- ESG investments reach a new maturity with less hype and skepticism, but investors looking to align with the Paris Agreement’s goals may start to see a shrinking pool of eligible opportunities.

- Corporate issuers are upping their ESG disclosure game, just in time for a flood of new disclosure requirements. Can investors keep up?

- COVID-19 exacerbated existing social inequalities and made it clear that new diseases are among the risks we face from continued biodiversity and habitat loss. Investors may seek new ways to tackle these systemic risks.

Climate. ESG bubbles. Disclosure. Social inequality. Biodiversity. The topics don’t get much bigger — or more systemic. Here’s our analysis of the five ESG trends that will matter most to companies and their investors in 2021.

#1 - Climate Reality Bites: Actually, We May Not Always Have Paris

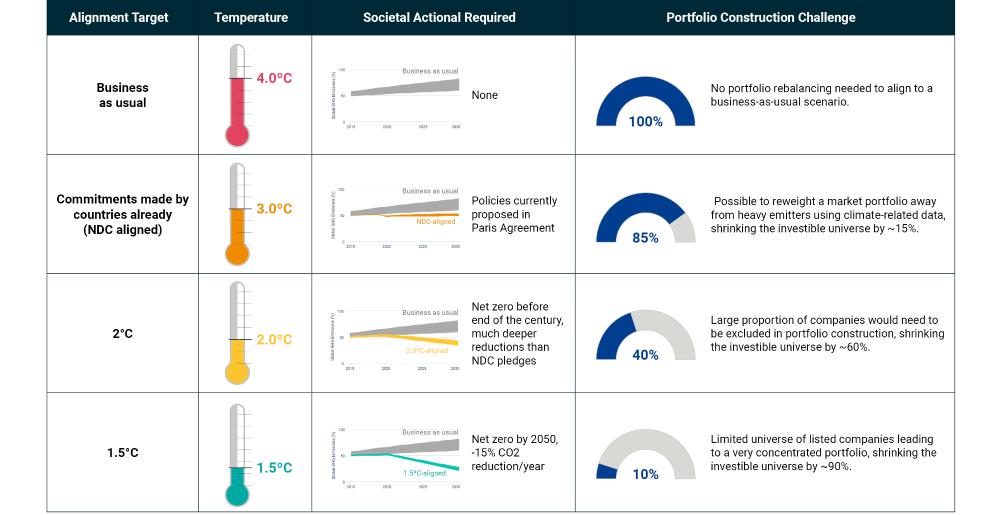

Five years ago in Paris, the world agreed to limit global warming to less than 2 degrees Celsius. Investors got on board, working to align portfolios with this goal. but the easy part is over now. A few exclusions and a portfolio tilt can get you only so far. In 2021, investors committed to aligning with the Paris Agreement face a steeper climb ahead: persuading companies to make radical changes or face a rapidly shrinking universe of qualifying investments.

Climate Change: Honey, I Shrunk the Equity Universe

This calculation is based on a hypothetical portfolio comprising companies of the MSCI ACWI Investable Markets Index (IMI), representing over 8,300 large-, mid- and small-cap companies with available climate-change data across developed and emerging markets, as of Nov. 30, 2020. The data for the warming pathways is provided by Climate Action Tracker’s Global Emissions Time Series dataset. Source: Climate Analytics, NewClimate Institute, MSCI ESG Research.

The informative image links to Trend 1, learn more.

#2 - Beyond Boom and Bust: ESG Investment Finds Its Footing

New Findings and Tools Replace ‘Belief’ (or not) in ESG Assets Allocated to ESG

Assets allocated to ESG investments have boomed in recent years.1 While some may fear that accelerating allocations could lead to frothy valuations, research so far suggests this is mostly unwarranted. In 2021, we see both hype and skepticism about ESG giving way to a more nuanced understanding of when and how ESG has shown pecuniary benefits — and when it hasn’t.

For starters, ESG investing is not another stock bubble. Below we see how the top third (T3), middle third (T2) and bottom third (T1) of companies in the MSCI ACWI Index, sorted by MSCI ESG Ratings, performed over a seven-year period. We found that the top third outperformed their peers due to higher earnings growth at the higher-rated companies while the middle third’s performance was attributable largely to higher reinvestment returns from dividend payouts and share buybacks.

Data for constituents of the MSCI ACWI Index from May 31, 2013, to Nov. 30, 2020.

The informative image links to Trend 2, learn more.

#3 - To Bee or not to Bee: Investors Tackle the Biodiversity Crisis

Could the Kunming Talks Become the Next Paris Agreement?

