Argentina and Turkey have experienced sharp corrections in their currency and debt markets over the past couple of months, leading investors to worry about possible contagion to other EM countries. Are other emerging markets heading in the same direction?

Our analysis suggests there have not been – as yet – signs of widespread contagion, but some countries, including Russia, South Africa, Brazil and Indonesia, have begun to move more in line with Argentina and Turkey.

EMERGING-MARKET COUNTRIES IN THE SPOTLIGHT

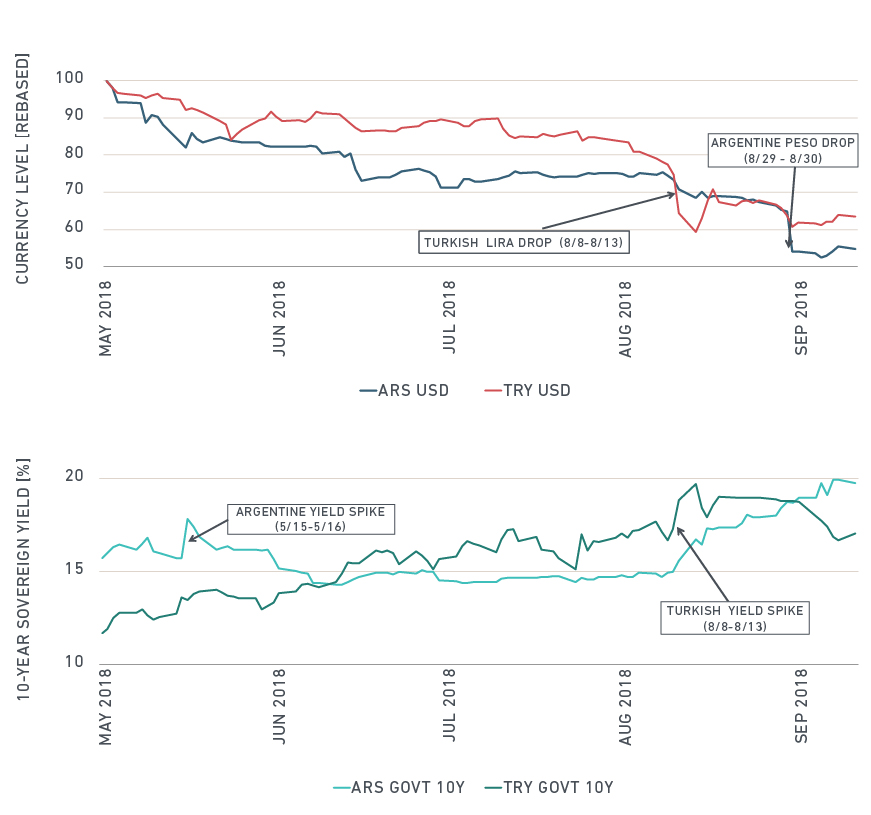

The 1997 Asian financial crisis provided a vivid lesson in how a problem in one country can quickly spread to seemingly unrelated markets. More recently, a few sharp moves in the sovereign yields and currencies of Argentina and Turkey made investors nervous about other emerging-market exposure (see exhibit below).

Argentina and Turkey currencies deteriorated and their sovereign yields rose

Source: MSCI

We examined whether these recent market corrections spread to other emerging-market countries. Our analysis distinguishes between three categories:

- The effect on other countries was larger than what historical sensitivities would imply; i.e., there was contagion

- The shock spread to other markets as expected based on historical sensitivities

