- Russia’s invasion of Ukraine has amplified supply-driven inflation and growth concerns in the U.S. and led to a recognition that last year’s high, demand-driven inflation might not have been transitory.

- The outlook ahead depends crucially on the severity of the supply shock, how quickly the Federal Reserve responds and whether it maintains credibility in keeping inflation in check.

- Under our stagflation scenario of a large supply shock and policy response the market deems too little or too late, a diversified portfolio could lose 13%.

Over the past few months, investors have increasingly focused on inflation and central banks’ potential tightening of monetary policy.1 With Russia’s ongoing war against Ukraine and resulting Western sanctions, they may also now worry about slowing economic growth. We model three different economic scenarios. In our most dire scenario, stagflation, a diversified portfolio of global equities, U.S. bonds and real estate could lose 13%.

Shifting expectations

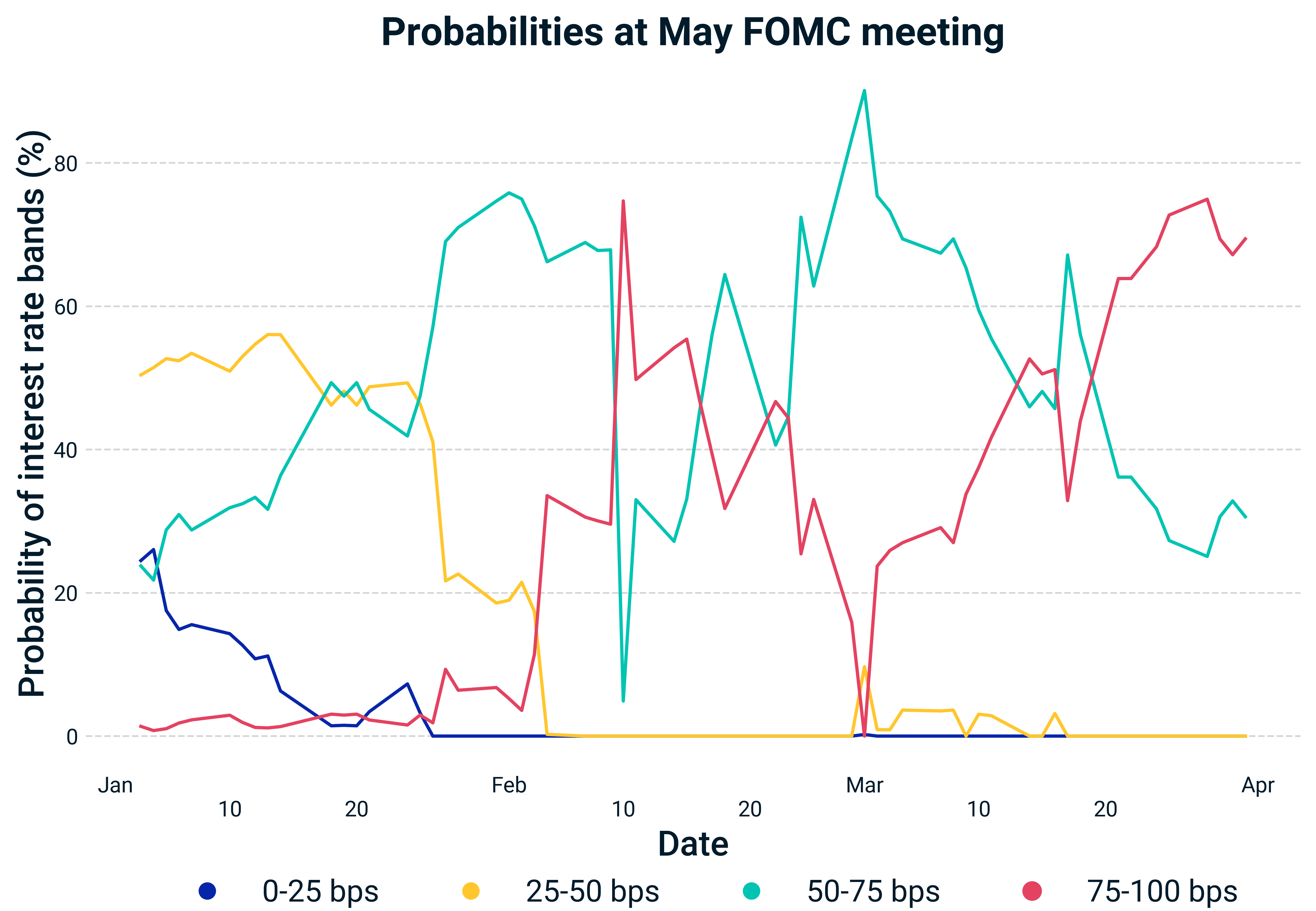

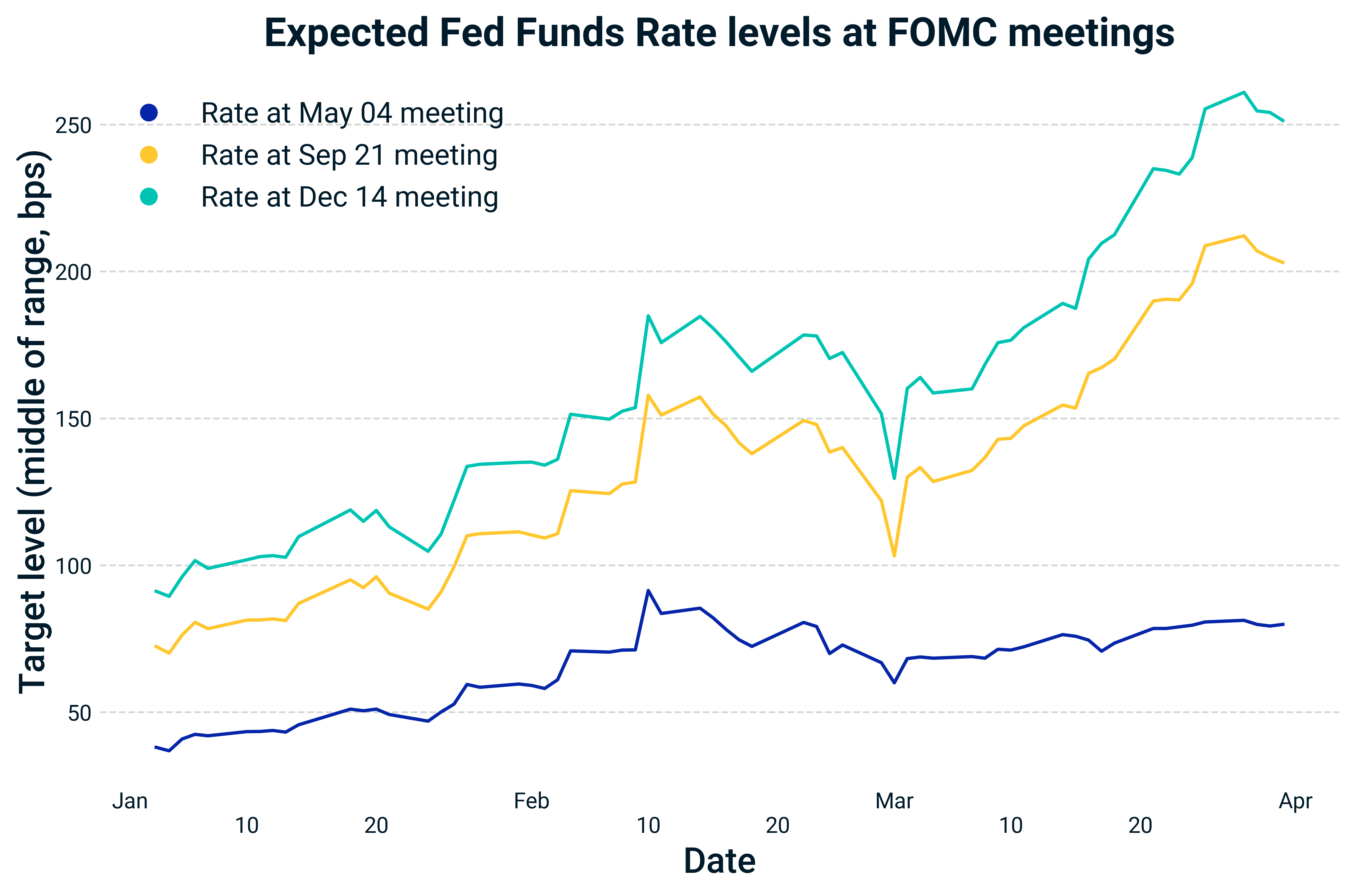

Market expectations for a potential rate hike at the next Federal Reserve’s Federal Open Market Committee (FOMC) meeting on May 3 and 4 have been fluctuating wildly. In the exhibit below, the left side shows that, while a 25-basis-point (bp) rate hike at the May FOMC meeting was expected around the beginning of March, markets are now pricing in a swift 50-bp hike. The expected level for the federal-funds rate at the end of the year went up significantly since Russia’s invasion of Ukraine (right-hand panel below), indicating markets expect significant policy adjustments in the second half of the year.2

Market expectations now indicate a more aggressive rate-hike path

