On Sept. 28, 2018 over USD 3 trillion in market capitalization will switch sectors because of changes to the Global Industry Classification Standard (GICS®)1 structure; specifically, the Telecommunications Services sector will significantly broaden and be renamed Communications Services. Our recent paper, “The New GICS Communication Services Sector,” provides full details. What does this change mean for the risk profiles for six of the largest companies affected?

While reclassifying a stock’s sector or industry may change the way the market views that stock over the long term, financial theory says that reclassification alone should not dramatically change its short-term behavior. Our analysis suggests that industry changes occurring as a result of the GICS sector changes would have decreased predicted Beta and total risk for some of these companies.

Risk profiles of reclassified firms

We can’t fully anticipate the market’s reaction to reclassification, but we can gain some insight by analyzing risk indicators before and after reclassification on a particular date in the past. We selected Oct. 2, 2017 (approximately one year prior to the GICS changes). We then applied those changes as inputs to MSCI’s Long-Term Global Equity Model (GEMLT), which uses GICS classification to define model industry factor structure. Finally, we compared the resulting risk forecasts with the actual risk indicators generated by the same model for the same companies on the same date.

For starters, high level statistics under our simulation showed that the new Communications Services sector had a higher Beta than Telecommunications Services (0.78 versus 0.69). At the industry level within GEMLT, the median stock exposed to the Internet factor experienced a 1% drop in Beta, a 0.4% drop for the Retailing factor, a 1.3% increase for the Software factor and virtually no change when exposed to the Media factor.

Turning to individual stocks, the following table summarizes how six of the largest companies to be reclassified in October will be mapped to industry factors in GEMLT.

How GICS reclassification and industry changes affect six large companies

| Company Name | New GICS Sector? | Current GICS Sector | New GICS Sector |

New GEMLT Industry Factor? | Current GEMLT Factor | New GEMLT Factor |

|---|---|---|---|---|---|---|

| Time Warner | Yes | Consumer Discretionary | Communication Services | No | Media | No change |

| Nintendo | Yes | Information Technology | Communication Services | No | Software | No change |

| Yes | Information Technology | Communication Services | No | Internet | No change | |

| Yes | Information Technology | Communication Services | No | Internet | No change | |

| Alibaba | Yes | Information Technology | Consumer Discretionary | Yes | Internet | Retailing |

| eBay | Yes | Information Technology | Consumer Discretionary | Yes | Internet | Retailing |

In GEMLT, risk model construction depends on industries and not on sectors.

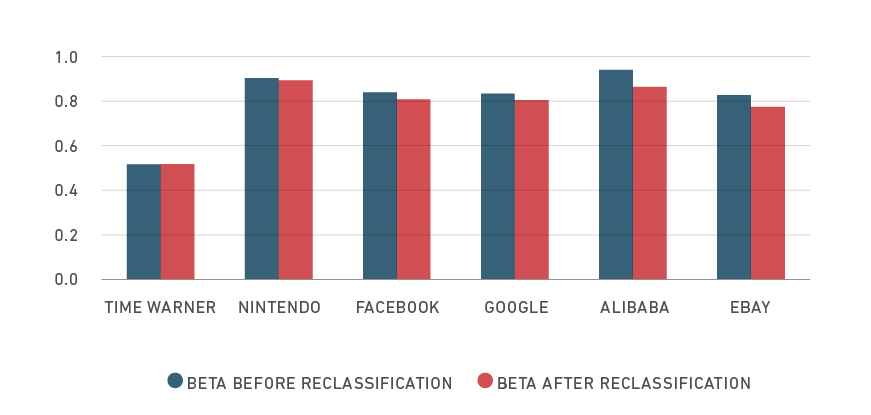

Beta changes: how they play out at sector, industry and stock levels

Digging deeper to the individual stock level, we found the change in Beta for reclassified stocks was well within the normal range for Time Warner Inc., Nintendo Co., Ltd., Facebook, Inc. and Google LLC, which are shifting GICS sector but not industry categorization in GEMLT. In contrast, Alibaba Group Holding Limited and eBay Inc., both of which are being reclassified to the Retailing industry in GEMLT, showed visibly larger changes.

How the GICS changes affected predicted beta

Predicted Beta (selected stocks)

Simulation was performed for Oct. 2, 2017

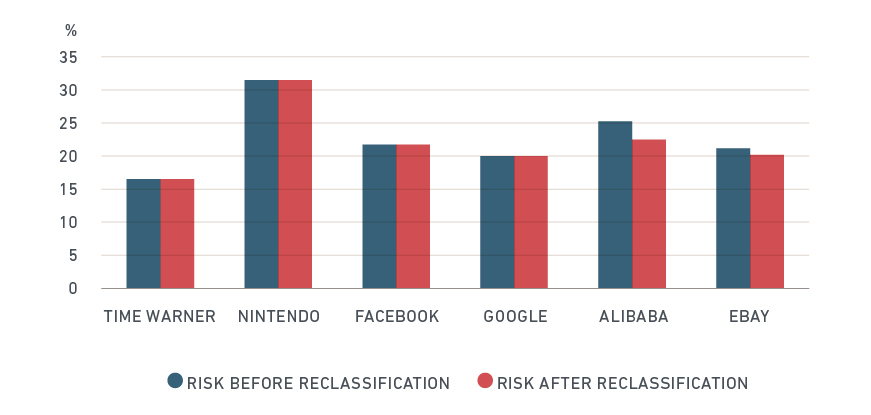

Total predicted risk fell for stocks that changed industry factors

Analogously, total predicted risk fell in line with predicted Beta. In fact, the stocks in our study that didn’t switch industry factors experienced no change in their predicted risk, as can be seen in the exhibit below. The stocks that switched industry factors experienced a noticeable drop (2.8 percentage points for Alibaba and 1 percentage point for eBay) on the date of the change.

How GICS changes affected predicted risk

Total Predicted Risk (selected stocks)

Simulation was performed for Oct. 2, 2017

Neither individual asset volatility nor correlations between factors were importantly affected in this scenario. However, companies that are exposed to a different industry after reclassification will get a different risk contribution from the new industry. Therefore, we attributed most of the change in both risk indicators to this industry shift.

As some very large companies switch GICS sectors, there will likely be implications for investors. Some will be induced by the reclassification itself while others will be caused by changes in the way the market views these securities because of a change. Based on our analysis, investors may want to consider whether sector reclassification may ultimately have an effect on the risk profiles of individual stocks in their portfolios.

1 GICS, the global industry classification standard jointly developed by MSCI and Standard & Poor’s.