could lose 15.8%. Returns on corporate bonds may shrink 4.6% globally and 7.4% in emerging markets.

Oil at $35 a barrel with systemic risk

A year of oil at $35 a barrel without an uptick in systemic risk

This scenario assumes that the energy sector and oil exporters suffer but that the global economy enjoys the effects of a supply-driven decline in oil prices that began nearly two years ago. The scenario further assumes that growth ticks up by 1% in developed and emerging markets, and that consumer prices fall about 0.2% over the period.

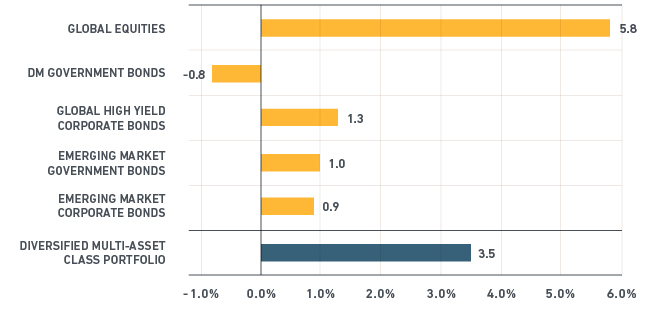

With investors less worried about a step-up in systemic risk, the scenario could produce a gain of 3.5% in a multi-asset class portfolio invested globally.

Stocks could rise 5.8% worldwide. An index of developed market government bond could lose 0.8%, while an index of emerging market government bonds could gain 1%. A corporate bond index may rise 1.3% globally and about 1% in emerging markets.

Oil at $35 a barrel without systemic risk

Model changes in oil prices on your portfolio

Of course, the scenarios discussed above represent just three of many possible sequences of events.

Read more on how to use MSCI’s RiskManager to model the effect of changes in the price of oil on your portfolio and to view the effects of all three scenarios discussed above on equities and global and emerging market corporate bonds by sector.

Read more on MSCI’s Macroeconomic Risk Model and Scenario Analysis Service.

Download our white paper about how MSCI is linking macroeconomic factors to portfolio returns and risk

The author thanks Thomas Verbraken, Jahiz Barlas, Carlo Acerbi and Jean-Maurice Ladure for their contributions and suggestions for this post.

1Assumptions for all three scenarios are derived from “Global Implications of Lower Oil Prices,” IMF Staff Discussion Note, July 2015