- Corporate boards have a central role in helping firms navigate a growing set of challenges including economic and social disruption.

- In these circumstances, investors may look harder at the collective level of skills and experiences present on the board.

- Introducing more climate-related experience, more women and appointing younger directors are three key factors that could help strengthen corporate boards.

Companies and their boards are facing an unprecedented range of pressing global issues — from an increased focus on climate- and ESG-related issues through to new regulations and a changing macro and geopolitical environment; from workforce relations and the management of human capital through to a cost-of-living crisis, we are in exceptional times.

In MSCI’s ESG and Climate Trends to Watch for 2023, we look at the role of boards in helping companies respond to the changing landscape. Here, we highlight three big themes for boards to consider that we will be watching in 2023 and beyond.

A stronger focus on climate

A recent study found that U.K.-listed companies with better governance practices tended to achieve higher carbon-emissions reduction compared to historic levels and to industry peers.1 If this holds true more widely, boards that spend significant time on environmental or sustainability issues and include directors with climate experience could help firms address climate-transition risk and reduce real-world emissions. Boards that include climate-savvy directors may be better able to build support for emissions targets, compared to those that do not.

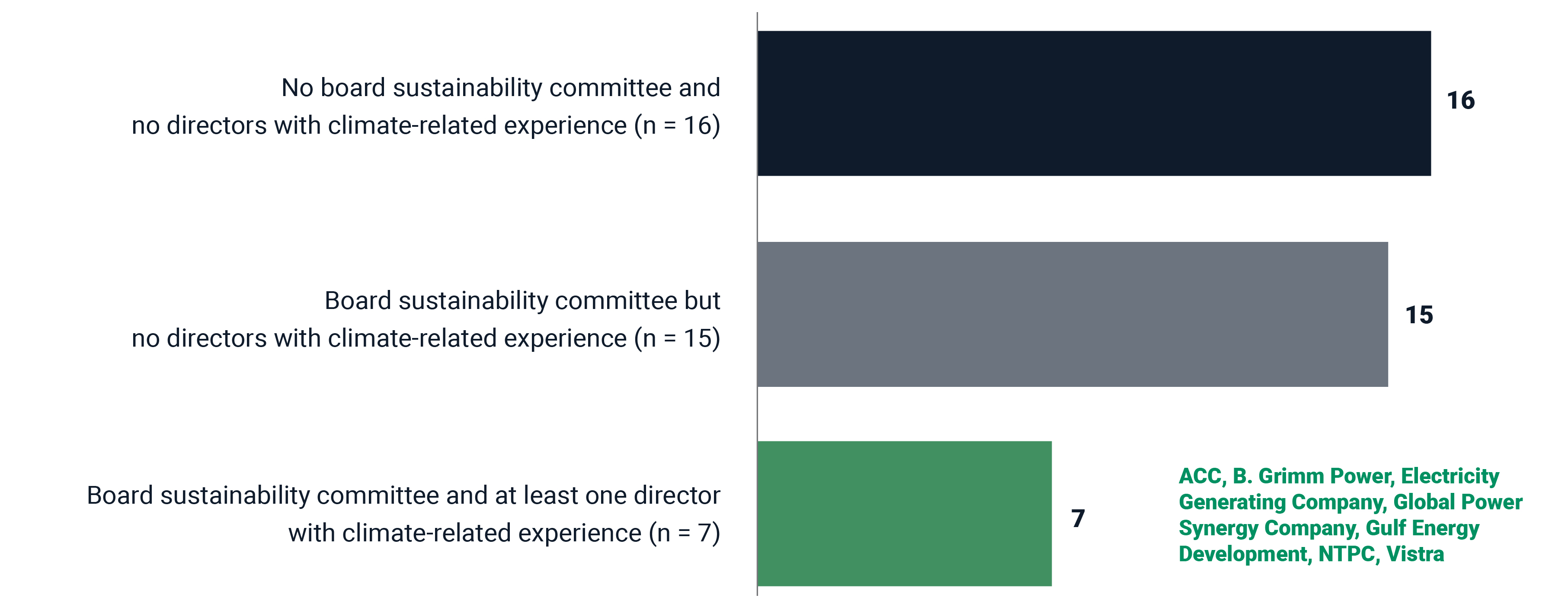

This could be particularly pertinent to emissions-intensive industries, where our analysis of a sample group of companies indicates that only a minority have climate-focused boards. In our study, we looked at board practices for a group of climate laggards: 38 constituents of the MSCI ACWI Index in emissions-intensive industries that were strongly misaligned with global temperature targets as of November 2022, as measured by MSCI Implied Temperature Rise (ITR).2 In the exhibit below, the seven companies highlighted in green had a board sustainability committee and at least one director with climate-related experience, based on our analysis.3 Their future emissions trajectories may answer whether climate-focused boards can help companies align with global temperature targets.

