- Continued forest loss represents growing physical and regulatory risks to companies and investors. COP15 has put further pressure on businesses to tackle deforestation, especially in biodiversity-sensitive regions.

- Our analysis flagged 11% of MSCI ACWI Index constituents as having the potential for direct or indirect contribution to deforestation, with food producers and retailers particularly well represented.

- Although most companies in industries with high exposure to deforestation risks are not formally addressing the issue, MSCI’s Biodiversity Screening Metrics can help investors manage biodiversity risks in their portfolios.

Forests are essential for our planet’s ecological balance and for our economy.1 Several industries depend on healthy forests as they provide critical ecosystem services such as water- and climate-cycle regulation, erosion prevention, crop pollination and soil fertility. Forests absorb greenhouse-gas (GHG) emissions and their loss negatively affects the net-zero goals of companies that rely on them for carbon offsets. Ongoing deforestation therefore poses significant risks to companies and investors.

Beyond COP15: Growing physical and regulatory risks

In the past two decades, the world has seen tree-cover loss of 436 million hectares — an area almost twice the size of Algeria.2 The expansion of urban areas, mining, road construction and forestry have been key drivers of this loss, while the production of agricultural commodities such as palm oil, soybeans, beef and timber in biodiversity-rich tropics were also key drivers.

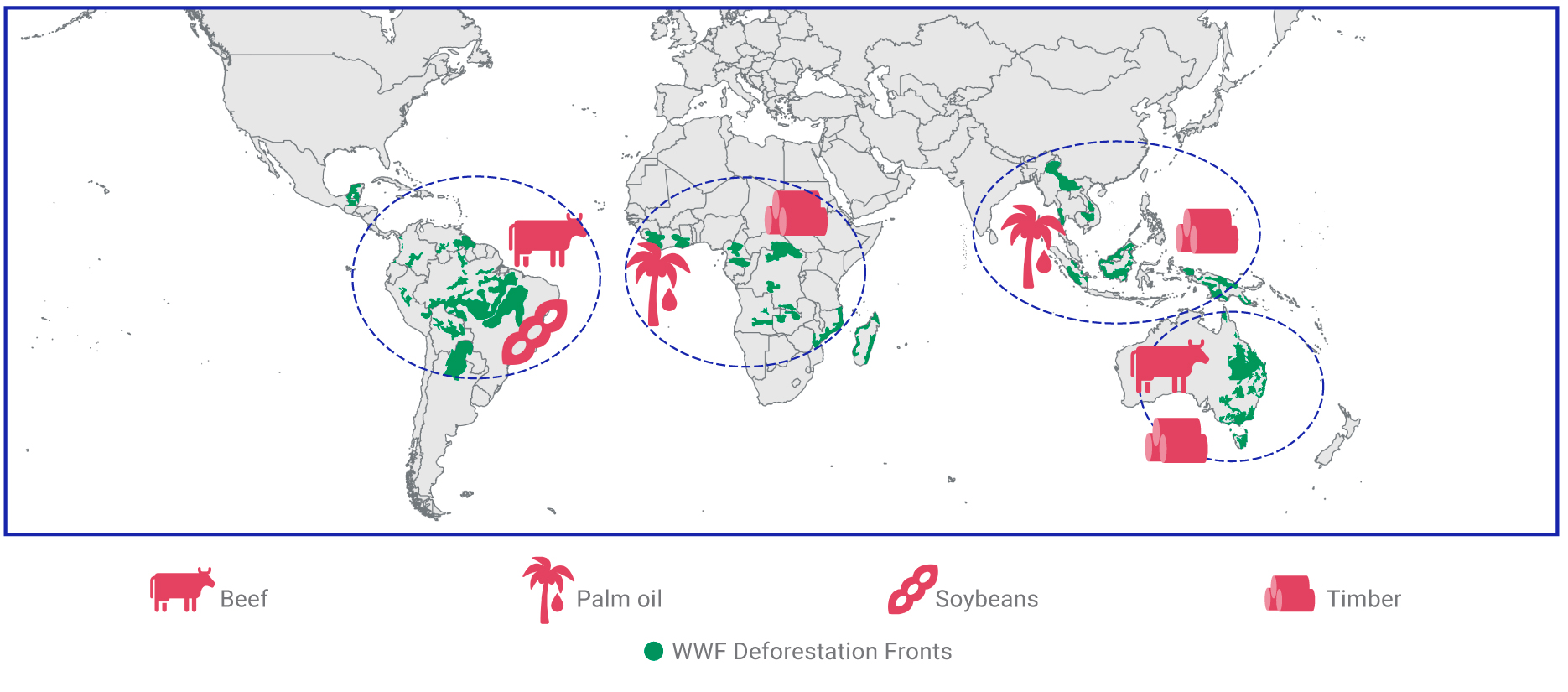

Deforestation-prone commodities and WWF Deforestation Fronts

World Wide Fund for Nature (WWF) Deforestation Fronts are areas that have a significant concentration of deforestation and where large areas of remaining forest are under threat. These areas are all within the tropic and subtropic regions. Source: “Deforestation Fronts: Drivers and Responses in a Changing World.” WWF, January 2021.

On what some may consider the positive side, however, there is growing regulatory pressure to address the problem of deforestation. In December 2022, the European Commission and European Parliament agreed on a new regulation on deforestation-free supply chains, whereby no product will be allowed to enter the EU market if made or based on land that was deforested after the end of 2019. Once finalized, these new rules may push companies and investors to increase their focus on the risks from deforestation. The UN Biodiversity Conference (COP15)3 could add to the pressure with a global biodiversity framework featuring national and global measurable targets to protect forests.

How can investors address deforestation-related risks in their portfolios?

Using our MSCI Biodiversity-Sensitive Areas Screening Metrics,4 we assessed which industries were most exposed to deforestation risks. Our analysis showed that, as of Nov. 30, 2022, 140 (5%) constituents of the MSCI ACWI Index had a potential direct contribution to deforestation. These companies could contribute to forest loss because they have physical assets in WWF Deforestation Fronts. We identified a total of 283 (10%) constituents with direct operations in such areas, with 70 of these classified as being part of a high-risk industry potentially contributing to forest loss. Of the Global Industry Classification Standard (GICS®)5 sectors, these industries included metals and mining, oil, gas and consumable fuels, transportation infrastructure and food products.