Recent evolution of the market-implied probability for various levels of the federal-funds rate at the upcoming March Federal Open Market Committee (FOMC) meeting (left) and the expected level of the federal-funds rate at three future FOMC meetings (right). Source: CME FedWatch, published with permission.

These swings in expectations illustrate that investors face large uncertainty in how inflation and monetary policy may evolve. In addition, the effect on growth and inflation of the Russia-Ukraine war is yet to be seen. Growth forecasts for 2022 are being adjusted downward;3 and, according to the Atlanta Fed’s GDPNow model, U.S. GDP growth is estimated to be as low as 1.5% for the first quarter. Long-term inflation expectations also rose by about 50 bps, compared to pre-invasion levels; but there could be room for even stronger inflationary pressures.4

Three hypothetical scenarios for inflation

Given the large uncertainty over how the economy and monetary policy will evolve in the months to come, we consider three hypothetical scenarios5 for inflation:

- Soft landing: Assumes that much of the ongoing inflation is caused by the booming economy of the past year — a positive demand shock — as a result of easing pandemic restrictions and government stimulation. As long as the Federal Reserve upholds its strong stance on stabilizing inflation by gradually hiking interest rates, and perhaps more important, consumers and corporations believe that this inflation stability is the path ahead, then inflation could ease without the need for aggressive monetary tightening, potentially enabling robust economic growth. If this scenario plays out, equity markets could regain some ground and Treasury yields may drop moderately.

