- China’s market reforms and increased accessibility led MSCI, through our methodology and consultations with international investors, to begin the inclusion of China A shares in the MSCI Emerging Markets Index in 2018.

- Global investors increased participation in the A-share market during the post-inclusion period (May 2018 to August 2020). During this time, A shares outperformed global equities and provided risk diversification.

- With greater availability of Chinese equities, many institutional investors have devoted more resources to navigate China exposure within the emerging-market opportunity set and explored the potential for dedicated China allocations.

As markets have been added to or removed from MSCI indexes, investors adjusted by incorporating the new information into their decision-making process. While the natural tendency may be to adapt and move forward, it can be helpful to step back at times and take stock of the factors behind inclusion, as well as how investors and markets have responded since. In this first of a series of blogs on that subject, we explore China A shares approximately one year after MSCI completed the 20% inclusion of China A large- and mid-cap securities in the MSCI Emerging Markets (EM) Index.

The inclusion of China A shares in the MSCI EM Index was driven by the same mechanisms as the inclusion of emerging markets such as the United Arab Emirates, Qatar and Saudi Arabia in recent years. Based on MSCI’s Market Classification Framework, and working in consultation with international institutional investors, inclusion reflects the key objective of the MSCI Indexes: to measure the performance of the broadest investable opportunity set.

The Road to Inclusion

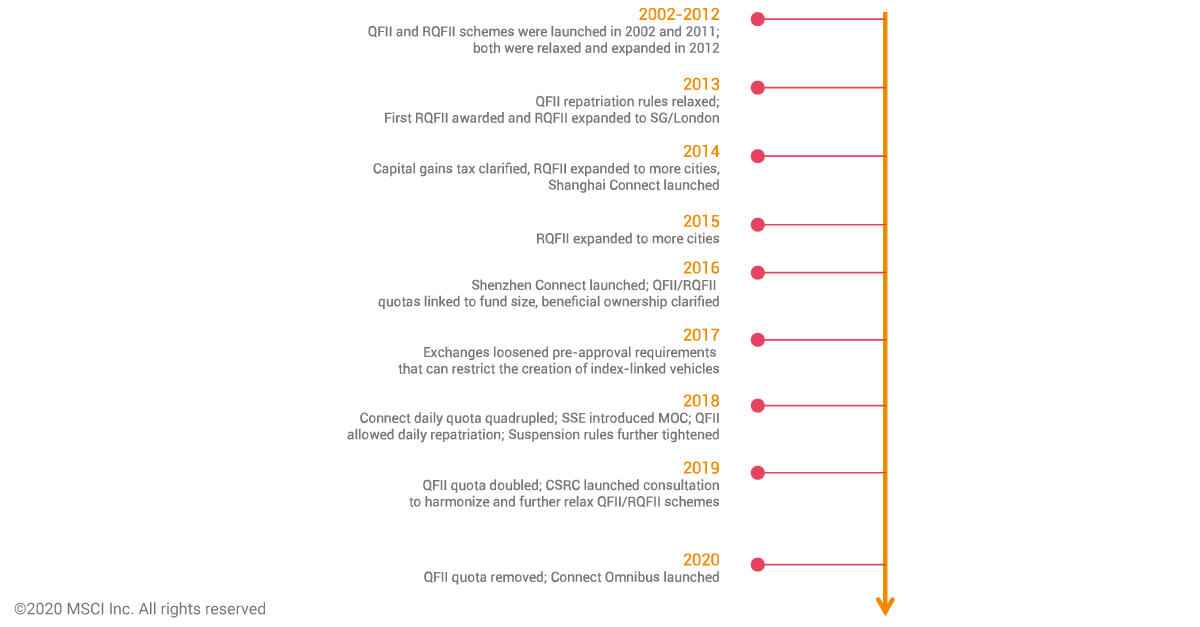

Based on reforms that started in 2002 with China’s Qualified Foreign Institutional Investors (QFII) scheme, in 2013, MSCI kicked off the consultation process regarding the accessibility of the market for China A shares. As the international investment community resisted inclusion through three rounds of consultations, Chinese policymakers and regulators responded with significant market reforms that addressed investor concerns on major market accessibility.

The Stock Connect program between the exchanges in mainland China and Hong Kong, introduced in 2014 and expanded over the next two years, proved to be the breakthrough global investors had been seeking — a channel that provided greater accessibility to all investors.

