Some real estate investors assume that higher-value (big ticket) real estate assets outperform lower-value assets, partly because there are fewer of them and they are harder to buy. But is this just speculation? Using MSCI global real estate dataset, we find evidence that higher-value assets have been more likely to outperform other assets in the same country and sector than lower-priced assets.

One of the defining characteristics of directly owned real estate is its lumpy and indivisible nature. Real estate assets can range in size and value from small warehouses worth a few thousand dollars to downtown office towers worth billions. But buyers are limited by size and capacity constraints. For direct investments, smaller investors are generally limited to lower-value assets (though they can access higher-value properties via pooled vehicles), while larger investors typically prefer larger properties for efficiency purposes. The resulting stratification of investment markets could lead to differences in performance within the broader real-estate market.

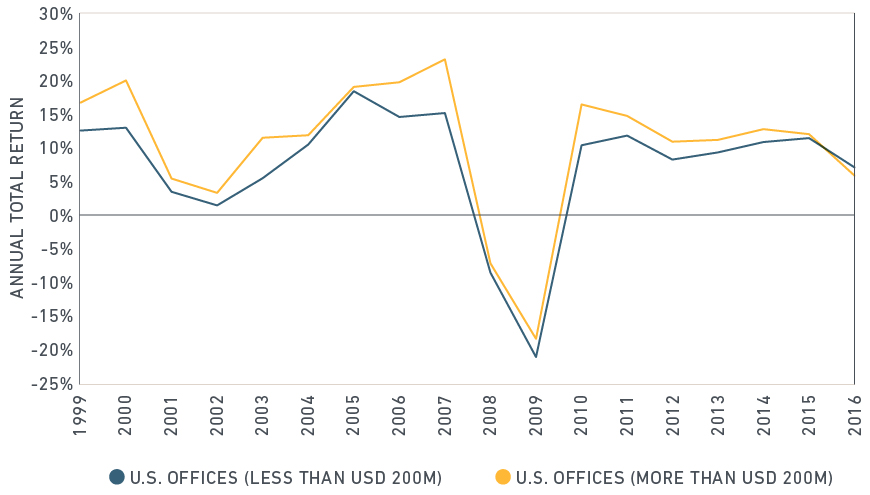

Since 1999, for example, U.S. office assets worth more than USD 200 million have outperformed smaller U.S. office assets in every year except 2016.1

Large U.S. office assets have outperformed smaller office assets in 17 of the past 18 years

Source: MSCI – Global Intel

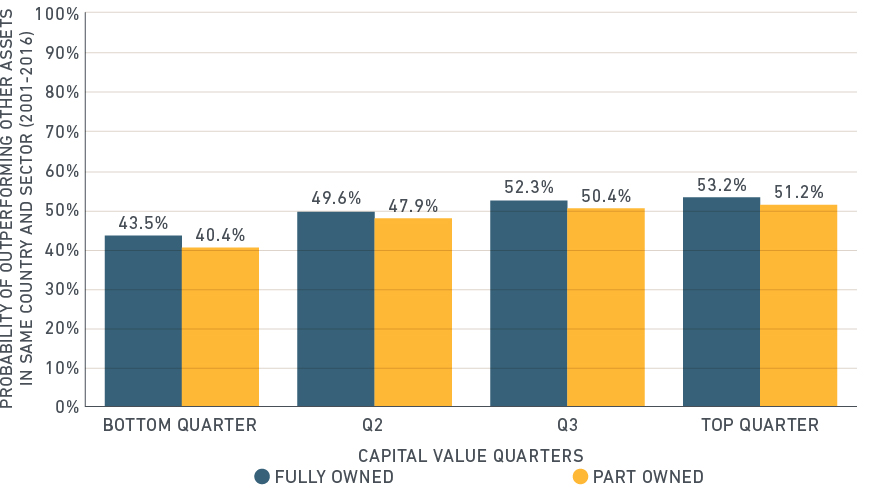

But has there been a systematic difference in performance across capital value bands at a global level? To answer this question, we used 487,152 annual return observations from 87,723 assets across 24 national markets over a 16-year period in the retail, office and industrial sectors. The analysis controls for difference in location and property type by comparing assets only within in the same country and sector.

The exhibit below shows that higher-value assets have historically had a higher chance than lower-value assets of outperforming other assets in the same country and sector. For instance, a fully owned asset in the top capital value quarter for its sector and country had a 53.2% chance of outperforming its country and sector peers overall, compared with 43.5% for a fully owned asset in the bottom quarter.

In addition, part ownership slightly reduced the chances of outperformance, though this effect appeared to be relatively small compared with the impact of asset size. To illustrate, a part-owned asset in the top capital value quarter still had a higher chance of outperforming than a fully owned asset in the first or second quarters.

High-value assets were more likely to outperform low-value in the same country and sector

Source: MSCI

Note: Probabilities are estimated using a probit model, in which the dependent variable can take only two values, in this case “outperform” or “underperform.”

Notwithstanding these results, it is important to consider the wider implications for portfolio performance. Adding larger assets to a direct portfolio can increase concentration risk and leave the portfolio more exposed to asset-specific performance. Outside of direct ownership, investors can consider indirect investment via fund structures to increase their exposure across the value spectrum. They can also use market data to understand how assets of various sizes have performed historically and to track the performance of individual assets relative to their peers.

1 Past performance is not necessarily an indicator of future performance.

Further reading:

Private real estate: valuations and sale price comparison report 2016 results