- Slamming the brakes: Depicts a scenario where a supply-side shock prevails due to high energy prices and continuing supply-chain issues, which further increase inflation and dampen economic activity. As inflation climbs further, policymakers decisively tighten monetary policy in a quest to extinguish inflation quickly, which could further slow economic growth in the short term but avoid long-term economic damage.

- Stagflation: Considers a similar starting point as the “Slamming the brakes” scenario, with a supply shock leading to higher inflation and slower growth. However, in this scenario central banks’ actions are too little or too slow, allowing inflation to run hotter for longer than it had in the past two decades. This could lead to a loss of central banks’ credibility, whereby consumers and corporations adjust their long-term inflation expectations, which in turn disrupt long-term economic growth. In this most-feared scenario reminiscent of the early 1980s, the equity-bond correlation might turn positive, reversing the hedge they have offered for most of the last two decades.

What we assume in our scenarios

Scenario assumptions are informed by the MSCI Macro-Finance model with a combination of hypothetical macroeconomic shocks and monetary-policy responses. The scenarios differ in their assumptions of the underlying macroeconomic shocks and central-bank policy strength and credibility with the public. These are not forecasts, but hypothetical narratives of how the various inflation scenarios could affect global multi-asset-class portfolios.

How different scenarios compare from the macroeconomic perspective

The plot below illustrates the underlying macroeconomic assumption behind each scenario: The “Soft landing” scenario leads to a larger economy and lower price levels; the “Slamming the brakes” scenario leads to near-term economic contraction but only moderate long-term price-level contraction; and “Stagflation” results in significantly higher price levels and disrupts growth in the long term.

