- With negative sentiment around retail real estate, many question whether valuations of retail property are too high.

- For properties that have been transacted, and where MSCI has both sale prices and valuations, there does not appear to be overvaluation, on average across global markets.

- The largest disparity across real estate sectors is found in the way industrial appraisals are lagging the transaction market.

Appraisers of retail real estate have come in for criticism for excessive bullishness. Media commentary has fixated on the shuttering of shops, while retail-focused real estate investment trusts (REITs) are priced at substantial discounts to the value of their assets.1 Against this backdrop, many question whether appraisers are overvaluing retail properties. But MSCI data on transacted assets suggests that appraisers haven’t been over-optimistic on the retail sector; and, if anything, they appear to have appraised retail assets more accurately than other property sectors — industrial real estate, in particular.

Price vs. valuation in historical context

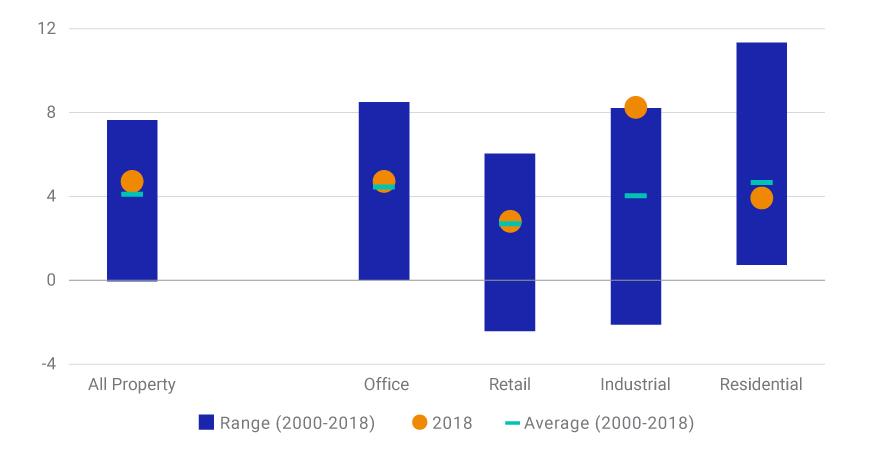

Countering some commentators’ skepticism, assets transacted during 2018 (across all sectors, including retail) were sold at premia, rather than discounts, to their most recent valuations, as the exhibit below indicates. While retail had the lowest premium across the sectors in 2018, it was in line with its 20-year average, as were the office and residential sectors. Meanwhile, industrial’s weighted average premium was at a record high.

Today’s appraisals and pricing in historical context

Sales price is expressed as a percentage premium or discount to most recent valuation. The weighted average is calculated across global sectors for assets sold in the period.

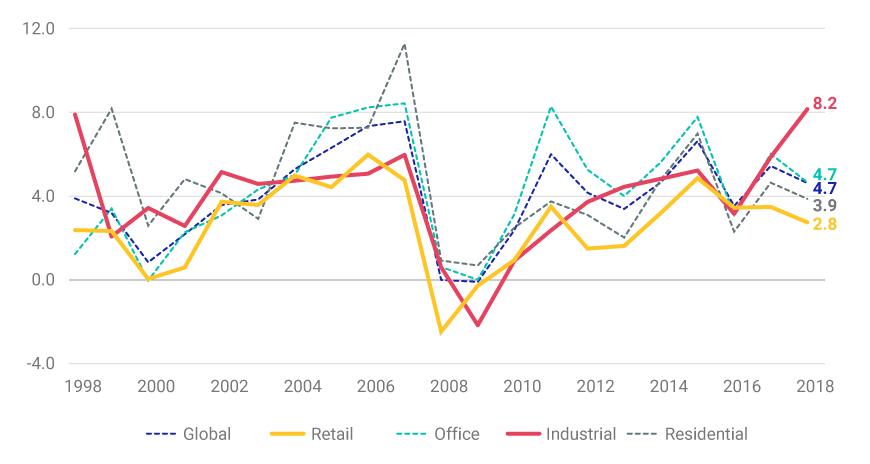

These premia were correlated with real estate’s capital-value growth cycle and widened in fast-moving market conditions, where appraisers struggled to keep pace. That said, they historically had a positive bias. Even during the depths of the global financial crisis, retail premia turned into only a minor discount.

Premia widened and narrowed with the real estate cycle

Sales price is expressed as a percentage premium or discount to most recent valuation. The weighted average is calculated across global sectors.

Why is there a difference between trading price and valuation?

The question of value is not as straightforward as it first appears. Most people are familiar with the phrase “something is only worth what someone is willing to pay for it.” Attributed to Publilius Syrus in the first century B.C., this notion has been around for at least a couple of thousand years. Publilius doesn’t paint the full picture, however. The marginal buyer sets the market price: the one who is most willing — but also able — to pay, but even then, only if the offer is accepted by the seller. For a listed security, with thousands of buyers and sellers agreeing on prices for thousands of identical shares, there is no question about the market price of a security. Negative sentiment about market dynamics can be efficiently transmitted to pricing.

When it comes to private real estate, however, we don’t have evidence for specific buildings — only that of broadly comparable buildings. The truth is, at any point in time we don’t know what someone is willing to pay. Appraisers balance relevance and “freshness” of market “comps” in their estimation of market value.

And the result? We can’t observe bids on assets that haven’t sold or those not offered for sale, so there is no way to assess the accuracy of valuations of such properties. For assets that have traded, however, it seemed appraisers did a reasonable job with the limited evidence they had.

1See, for instance: Evans, J. “Death of the high street weighs on landlords round the world.” Financial Times, June 21, 2019.

Further Reading

Valuations and Sale Price Comparison Report 2018

Asian retail resilience: Have store hours affected performance?