- The shock was purely idiosyncratic and did not spread to other countries

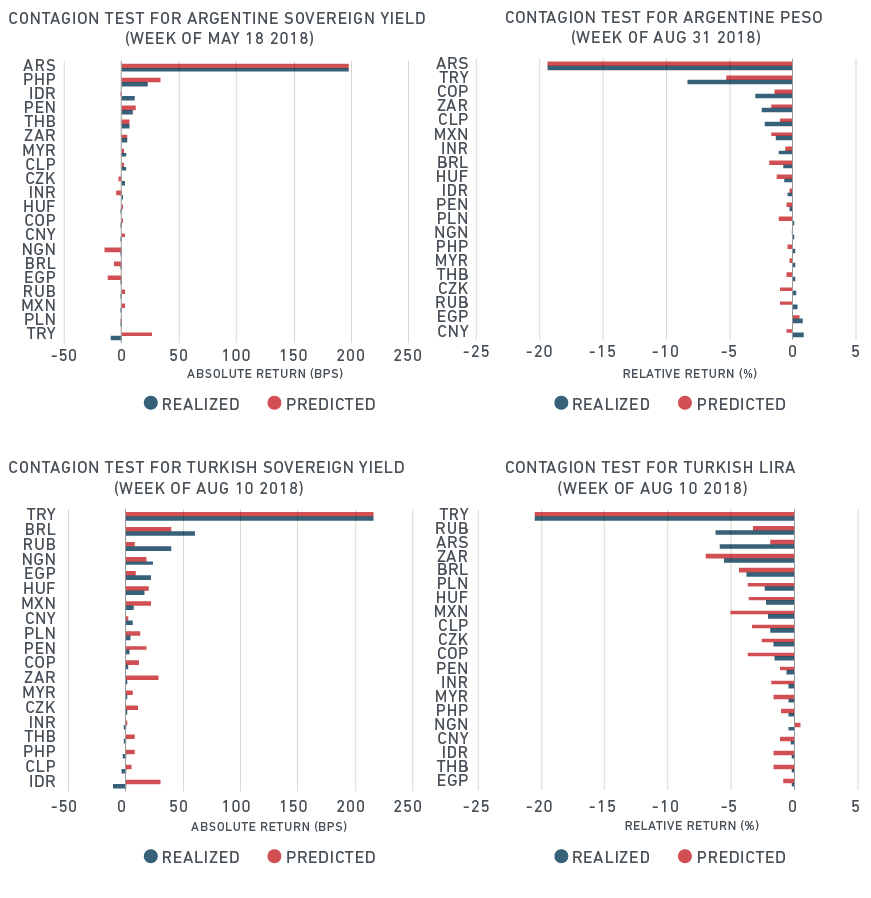

We compared the realized returns for emerging-market currencies and sovereign yields with predictions based on past sensitivities to countries experiencing stressful conditions.1 A significant discrepancy between realized and predicted returns could suggest a marked shift toward increasing contagion.

Argentine and Turkish market corrections did not show contagion

LOOKING BEYOND HISTORICAL SENSITIVITY DATA

Our analysis indicates that there was not widespread contagion (our first category) to EM countries during the recent market corrections in Argentina and Turkey. In general, realized returns fell into one of the last two categories. For the Turkish lira, returns were mostly in line with historical sensitivities (category two); and for the other contagion tests returns were typically in line with the idiosyncratic interpretation (category three).

However, some countries were hit harder than the historical sensitivities implied. When Argentine yields spiked in mid-May, Indonesian (IDR) yields rose more than predicted (top left panel). During the Turkish correction in mid-August, Brazilian and Russian bonds experienced losses beyond what historical sensitivities would have suggested (bottom left panel).

During the Argentine peso drop at the end-August, the Colombian, South African and Chilean currencies fell more than expected (top right panel). For the Turkish lira’s mid-August drop, the Russian ruble and Argentine peso declined more than predicted (bottom right panel).

Many of these countries share some of the vulnerabilities of Argentina and Turkey: high foreign currency debt exposure, a weakening currency, high inflation and/or political instability. In short, there seem to be good reasons these countries were more sensitive to Argentina and Turkey’s problems. Could these countries be the next dominoes to fall?

These findings also suggest that a few vulnerable countries’ bond and currency markets may be experiencing a fundamental change, which would make past returns less accurate as a guide to future correlations and risk. Ahead of any potential correction, investors may want to pay attention to these countries and their exposure to the fundamental drivers of potential weaknesses.

1 For example, we shock the Turkish lira with the return observed between Aug. 8 and 13, 2018, and predict how other currencies would have reacted based on their historical sensitivity to the Turkish lira.

Further Reading

Does Turkey offer lessons for managing emerging-market currency volatility?

What happens if Italy leaves the EU?

Modeling future shocks: MSCI best practices for predictive stress testing