Following that breakthrough and the positive feedback and support from investors, MSCI concluded the fourth consultation and publicly announced in June 2017 that it would include large-cap China A shares in the MSCI EM Index. The inclusion ratio was set at 5% for May and August of 2018.1

China’s Market-Liberalization Efforts

Note: QFII and RQFII refers to the Qualified Foreign Institutional Investors and RMB Qualified Foreign Institutional Investors scheme in China’s mainland market. Shanghai/Shenzhen Connect allows foreign investors to trade stocks listed on Shanghai/Shenzhen Stock Exchanges directly via brokers in Hong Kong and the connections with Hong Kong Stock Exchange. CSRC refers to China Securities Regulatory Commission. The Stock Connect program was initially launched in November 2014, with the opening of Shanghai-Hong Kong Connect channels. Under the program, investors in each market can trade shares on the other market using their local brokers and clearinghouse .

Chinese Reforms Continued

As the quadrupling of Stock Connect’s daily quota and additional market reforms were introduced, MSCI started another consultation on the “Further Weight Increase of China A Shares” in September 2018. Following overwhelmingly positive feedback, MSCI announced in February 2019 it would increase the inclusion ratio to 20% and include mid-cap China A shares in May, August and November of 2019. That same year, MSCI twice reiterated that any further weight increases would be subject to additional significant market reforms by the Chinese government and regulators, as well as additional consultations with market participants.2

As of August 2020, the overall weight of China and China A shares in the MSCI EM Index rose to about 41% and 5.1%, respectively.

Composition of the MSCI EM Index: August 2020 vs. May 2018

The pie chart on the left does not include China A shares as partial inclusion in the MSCI Emerging Markets Index had not yet started.

Investors’ Experience Since China A Shares’ Inclusion

From the time MSCI announced in June 2017 that it would partially include China A shares in the MSCI EM and MSCI ACWI Indexes, global investors’ interest in Chinese stocks has increased:

- The opening of special segregated accounts (or SPSA), a proxy for international investors’ readiness and appetite to trade A shares, surpassed 10,600 accounts as of June 2020, up from less than 1,700 three years prior.

- The total portfolio value settled through the Northbound Stock Connect reached CNY 1.7 trillion (USD 240 billion) as of June 2020.3

- More than 1,500 China A shares, including those being added to the MSCI EM Index, are accessible to Stock Connect investors. Stock Connect is rapidly establishing itself as the primary channel to access A-shares.

Interest is up, but have investors’ portfolios benefited from increased availability of China A shares?

From a performance perspective, the MSCI China A Index returned 28.9% from May 31, 2018, to Aug. 31, 2020, compared to the MSCI EM Index and MSCI World Index returns of 4.35% and 22.2%, respectively, during the same period.

Performance of MSCI China A, EM and World Index Over Time

| Annualized returns | MSCI China A Index | MSCI EM Index | MSCI World Index |

|---|---|---|---|

| 3-year | 8.1% | 2.8% | 9.8% |

| 5-year | 7.4% | 8.7% | 10.4% |

| 10-year | 7.1% | 3.8% | 10.7% |

Performance data based on Net TR Index in USD as of Aug. 31, 2020

From a risk-diversification perspective, the exhibit below shows that China A shares demonstrated relatively low correlation to other EM and developed markets prior to and after May 2018.

Correlation Between Markets Before and After May 2018

Issues Remain

The partial inclusion of China A shares better reflects the total China equity opportunity set, and institutional investors have devoted more time and resources to determining how to navigate Chinese equity markets. As they continue evaluating their approach, considerations include how they:

- Evaluate the role of EM allocations given the growth of increased China representation in the benchmark

- Approach the policy of EM investing, as well as China’s role in broader policy considerations

- Design and implement a dedicated China investment program

The author thanks Shuo Xu and Naoya Nishimura for their contributions to this post.

1Even though the actual daily net purchase quota of the Stock Connect program could theoretically accommodate a bigger inclusion ratio in 2018, investors still preferred a 5% initial inclusion ratio as the program was not tested under “real” index-inclusion scenarios.

2Specifically, four areas of remaining market-accessibility concerns were raised by investors for inclusion beyond 20%: (1) the lack of listed futures and other derivatives products may make investors’ ability to implement and manage the risk of China A shares in the MSCI indexes less efficient; (2) the short settlement cycle of China A shares presents operational risk and tracking challenges, especially for those based outside Asian time zones; (3) investors are concerned with the misalignment between onshore China and Stock Connect holidays; and (4) investors highlighted the pressing need for a well-functioning omnibus mechanism — i.e., the ability to place a single order on behalf of multiple client accounts.

3The Stock Connect program was established for connectivity of trading and clearing between mainland China’s (Shanghai and Shenzhen) and Hong Kong’s securities markets. The mechanism involves Northbound Trading and Southbound Trading: With Northbound Trading, international investors will be able to trade eligible securities in mainland China through the Hong Kong Exchange, whereas with Southbound Trading, mainland investors will be able to trade eligible securities in the Hong Kong through the Shanghai and Shenzhen exchanges.

Further Reading

China and the future of equity allocations

Emerging markets since China A shares’ inclusion

The rise of fundamental factors in China A shares

Can your investment strategy work with China A shares?