Climate board practices at select emissions-intensive companies

Analysis covers 38 constituents of the MSCI ACWI Index with an ITR above 3.2°C. Under the Global Industry Classification Standard (GICS®), these companies were classified in these sub-industries: independent power producers and energy traders, electric utilities and construction materials. These three sub-industries were the most emissions-intensive GICS sub-industries, based on our data for fiscal year 2020. GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

Source: MSCI ESG Research and company disclosures (as of November 2022).

The gender diversity factor

When analyzing companies and their board composition, we have previously observed a correlation between the presence of female directors and strong talent-management practices, as well as higher growth in employee productivity.

The global drive towards greater board gender diversity continues and in recent years several countries have introduced legislation to ensure better female representation on boards. Taking Asia as an example, Malaysia introduced a 30%-female-director recommendation in its code on corporate governance in 2017 while India strengthened gender-diversity requirements in 2020 to include an independent female director at the top 1,000 companies based on market cap.4 More recently, new regulations around gender diversity on boards came into effect in Korea in August 2022.5

Generally, independent directors may help enhance management oversight and protect the interests of non-majority shareholders, while the requirement for independent female directors could also help improve talent-management practices.

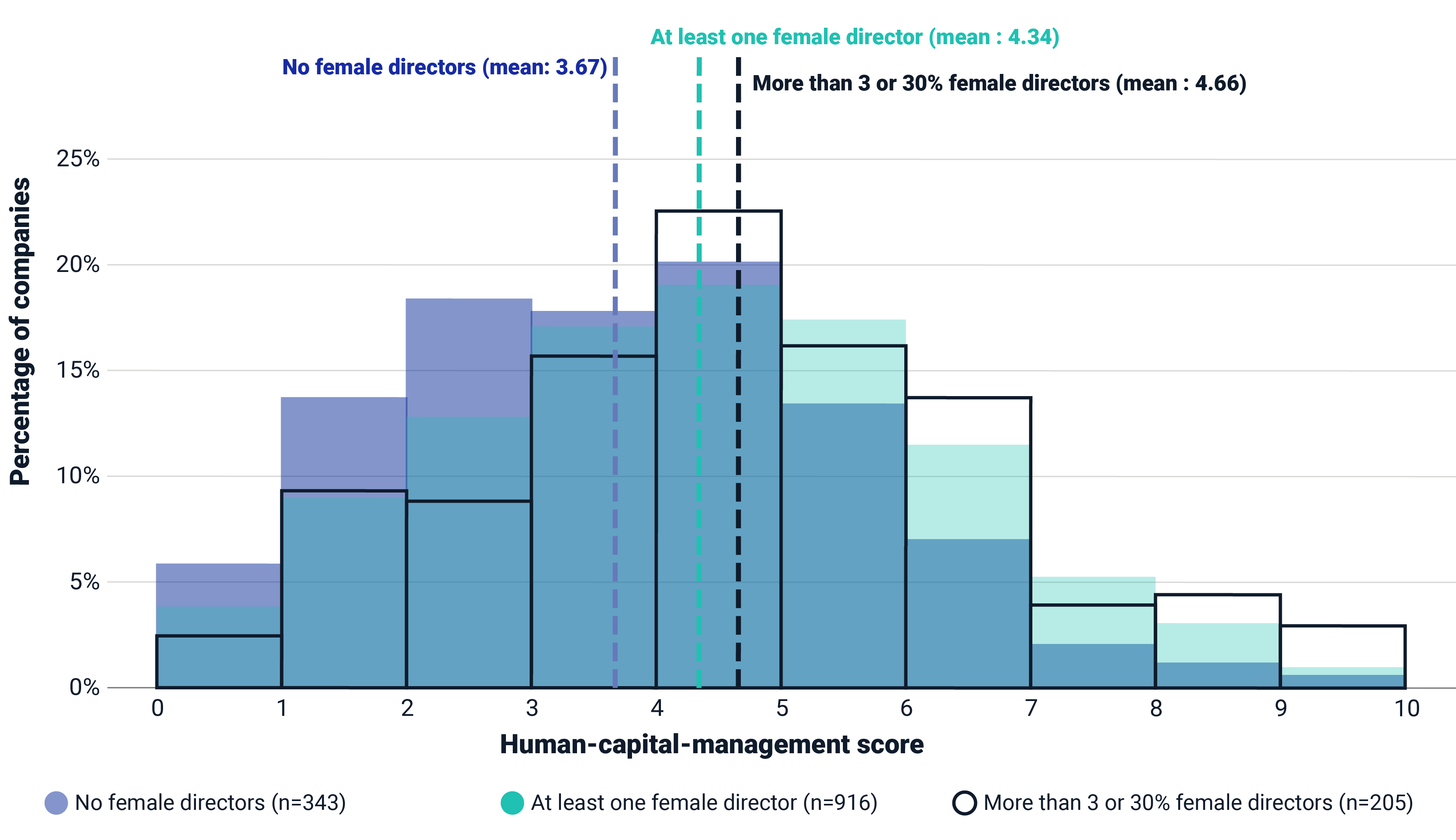

While not necessarily evidence of causality, the exhibit below shows that, on average, companies with at least one female director had higher human-capital-management performance than those without any female directors (4.3 vs. 3.7 on a 0-10 scale).6 The difference was even greater at companies that had at least three female directors or 30% women on the board, a potential “tipping point.”

Human-capital management at companies with female directors

Among the constituents of the MSCI Emerging Markets Investable Market Index (IMI), we selected APAC companies with labor management or human capital development as a weighted key issue in the MSCI ESG Ratings model: China (n=529), India (n=139), Indonesia (n=29), South Korea (n=328), Malaysia (n=65), Philippines (n=21), Taiwan (n=103) and Thailand (n=45). The MSCI Emerging Markets IMI (n=3,064) captures large-, mid- and small-cap representation across 24 emerging markets. Data reflects the distribution of management scores under our human-capital-development key issue for companies with varying levels of female-director representation. Data as of Oct. 25, 2022.

Source: MSCI ESG Research.

