- Global equities were up in Q4 2021, with the MSCI Quality Indexes leading performance among the MSCI Factor Indexes.

- Potentially higher rates to fight inflation have some examining how yield-curve changes impacted equities. We found: Value and momentum outperformed in bear-flattening regimes; value and low size in bear-steepening ones.

- MSCI’s adaptive multifactor model pointed to an overweight to value and low size as of Dec. 31, 2021.

In 2021, economies around the world recovered from the pandemic and vaccination rates rose. The omicron strain, however, reminds us we are not yet out of the woods. If economic expansion continues in 2022 with a sustained period of high inflation, we could see rising interest rates around the world. This has led investors to re-evaluate their equity portfolios. To help, we focus on factor-index performance in different U.S. interest-rate and yield-curve regimes.

But first, a roundup of market and factor performance over the fourth quarter.

Higher inflation and higher volatility

Global equity markets posted positive returns in Q4 2021, with the MSCI ACWI Index up 6.8% for the quarter, reaching an all-time high on Nov. 16, followed by higher volatility (the Cboe Volatility Index® (VIX) reached above 30 on Dec. 1). As of Dec. 31, 2021, the MSCI ACWI Index’s price-to-earnings ratio (P/E) stood at 21.25, with analysts expecting year-over-year earnings to grow by 7.14%.1 Inflation rose throughout 2021 and surged toward the end of the year. As of October 2021, the consumer price index (CPI) for all items in Organization for Economic Cooperation and Development countries, a proxy for global inflation, stood at 5.19% — a level last observed in February 1997.

(Residual) volatility in a crowded place

The exhibit below shows the pure-factor performance of MSCI’s Global Equity Model over the choppy fourth quarter, when many defensive factors outperformed. Residual volatility has been a "crowded factor" in the MSCI Factor Crowding Model since late 2020 and remained so as of November 2021. Over Q4 2021, residual volatility declined 3.5%. Dividend yield has also lagged, perhaps at the prospect of higher interest rates. On the other hand, momentum and earnings yield, alongside profitability, investment quality and ESG were the best-performing factors for the quarter.”

Pure-factor performance in Q4

Performance of the MSCI Global Equity Model (GEM+ESG) pure factors from Sept. 30, 2021, to Dec. 31, 2021.

Quality-factor indexes outperformed

The notable uptick in market volatility over Q4 2021 resulted in positive active returns for the MSCI Quality Indexes in all regions. Indexes with pro-cyclical factor exposure, namely the MSCI Equal Weight Index (size factor) and the MSCI Enhanced Value Index underperformed in most regions. The MSCI Minimum Volatility Index’s performance was mixed, with outperformance in emerging markets and Asia ex-Japan.

Within the MSCI World ex USA Index universe, four out of the seven MSCI Factor Indexes delivered positive active returns, led by quality and yield. While the MSCI Emerging Markets and the MSCI All Country Asia ex Japan Indexes were negatively impacted by China’s continued slump, all factor indexes in these regions delivered positive active returns, due to their underweight to China.

Continued dispersion in factor performance between developed and emerging markets

The table shows regional variations of the MSCI Minimum Volatility Index (USD), MSCI High Dividend Yield Index, MSCI Quality Index, MSCI Momentum Index, MSCI Enhanced Value Index, MSCI Equal Weighted Index and MSCI Growth Target Index, from Sept. 30, 2021, to Dec. 31, 2021. The bar chart shows the active returns of the same indexes, by region, for each month in the quarter, as well as for the full quarter.

Factor performance varied in different rate regimes

With the Federal Reserve indicating it will start the tapering process gradually and potentially raise interest rates to address inflation, we saw a rise in long-term interest rates during Q4. The yield on 10-year Treasurys has risen about 96 basis points (bps) from the low of 0.55% at the end of July 2020 to 1.51% at the end of December 2021. On the other hand, the 2-year Treasury yield rose only around 62 bps, from 0.11% to 0.73%, over the same period. This led to a steepening of the yield curve and a scenario known as “bear steepening.”

The combination of the long-term interest rates and changes in the yield curve can be used to define four economic regimes, shown in the exhibit below.

Four economic regimes formed by interest-rate direction and yield-curve shape

Bear flattening is when short-term interest rates rise faster than long-term interest rates. Bear steepening is when long-term interest rates rise faster than short-term interest rates. Bull steepening is when short-term interest rates fall faster than long-term interest rates. Bull flattening reflects long-term interest rates falling faster than short-term interest rates.