Scenarios’ potential impact on growth, inflation and rates

Evolution of the real GDP and consumer price index (CPI) and the one-year Treasury yield under our baseline and hypothetical inflation scenarios. The real GDP and CPI are normalized to 100% on March 2022. Scenarios have different one-year Treasury yields in 2022, reflecting the different central-bank actions taken during the near term.

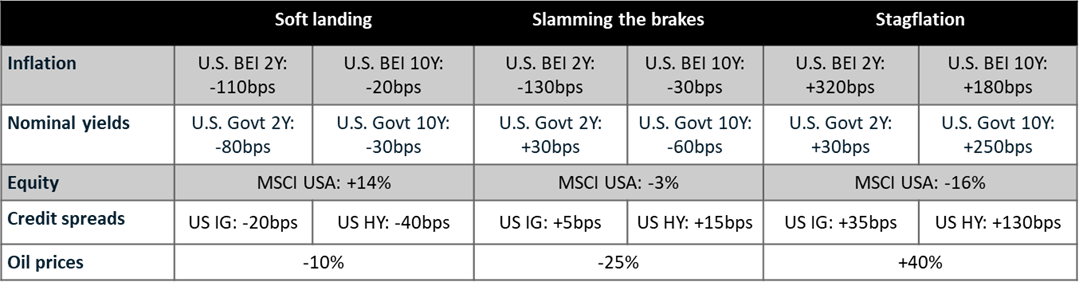

Potential implications for financial portfolios

To assess the scenarios’ impact on multi-asset-class portfolios, we used MSCI’s predictive stress-testing framework and applied it to a hypothetical global diversified portfolio.6 For a diversified portfolio consisting of global equities and U.S. bonds and real estate, the impact ranged from -13% to +8% for the “Stagflation” and “Soft landing” scenarios, respectively, while the “Slamming the brakes” scenario registered a -1% return. Under our dreaded stagflation scenario, equities and bonds sustain sizable losses, as high inflation and low growth hit simultaneously. The exhibit below shows more detailed results, by asset class and region and for various base currencies.

Impact across asset classes under our scenarios

Portfolio impact of the scenarios based on market data as of March 25, 2022. U.S. Treasurys and Treasury inflation-protected securities are represented by Markit iBoxx indexes. Equity markets and corporate bonds are represented by MSCI indexes. Private equity is represented by model portfolios. U.S. real estate is represented by the MSCI/PREA U.S. AFOE Quarterly Property Fund Index. U.K. real estate is represented by the MSCI/AREF UK Quarterly Property Fund Index. The composite portfolio is represented by the following weights: 50% global equities (35% public and 15% private), 10% U.S. Treasurys, 10% U.S. Treasury inflation-protected securities, 10% U.S. investment-grade bonds, 10% U.S. high-yield bonds and 10% U.S. real estate. Source: IHS Markit, MSCI

The Russia-Ukraine war has added another hurdle for the global economy, after the inflation that resulted from substantial economic stimulus from governments responding to the pandemic. Investors can hope for the best, but still prepare for the worst, as stagflation lurks as a potential grim outcome.

The authors thank Chenlu Zhou and Peter Shepard for their contributions to this blog post.

1 Smith, Colby. “Expectations grow that Fed will deploy jumbo-size rate rises.” Financial Times, March 27, 2022.

2Duguid, Kate, Rovnick, Naomi: ”US government debt sell-off worsens as banks predict swift Fed rate rises.” Financial Times, March 25, 2022

3Cox, Jeff. “Goldman cuts GDP outlook and raises its concern over a recession.” CNBC, March 11, 2022. “Global Economic Outlook — March 2022.” Fitch Ratings, March 21, 2022.

4Agnew, Harriet. “Investors bet Ukraine war will prompt companies to bring production onshore.” Financial Times, March 26, 2022.

5The shocks in these scenarios are not meant to be instantaneous, but rather on a medium horizon, as changes in the market will take time to materialize.

6The results are generated based on this methodology, using MSCI's BarraOne®, whereby we used current correlations to propagate the shocks to a hypothetical multi-asset-class portfolio. MSCI clients can access BarraOne® (Client Only) and RiskMetrics® RiskManager®(Client Only) files for these scenarios on the client-support site.

Further Reading

Markets May Be Vulnerable to Stagflation from Russian Invasion