Balancing experience and youth

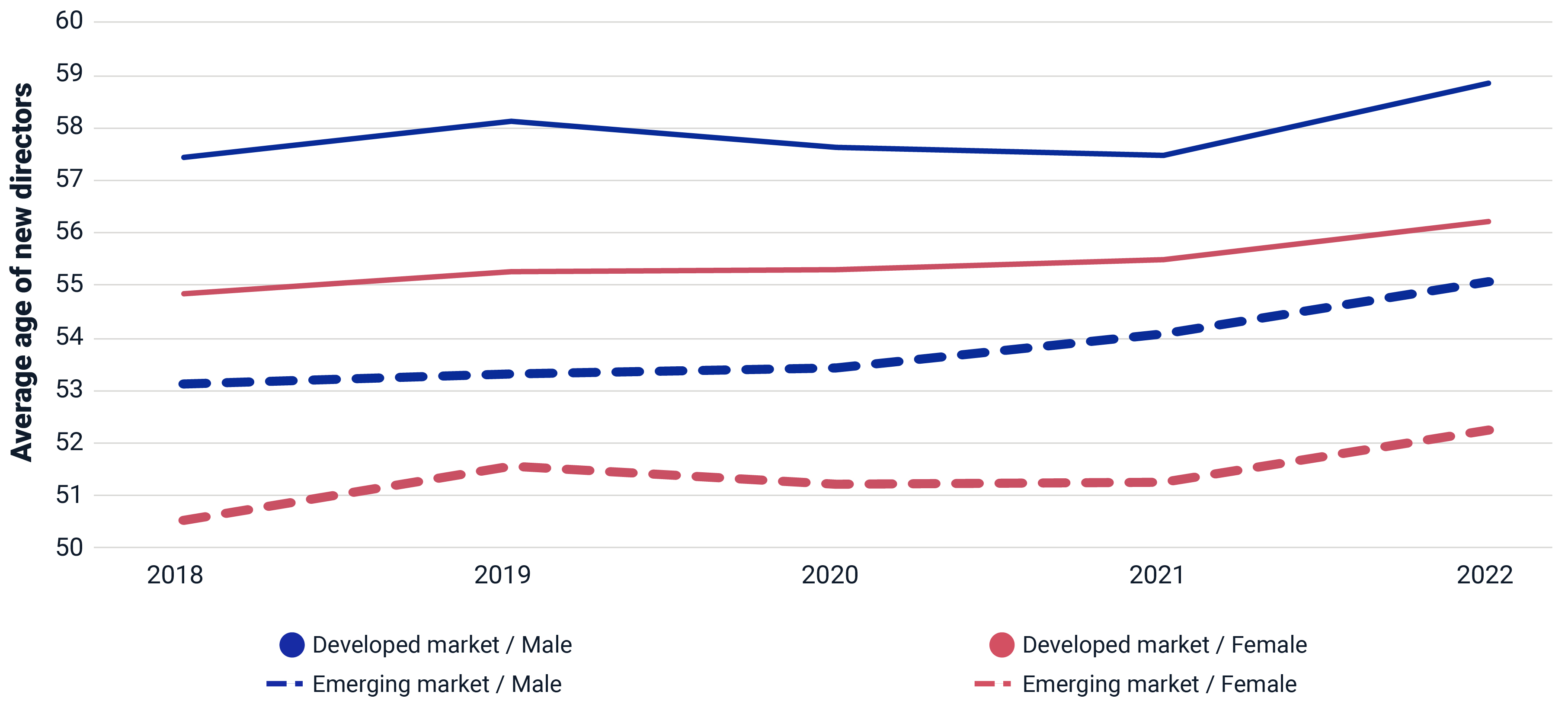

Boards are aging — and this at a time when the changing corporate and economic landscape calls for new skills, fresh ideas and innovation. The average age of new directors for constituents of the MSCI ACWI Index rose from 54.8 years in 2018 to 56.3 years in 2022. Globally, significant age gaps exist between male and female directors and between those who serve on the boards of companies in developed and emerging markets.7 When combined, these trends are amplified, as demonstrated below.

Average age of new directors by market and gender

Constituents of MSCI ACWI Index, as of Oct. 18, 2022. MSCI ACWI Index constituents (n=2,625), developed-market constituents (n=1,397) and emerging-market constituents (n=1,228). Includes directors who joined a board in the 12 months prior to Oct. 18 in each year.

Source: MSCI ESG Research.

Younger directors may not only enhance a board’s generational diversity, but can help companies chart a path forward in an increasingly complex and technology-dependent business environment. Boards and their nomination committees will require strong onboarding programs, however, to maximize the contributions of younger directors who are likely to bring fewer years of professional experience and who may be less familiar with the nuances of board work.8 At the same time, boards seeking younger talent may also be forced to consider these directors’ other commitments: They are more likely to be full-time employees at other companies, which could limit their capacity for board work.9

Analyzing corporate boards — as important as ever

An effective board with a balanced level of relevant skills and experiences can play a central role in helping firms address the current complex market environment. Climate-savvy directors could help a company pursue its ambitions to be a responsible corporate citizen and address investors’ growing focus on the environment, while adding more women in the boardroom could improve gender diversity and potentially contribute to better human-capital management. And introducing a younger cohort of directors could help support decision-making by bringing a wider range of views and experiences to board discussions.