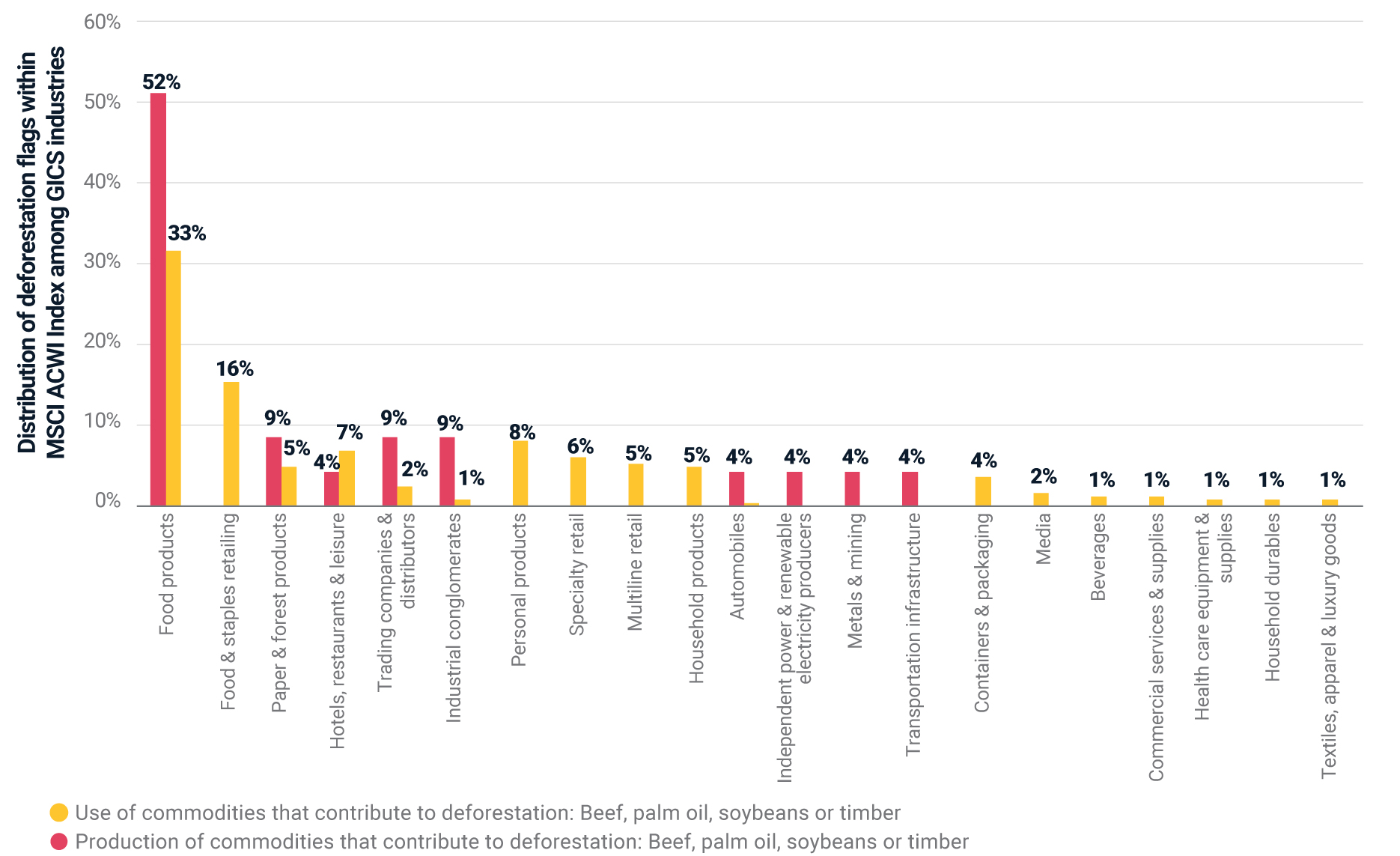

Overall, we found that less than 1% of constituents of the MSCI ACWI Index were potential direct contributors to deforestation as cultivators of commodities such as palm oil or soy. By contrast, deforestation risks often lay in the supply chain. By extending our analysis to companies that use such commodities for their business, we identified a total of 244 constituents (8.7%) that may indirectly contribute to forest degradation. Food products, food and staples retailing, paper and forest products, hotels, restaurants and leisure and trading companies and distributors stood out for having the most companies flagged for direct or indirect contribution to forest loss.

Deforestation risks by industry through production/use of commodities

Source: MSCI ESG Research as at Nov. 30, 2022.

