- For property investors in EU markets, energy-performance certificates are one of the tools available to assess the energy efficiency of existing buildings.

- An analysis of the MSCI Netherlands Annual Property Index showed that property owners improved the energy efficiency of their portfolios through both capital expenditure on existing properties and transactional activity.

- While more energy-efficient properties haven’t to date outperformed over longer periods, they did produce a higher total return in 2022 — a period of persistent high energy costs.

There’s an increased focus on climate change and net-zero commitments among real estate investors, who can “green” their portfolios by both improving existing assets and acquiring more efficient assets, while disposing of lesser ones. Energy-performance certificates (EPCs) issued in the European Union and other jurisdictions are among the tools available to assess the energy efficiency of existing buildings — and are more and more mandated by governments.

In the EU, an EPC is required when buildings are constructed, sold or rented. The legislative framework underpinning the certifications1 is now more than 10 years old, making it increasingly meaningful to examine its actual impact on real estate investment performance.

Buying carbon efficiency, selling emission exposure

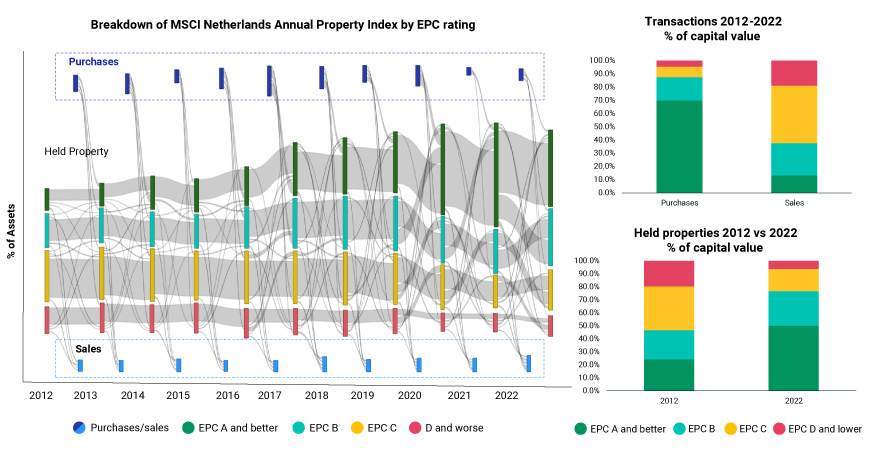

Data from the MSCI Netherlands Annual Property Index shows that the percentage of properties by value with an EPC rating of A or better had increased from 24.2% in 2012 to 50.2% in 2022, while the capital-value weight of properties with an EPC of D or worse had declined from 19.6% to 6.1%. While many properties held continuously by a single owner over the 10-year analysis period improved their EPC over time, investors also acquired a larger percentage of more energy-efficient assets while disposing of less efficient properties. Approximately two-thirds of purchased assets had EPCs of A or better while around two-thirds of assets sold had C or worse.2

Investors bought carbon-efficient assets, sold less efficient ones

Source: MSCI Netherlands Annual Property Index

Controlling for property type

Property types have performed very differently within the Netherlands over the last 10 years. We focused on residential property (62% of the MSCI Netherlands Annual Property Index) to better isolate the impact of EPCs versus other performance drivers. Residential property is relatively homogeneous in terms of unit size and tenants’ occupational characteristics across properties, unlike commercial property (for example offices and industrial buildings), which can vary widely in tenant types and how intensively they use energy.