In the context of assessing businesses, investors may do well to look beyond just the financial fundamentals. In the current environment, analyzing the composition of corporate boards remains as important as ever.

1Luo, Le, and Tang, Qingliang. 2021. “Corporate governance and carbon performance: role of carbon strategy and awareness of climate risk.” Accounting & Finance 61: 2891-2934.

2Please see the note below the accompanying chart for more details about these companies. ITR is designed to show the temperature alignment of companies, portfolios and funds with global climate targets. It compares a company’s current and projected greenhouse gas emissions across all emission scopes with its share of the remaining global carbon budget for keeping global warming well below 2°C. It converts a company’s “undershoot” or “overshoot” of its carbon budget to an implied rise in average global temperatures this century, expressed in degrees Celsius.

3We identified environmental or sustainability committees based on official board committee names. Our evaluation of climate-related director experience is based on a review of disclosed director biographies.

4“Malaysian Code on Corporate Governance (As at 28 April 2021).” Securities Commission Malaysia, April 28, 2021. “Securities and Exchange Board of India (Listing Obligations and Disclosure Requirement) Regulations, 2015.” Securities and Exchange Board of India, July 25, 2022.

5Korean companies listed in the KOSPI index, with total assets greater than KRW 2 trillion are required to appoint at least one female director as of August 2022.

6Human-capital-management performance refers to average key issue score for the labor-management and human-capital development key issues under the MSCI ESG Ratings methodology.

7Market classifications are based on the MSCI Market Classification Framework, July 2022.

8“Directors’ Responsibilities in Canada.” Osler, Hoskin & Harcourt LLP and the Institute of Corporate Directors, Oct. 1, 2014.

9“Episode 58: How do we get more young people serving in the boardroom.” Future Directors Podcast, March 1, 2021.

Further Reading

ESG and Climate Trends to Watch for 2023