- Global equities were up slightly in Q1 2021 after a two-quarter rally, and the rally in the value factor continued to strengthen. For USD and EUR investment-grade corporate bonds, carry and value were the best performers.

- The performance of asset selection based on value descriptors has been pervasive across regions and uniformly across a majority of sectors.

- As economies reopen with increasing numbers of COVID-19 vaccinations, MSCI’s adaptive multi-factor model pointed to a continued overweight of low size and value.

Many market participants have recognized value often plays a strong part during economic recoveries and this time has not been an exception, as evident in Q1 2021 performance and discussed in last quarter’s “Factors in Focus – Val-Come Back.” The recovery in economic indicators and reopening of the global economy, following the roll-out of vaccinations, has reignited discussion on the performance of the value factor. In our recently published, “Reopening Economies and the Resurgence in Value” blog post, we discussed the three points that characterized what was different at the end of Q1 2021 in the context of the last 15 years of value-factor performance. Before we take a closer look at how value has performed in the context of all other factors in Q1 2021, we first see what was favored by investors by looking at fund flows.

Factor ETF Flows into Value, Yield and Size

Equities worldwide were up slightly in Q1 2021, as increasing numbers of COVID-19 vaccinations drove global economies further toward reopening and recovery. The MSCI ACWI Index was up 4.7% for the quarter, reaching an all-time high on Feb. 16 and falling thereafter. How have investors responded to changing market conditions?

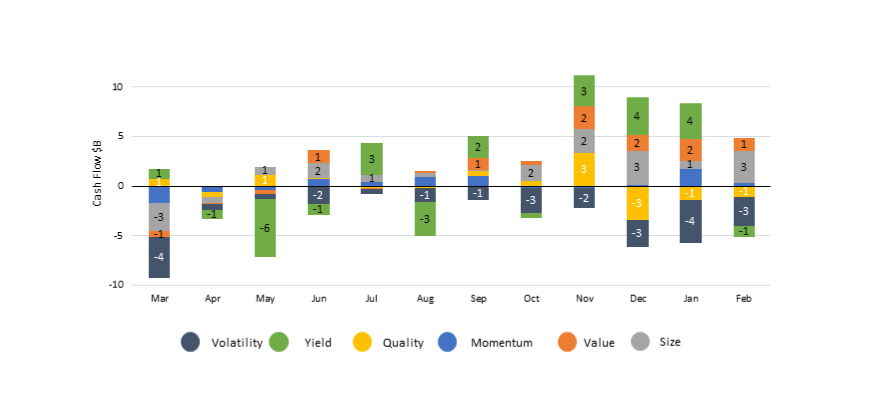

The exhibit below shows the USD flows of globally listed ETFs from March 2020 to February 2021. Most recently, a clear trend emerges whereby value, yield and size ETFs — linked to the top-three performing factors during economic recovery — saw the biggest inflows since November last year, with a total of USD 27 billion flowing into these factor ETFs in the four months through February 2021.

Factor ETF Monthly Flows

All data as of Feb 26, 2021; defined as each share class of an exchange-traded fund, as identified by a separate Lipper ID. Only primary listings, and not cross-listings, are counted. MSCI does not guarantee the accuracy of third-party data.

Q1 2021’s Triple-Crown Victory for Value

We now take a look at the pure factor performance of the MSCI Global Equity Model over the course of the first quarter. Momentum and low volatility (low beta and low residual volatility) continued their respective nosedives, while all three value descriptors (book-to-price, earnings yield and long-term reversal) were the top performers for the quarter.

Pure-Factor Performance in Q1 — Fundamental Factors in Vogue

Factor performance of the MSCI Global Equity Model (GEM+ESG) pure factors from Dec. 31, 2020, to Mar. 31, 2020

Value Indexes Outperformed Everywhere

Value-factor indexes across global, regional and international markets outperformed. Among the MSCI ACWI Indexes, value’s active return was 6.9% compared with the MSCI ACWI Index and nearly twice that (13%) vs. the MSCI USA Index.

The MSCI USD and EUR Investment Grade (IG) Corporate Bond Indexes’ rallies continued during the quarter, returning 1.2% and 0.3% spread returns, respectively (i.e., in excess of their duration-matched U.S. Treasury/German bund returns). Among excess returns in corporate-bond factor indexes, carry within USD corporate bonds outperformed by 260 basis points (bps) compared to a relatively moderate 20 bps in EUR corporates.