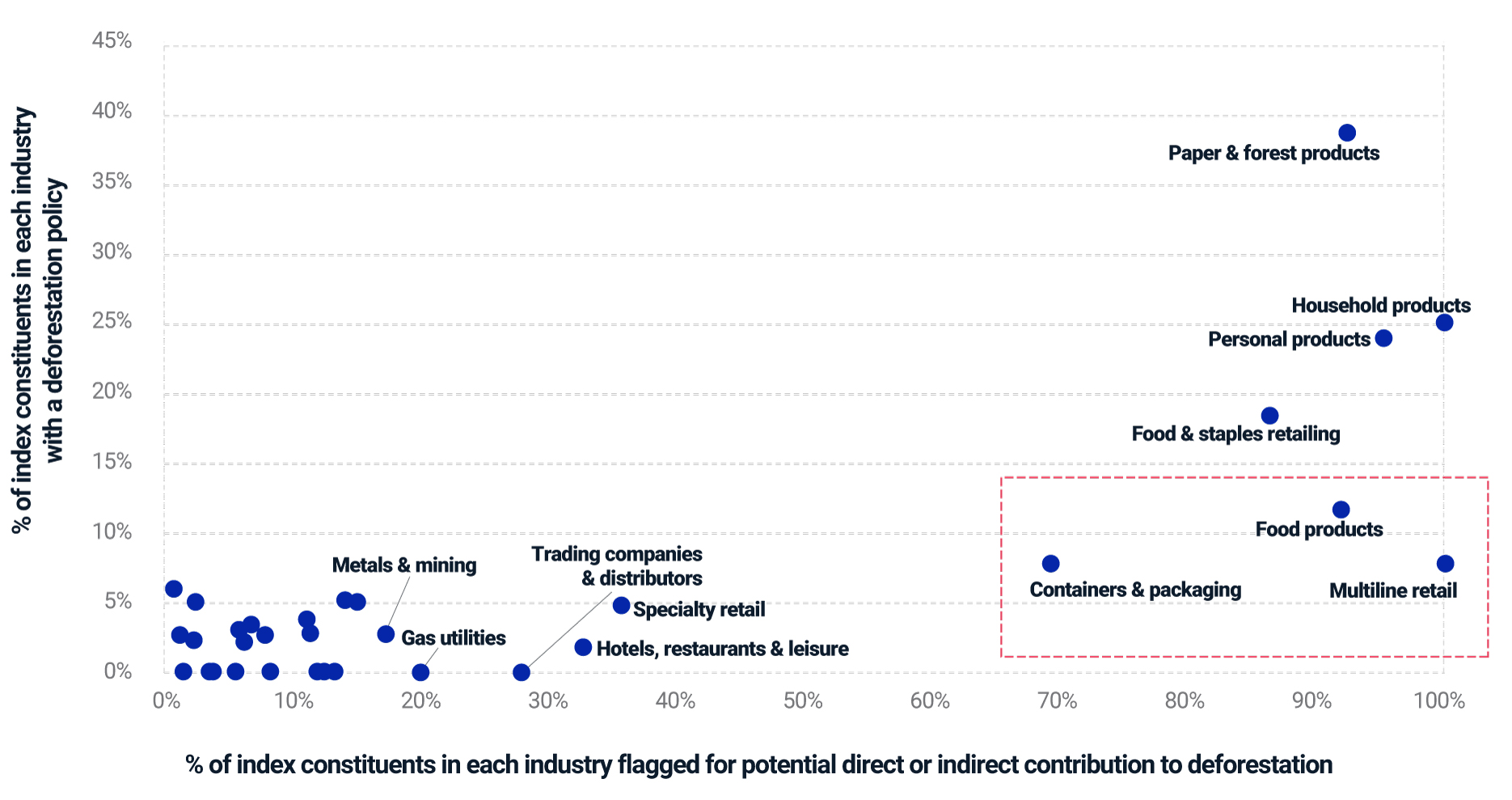

Our analysis also highlighted that among industries with high exposure to deforestation risks, only a few companies had adopted a basic policy on deforestation. While 94% of food producers and 86% of food retailers were flagged for direct or indirect contribution to deforestation, only 12% and 18%, respectively had disclosed a policy. In addition, for the household product and personal product industries — where deforestation risks may be found in the supply chain — the share of companies with relevant policies in place was 25% and 24%, respectively.

Potential deforestation contribution vs. deforestation policy

X-axis: Share of companies within selected industries of the MSCI ACWI Index as of Nov. 30, 2022 that were flagged for direct or indirect contribution to deforestation.

A company is flagged for potential direct contribution when it produces commodities that contribute to deforestation (palm oil, soybean, beef or timber), and/or is classified as operating in a high-risk area and/or that has been involved in controversies linked to deforestation.

A company is flagged for potential indirect contribution when it depends on/uses at least one of the commodities that contribute to deforestation: palm oil, soybean, beef or timber.

Y-axis: Share of companies within selected industries of the MSCI ACWI Index as of Nov. 30, 2022, that have disclosed a deforestation policy.

Source: MSCI ESG Research, December 2022.

A starting point for portfolio construction and engagement

Investors could use these results as a starting point to integrate deforestation-related risks into their investment decisions. In particular, the screening metrics could help investors select flagged companies for an in-depth review of risk-management practices and for active engagement, and might view companies with robust policies, supply chain/commodity certification and monitoring or stringent targets as better positioned to address relevant risks than peers without.

1 Harris, Nancy L., et al. 2021. “Global maps of twenty-first century forest carbon fluxes.” Nature Climate Change. 11, 234-240.

2 Tree-cover loss is defined as the removal of tree canopy through human-caused or natural events. Percentages calculated based on data for 2001 to 2021 from Global Forest Watch/World Resources Institute, December 2022.

3 The 15th Conference of the Parties to the Convention on Biological Diversity in Montreal, Canada, commonly abbreviated as COP15, (Dec. 7 to 19, 2022.)

4 MSCI’s Biodiversity Screening Metrics will be published in January 2023. The MSCI Biodiversity-Sensitive Areas Screening Metrics enable investors to identify companies that have physical assets located in areas of high biodiversity relevance, while the MSCI Deforestation Screening Metrics identify companies with exposure to deforestation risks.

5 GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

Further Reading

The MSCI Net-Zero Tracker – COP27 and COP15: The climate and nature crises

Climate and Net-Zero Solutions