Hero - MSCI Developed Markets Indexes

Developed Markets Indexes

Capturing investment opportunities in established capital markets

Social Sharing

Intro - MSCI Developed Markets Indexes

No matter where you call home, developed markets are a cornerstone of global investing.

As investors move away from their home markets, the developed markets opportunity set is a fitting starting point for constructing diversified global portfolios. Developed nations have more advanced economies, well-developed infrastructure, more mature capital markets, and higher standards of living. They may be complemented with an allocation to emerging markets while potentially providing greater stability, transparency and liquidity to portfolios.

The MSCI World Index1, launched in 1986, is a widely recognized benchmark that measures the performance of equity markets across developed countries.

-

23Countries

-

88%Weight in MSCI ACWI Index

-

1,517Constituents

Exhibit and paragraph - MSCI Developed Markets Indexes

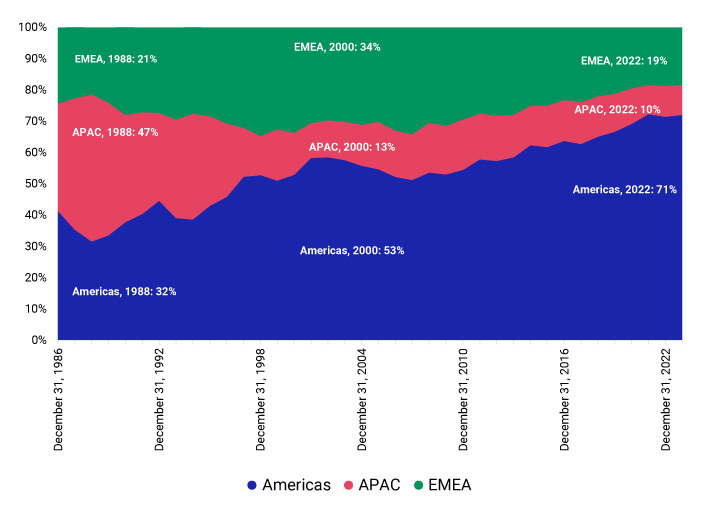

MSCI World Regional Weights Through TimeThe MSCI World country composition has remained fairly stable over time. However, as global markets change, so do MSCI World’s regional and country weights. In the late 1980s, for instance, Japan represented over 40% of the developed markets as property and share prices rose. Later, in the early 2000s, European markets gained prominence due to strong economic growth and the introduction of the Euro currency. Over the last two decades, the USA has maintained its position as the largest developed market, currently representing nearly 70% of the MSCI World Index.

|

MSCI Developed Markets Indexes are built using MSCI’s Global Investable Market Indexes (GIMI) methodology (PDF, 1.7MB), which considers variations reflecting conditions across regions, market cap segments, sectors and styles. The indexes are available in select global, regional and country versions as well as style indexes designed to represent the performance of securities exhibiting the value/growth characteristics.

Interactive Assets

Constructing - MSCI Developed Markets Indexes

Constructing highly diversified global portfolios

The most valuable benefit of diversification is the potential to moderate market volatility and risk. But diversification can also increase exposure to new opportunities and potential new sources of returns. In a constantly shifting global landscape, capturing the investment opportunity set across different regions and countries through dynamic and ever-evolving indexes offers investors a distinct advantage.

Our research suggests that global equity mandates, often complemented by dedicated emerging market and small cap specialist mandates, may emerge as the “new classic” structure for implementing global equity allocations. Investors may consider active and passive management as complementary strategies across these distinct equity segments. Investors seeking greater home-market exposure can manage separate domestic portfolios alongside the global equity structure or explore a core-satellite structure where the active-passive split extends to each equity market segment to implement the global equity allocation.

Contact - MSCI Developed Markets Indexes

Related content - MSCI Developed Markets Indexes

Related content

Emerging Markets

Our suite of Emerging Markets Indexes is designed to offer investors a variety of choices that represent different regions, countries, size segments and sectors.

Explore moreN Indexes

Free float-adjusted market capitalization weighted indexes designed to track the performance of the largest N securities of an underlying MSCI IMI Index.

Read moreMarket Classification

Learn about our index market classification framework and how it is reviewed.

Learn moreUnlock Australia's Investment Potential with MSCI Australia Indexes

Building on the MSCI Australian Domestic Module launched in 2020, our latest addition is an enhanced series of AUD-denominated market-cap indexes: the MSCI Australia Listed Indexes.

Explore moreFootnotes - MSCI Developed Markets Indexes

1 Source: MSCI, as at May 31, 2023