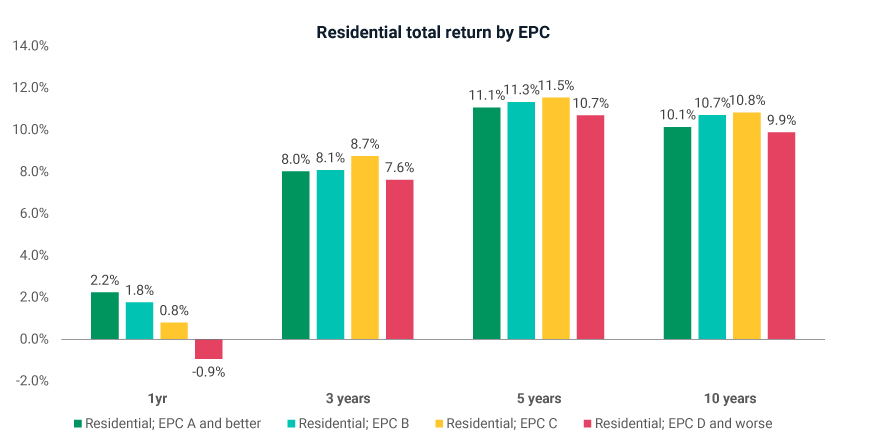

In 2022, residential assets with an EPC rating of A or better produced a total return of 2.2%, compared to 1.8% for B and 0.8% for C. Residential properties rated EPC D or below delivered a total return of -0.9%, which was 320 basis points lower than that for A or better.

Over longer periods, however, residential properties’ EPC rating had a lesser impact on performance, with those rated A or better producing similar total returns to those rated B or C. Instead, it was lower-rated properties that lagged. Residential assets rated D or worse underperformed more energy-efficient assets to varying degrees over the three, five and 10 years to December 2022.

More energy-efficient properties outperformed in 2022

Annualized total return, based on end-2022 rating. Source: MSCI Netherlands Annual Property Index

To gauge the impact of the EPC rating on investment performance, while also controlling for sample impact, we analyzed 462 residential properties held by a single owner from 2012 to 2022. By 2022, 94% of these residential properties either maintained (57%) or improved (37%) their EPC rating, compared to their certification level in 2012.

We found that properties with a lower rating required more ongoing capital expenditure than more energy-efficient assets did. Residential properties rated D or worse at the end of 2022 required a cumulative capital expenditure equal to 8.5% of starting capital value. This figure increased to 12.6% for properties that maintained a D or worse throughout the 10 years. By contrast, properties rated A or better at the end of 2022 required a cumulative capital expenditure (capex) equal to 3.4% of base capital value and 3.0% for those that maintained A or better across the period.

Longer-term investment performance was mixed

Despite lower capex, the impact of energy efficiency on longer-term investment performance for the 10 years to 2022 was less clear. Properties that maintained a rating of A or higher over the 10 years delivered annualized capital growth of 5.5% compared to the 5.6% of properties that maintained a D or worse. In our sample, the best 10-year annualized capital growth of 6.6% was produced by residential assets that improved from C to A over 10 years, while the worst capital growth of 4.3% came assets that saw their EPC slip from A to B over 10 years.

While energy efficiency did not have a clear impact on long-term capital growth to date, despite lower capital expenditure, we found a greater difference in the growth of net operating income (NOI) and yields when comparing residential properties of varying energy efficiency. This finding may support future investment performance in the light of increasing cost pressures faced by property owners. Properties that improved their energy efficiency during the 10-year period mostly experienced higher-than-average NOI growth, while we saw lower growth from properties with deteriorating energy efficiency.

More energy-efficient buildings were also viewed as lower-risk now compared to a decade ago. The NOI yield of residential properties rated A or better was at a 40-basis-point premium to those rated B at the end of 2022, while their yields were only 5 basis points apart in 2012. Given their higher capital expenditure, less energy efficient properties would also yield less net operating income on a capex-adjusted basis.

More energy-efficient properties less capex-intensive, priced as lower-risk

“Capex % of Base CV” is the cumulative capital expenditure expressed as a percentage of 2012 capital value. Source: MSCI Netherlands Annual Property Index

More energy-efficient buildings enter 2023 on solid footing

In our analysis of Dutch residential assets, more energy-efficient properties did not deliver significantly superior longer-term returns since 2012, but were less capital-intensive, which would enable property owners to deploy funds elsewhere. However, more energy-efficient properties did produce a higher total return in 2022, and with high energy costs persisting, we could see a sustained increase in demand for more energy-efficient properties that could underpin returns.

Beyond sector and geography, property attributes such as energy efficiency can impact property’s net-income growth and yield and, as a result, its investment returns. Segmenting property assets by EPC may allow investors to understand how assets’ energy efficiency impacts property fundamentals and investment performance.

1Including the Energy Performance of Buildings Directive 2010/31/EU and the Energy Efficiency Directive 2012/27/EU

2Percentage of assets sold and purchased, by capital value

Further Reading

Real Estate Factors’ Performance: The Financial Crisis vs. Now