Risk Control Indexes hero banner

Risk Control Indexes

Maximum Exposure and other solutions

Social Sharing

What is Risk Control Indexes?

Traditionally risk control indexes have been designed to target a specific volatility level of an underlying equity index by rebalancing among an equity index and cash on a frequent basis (e.g. daily). Within the context of structured products, some managers have used such risk control indexes as a reference of performance with respect to payouts to investors.

What is Maximum Exposure Risk Control Indexes?

The launch of MSCI’s Maximum Exposure Risk Control Indexes represents an alternative way to incorporate risk control by maximizing the weighted risk allocation of an equity and fixed income index. This represents an extension of our existing Risk Control methodology and emerges from an in-depth comparative review and analysis by our research team.

The MSCI Maximum Exposure Risk Control Indexes aim to replicate the performance of an investment strategy that maximizes the risk-weighted exposure to the underlying indexes and targets a specific level of risk by varying the weights of three components, determined daily based on an optimization seeking approach:

- Equity index (e.g., market-cap, thematic, ESG, Climate or factor index);

- Fixed income index (e.g., U.S. treasury index); and

- Cash.

The idea to maximize the exposure to both equity and fixed income asset is the key one in this approach: risk-adjusted returns of the two may be similar and there is no reason to treat them differently (see paper below for exact optimization formula).

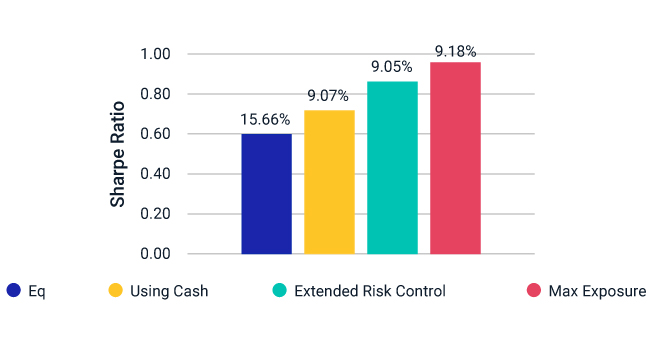

Maximum Exposure Risk Control had on an average1

- Improved risk-adjusted returns over the sample period

- Similar or higher exposure to both underlying indexes

- Realized volatility close to the target

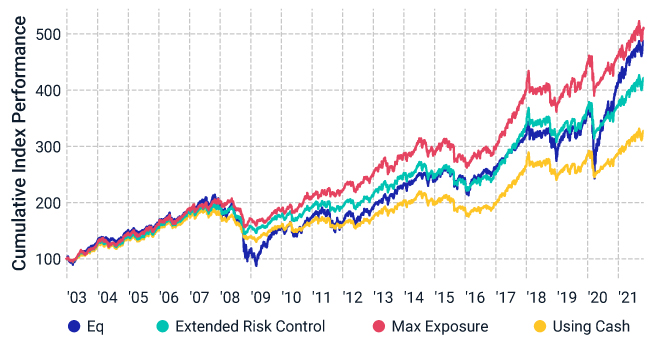

MSCI ACWI risk control 10% performance and their realized volatility*

* Extended risk control mechanism allocates to the equity index based on its volatility, up to 100% leverage. Remaining weight (up to 100%) is allocated to treasuries. Second layer with cash adjustment is applied to reach closer to the risk control level with a leverage cap of 150%.

Index series

Learn more about these new indexes

We have launched five new MSCI Maximum Exposure Risk Control Indexes, that offers investors an alternative optimized approach to risk control that aims to maximize weighted risk allocation of an equity and fixed income index.

Methodology (PDF, 303 KB) Factsheet (PDF, 125 KB) Factsheet(ESG Leaders) (PDF, 109 KB)

The five MSCI Maximum Exposure Risk Control Indexes available are:

| Index Name | Ticker |

| MSCI World 10% Maximum Exposure Risk Control Index | MXWORC10 |

| MSCI World ESG Leaders 10% Maximum Exposure Risk Control Index | MXWOESRC |

| MSCI Emerging Markets 5% Maximum Exposure Risk Control Index | MXEFRC05 |

| MSCI EAFE 5% Maximum Exposure Risk Control Index | MXEARC05 |

| MSCI USA ESG Leaders 5% Maximum Exposure Risk Control Index | MXUSESRC |

What is Extended Risk Control Indexes?

What is Extended Risk Control Indexes?

The MSCI Extended Risk Control Indexes aim to replicate the performance of an investment strategy that attempts to control the level of volatility by adjusting the weights of an MSCI Equity index Component, a Treasury Component and a Cash Component.

Available Indexes:

| Index Name | Ticker |

| MSCI World 10% Extended Risk Control Index | MXWOEXRC |

| MSCI World ESG Leaders 10% Extended Exposure Risk Control Index | MXWOESER |

| MSCI Emerging Markets 5% Extended Risk Control Index | MXEFEXRC |

| MSCI EAFE 5% Extended Risk Control Index | MXEAEXRC |

| MSCI USA ESG Leaders 5% Extended Risk Control Index | MXUSESER |

Featured Content

Featured Content

Risk Control with Maximum Exposure

In this paper, we introduce alternative approaches to risk control that aim to maximize exposure to non-cash assets, and compare them against classic risk-control approaches. We began by applying various risk-control approaches to the MSCI ACWI Index, and evaluated each in terms of performance, exposure and sensitivity to varying leverage and volatility-target levels.

Risk Control Indexes Related Content

Related Content

Index Licensing for Derivatives

Over the past twenty years, the growth of the derivatives market has demonstrated the rapid adoption and use of equity index futures and options by investors.

Read moreRisk Control Indexes Factsheet

Traditional market cap weighted indexes reflect the performance of equity markets with varying levels of volatility.

Download PDF (PDF, 165 KB)Standard Risk Control Methodology

The MSCI Risk Control Indexes may serve as benchmarks for managed volatility strategies and as the basis for exchange traded funds and structured products. Read the methodology.

Download PDF (PDF, 255 KB)Risk Control Indexes footnotes

1 Sample period: Jan 1, 2002 – Oct 31,2021. VT=10% using MSCI ACWI and leverage constrained to 150%.