The exhibits below illustrate the average active monthly returns of MSCI’s World and USA standard-factor indexes in each regime defined above. The results were generally in line across regions. The MSCI Enhanced Value Indexes delivered the strongest performance in rising-rate regimes, while the MSCI High Dividend Yield Indexes performed best in falling-rate regimes, and remained invariant to the changing nature of the yield curve. The MSCI Minimum Volatility Indexes, on the other hand, did best when the yield curve was flattening (bear and bull flattening) — i.e., when the market may have expected slower growth.

MSCI World and USA Factor Index performance

Period from June 1994 to December 2021 for all indexes, except the MSCI World and MSCI USA Enhanced Value Indexes, which start in November 1997; the MSCI World Growth Target Index, which starts in June 1995; the MSCI USA Growth Target Index, which starts in December 1998; and the MSCI World and USA Quality Indexes, which start in May 1999. Interest-rate regime is defined by the month-on-month change in the 10-year constant-maturity U.S. Treasury. Yield-curve regime is defined by the month-on-month change in the difference between the 10-year and 2-year constant-maturity U.S. Treasury. Source: FRED, Federal Reserve Bank of St. Louis

MSCI’s adaptive multifactor allocation model

Our adaptive multifactor framework is a model designed to analyze decisions about tilting toward factors. Our research has shown that factors were sensitive to changing market conditions and suggests there has been value in taking a holistic approach to factor assessment that encompasses not only the macroeconomic environment as shown above, but factor valuations, recent performance trends and risk sentiment.

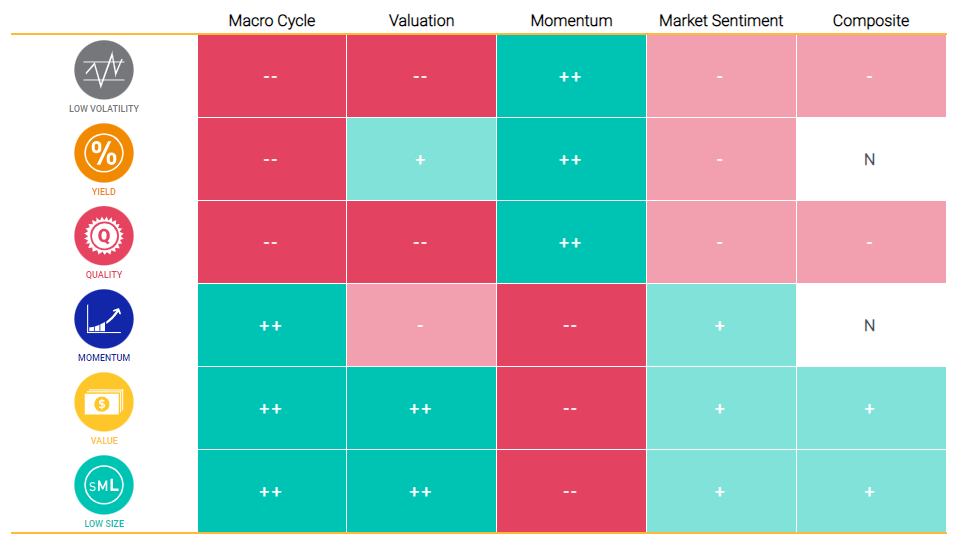

As of Dec. 31, 2021, our adaptive multifactor model showed the following exposures across the four pillars:

- The macro-cycle pillar indicated an overweight to value, low size and momentum, based on signals from the Chicago Fed National Activity Index, Federal Reserve Bank of Philadelphia’s ADS Index and PMI.

- The valuation pillar overweighted low size, value and yield based on the valuation gap compared to an equal-weighted factor mix in the context of nearly 30 years of a factor’s history.

- The momentum pillar selected quality, yield and low volatility, based on the last three months’ relative performance.

- The market-sentiment pillar showed a risk-on environment, based on the VIX term structure, as well as the neutral environment, based on credit spreads — resulting in an underweight to low volatility, yield and quality and an overweight to momentum, value and low size.

Exposures from MSCI’s adaptive multifactor allocation model

As of Dec. 31, 2021. Positive exposures are denoted as + or ++, negative as - or -- and neutral as N.

At the end of 2021, overall, our adaptive multifactor model showed an overweight to value and low size and an underweight to quality and low volatility, relative to an equally weighted factor mix. MSCI will continue to monitor changes to the macro environment and its impact on factor performance throughout 2022.

1Calculated as the weighted average of the short-term (12-month) forward-earnings-per-share growth rate of constituent stocks. For more details, please refer to MSCI Fundamental Data methodology.

Further Reading

Factors in Focus: Impact of Inflation on Style Factors

Factors in Focus: Where’s the Value in Defensive Positioning?