During the darkest days of the pandemic, emboldened wildlife roamed residential streets. The virus has reminded us of what we’ve unwittingly lost: nature, critical not just for personal pleasure but for sustaining the global economy. In 2021, policymakers and investors will heed the alarm on biodiversity loss, adapting a playbook they had established for measuring and managing climate risk. A major UN conference on biodiversity in Kunming, China, could become an inflection point.

One of the main drivers of deforestation and biodiversity loss is unsustainably harvested soy. We identified the major soy producer and consumer countries as well as corporate processors, traders and users of soy and examined their efforts to eliminate deforestation across the soy value chain. We focused our analysis on the food products industry given that over 70% of soy production goes into animal feed and the remainder is split between other types of food and biofuel production.

Soy Producers and Users: Revenue Dependency and Progress Toward Zero Deforestation

Universe: Soybean buyers, MSCI ACWI Index, as of Nov. 11, 2020. Food processors typically do not disclose their level of reliance on soy, especially when it is embedded in their supply chain and not directly sourced by them. We made soy reliance estimates based on companies' publicly available operating segments description and commonly known food products derived from soy. Source: MSCI ESG Research, as of Nov. 17, 2020

* Direct use only (CJ, Nestle, Danone, Tyson) CJ figure includes only CJ Selecta sourced soy certified to RTRS

** Mowi’s feed production

The informative image links to Trend 3, learn more.

#4 - The ESG Data Deluge: Sink or Swim for Companies and Investors

Corporate Issuers Up Their Game; Can Investors Keep Up?

When it comes to ESG reporting and establishing a sustainability strategy, it’s clear that companies are stepping up their game — and just in time, as there is an avalanche of disclosure requirements coming their way. It’s coming for investors too, who may find that an energized base of issuers knows a thing or two about ESG data reporting.

Institutional investors may need to report on an array of new ESG metrics for their portfolio companies if the European Union’s Sustainable Finance Disclosure Regulation (SFDR) is finalized in its current form. Even though the current draft says the requirements wouldn’t kick in until March 2021 at the earliest,2 most companies are not prepared for this possibility. The table below lists the 32 primary adverse indicators that would be required in the current form of the regulation, together with MSCI ESG Research’s assessment of data availability for constituents of the MSCI ACWI IMI. It’s no small task that lies ahead. But from where we sit as intermediaries between investors and corporate issuers, it’s clear that companies are stepping up their game.

SFDR Draft Principle Adverse Impacts Indicators: Company-Level Data Availability

Data for constituents of MSCI ACWI IMI as of Nov. 12, 2020. Source: MSCI ESG Research

* Direct use only (CJ, Nestle, Danone, Tyson) CJ figure includes only CJ Selecta sourced soy certified to RTRS

** Mowi’s feed production

The informative image links to Trend 4, learn more.

#5 - Righting the Scales: Social Inequalities Test Investors’ Creativity

Targeting Systemic Problems Also Calls for Some (Reputational) Risk Tolerance

COVID-19 has put its thumb on the top 1% side of the wealth scale, undoing decades of progress toward greater equality. Engaging with individual companies might not be enough to repair the damage that’s been done.

In 2021, we see investors taking steps toward more creative, systemic approaches to reduce inequalities, with those in the vanguard willing to risk a few failures in pursuit of solutions.

One possible solution: social bonds, where bond proceeds are used to fund projects with positive social outcomes. Issuance soared in 2020, with many focused on mitigating the negative impacts of the pandemic. The definitions and standards of assessment for social bonds are not as well developed as they are for green bonds, leaving some investors concerned about the possibility of “social washing.” Yet there is an acute need for scalable solutions in this era of rising inequality and a global health crisis.

USD Value of Social, Sustainability and Green Bond Issuances 2015-2020

Social bonds aim to finance projects or operations with social benefits, as green bonds aim to finance environmentally beneficial projects. Sustainability bonds incorporate both social and environmental elements. Data as of Oct. 15, 2020. Source: Climate Bonds Initiative, MSCI ESG Research.

The informative image links to Trend 5, learn more.

1Darbyshire, M. “ESG funds continue to outperform wider market.” Financial Times, April 3, 2020. Riding, S. “ESG funds attract record inflows during crisis.” Financial Times, Aug. 10, 2020.

2 Humphreys, N. “Demystifying the Sustainable Finance Disclosure Regulation.” Bloomberg Professional Services. Aug. 10, 2020.

Further Reading

Up in Smoke? Brazil’s Wildfires May Affect Bond Prices

TCFD-based reporting: A practical guide for institutional investors

Green bonds: Growing bigger and broader