Value Could Not Be Stopped

The table shows regional variations of the MSCI Minimum Volatility Index (USD), MSCI High Dividend Yield Index, MSCI Quality Index, MSCI Momentum Index, MSCI Enhanced Value Index, MSCI Equal Weighted Index, MSCI Growth Target Index, MSCI USD IG Low Risk Corporate Bond Index, MSCI USD IG Carry Corporate Bond Index, MSCI USD IG Quality Corporate Bond Index, MSCI USD IG Value Corporate Bond Index and MSCI EUR IG Low Size Corporate Bond Index, from Dec. 31, 2020, to Mar. 31, 2021. All the EUR IG Corporate Bond returns are denominated in euros, not U.S. dollars. The bar chart shows the active returns of the same indexes, by region, for each of the months in the quarter as well as the full quarter. Excess returns for bond indexes were computed by subtracting the duration-matched U.S. Treasury/German bund returns from the total returns, before including any transaction-related costs of the index over the corresponding period.

Finding Value Within Sectors

While the MSCI Enhanced Value Indexes clearly outperformed across global and regional markets, what remains to be seen is 1) how consistent stock selection was within each sector and 2) which value descriptor(s) supported performance. Before we present details, we remind readers that the MSCI Enhanced Value Indexes are designed to be sector neutral, with active weights stemming from asset selection within each sector as opposed to over or underweighting sectors as a whole.

To answer the first question, we simply plotted the active returns of the MSCI ACWI Enhanced Value Index relative to its parent MSCI ACWI Index. We found that 10 of the 11 sectors in this index outperformed — with information technology and consumer discretionary leading and energy being the exception. In other words, value outperformance was pervasive across sectors, as it was across regions.

MSCI Enhanced Value Active Sector Returns

Active return contribution of various sectors in ACWI Enhanced Value index for Dec. 31, 2020, to Mar. 31, 2021 period.

To answer the second question, we plotted the active return contribution of each value descriptor for each sector. We found all three descriptors contributed positively in a majority of sectors. Even within energy, overall, value delivered a positive contribution, but was offset by sector-specific effects.

Value-Factor Descriptors Active Return Contribution to Each MSCI Enhanced Value Index Sector

Active return contribution of the three value descriptors – book-to-price, earnings yield and long-term reversal from GEMLT model - for various sectors in ACWI Enhanced Value index for Dec. 31, 2020 to Mar. 31, 2021 period.

MSCI’s Adaptive Multi-Factor Allocation Model

Our adaptive multi-factor framework is a model designed to analyze decisions about tilting toward factors. Our research has shown that factors were sensitive to changing market conditions and suggests there is value in taking a holistic approach to factor assessment that encompasses not only the macroeconomic environment as shown above but also factor valuations, recent performance trends and risk sentiment.

As of March 31, 2021, our adaptive multi-factor model showed the following exposures across the four pillars:

- The macro-cycle pillar indicated an expansion and thus overweighted value, low size and momentum, based on the CFNAI, Federal Reserve Bank of Philadelphia’s ADS Index and PMI.

- The valuation pillar overweighted value, low size and low volatility, based on the valuation gap compared to an equal-weighted factor mix in the context of nearly 30 years of a factor’s history.

- The momentum pillar selected value, yield and low size, based on the last three months’ relative performance.

- The market-sentiment pillar showed a risk-on environment, based on the Cboe Volatility Index® (VIX) term structure and credit spreads, resulting in an underweight to low volatility, yield and quality and overweight to momentum, value and low size.

Exposures from MSCI’s Adaptive Multi-Factor Allocation Model

As of Mar. 31, 2021. Positive exposures are denoted as + or ++, negative as - or --, neutral as N.

Overall, our adaptive multi-factor model showed an overweight to value and low size and an underweight to quality, yield and low volatility, relative to an equally weighted factor mix. As the world grows more hopeful about vaccines and the potential for global economies to restart, we’ll continue to evaluate the potential effect on value and other factors.

Further Reading

Factors in Focus: Resurgence in Value Webinar

Perspectives Podcast: In Spring, Does an Investor’s Fancy Lightly Turn to Value?

Reopening Economies and the Resurgence in Value

Factors in Focus: Val-Come Back.

Factors in Focus: Impact of Inflation on Style Factors