MSCI ACWI Index hero

MSCI ACWI Index

Social Sharing

MSCI ACWI intro

The MSCI ACWI Index, MSCI’s flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets. As of May 2022, it covers more than 2,933 constituents across 11 sectors and approximately 85% of the free float-adjusted market capitalization in each market. The index is built using MSCI’s Global Investable Market Index (GIMI) methodology, which is designed to take into account variations reflecting conditions across regions, market cap sizes, sectors, style segments and combinations.

MSCI ACWI Index market allocation

Historical research has shown that investment outcome success is predominately determined by the allocation decision process.3

- Investors are increasingly looking beyond their home market toward the full global equity opportunity set as the starting point for their investments

- Allocation decisions that start with the full opportunity set can be adjusted based on investor goals, expertise, philosophy and constraints

- Not considering the full opportunity set can introduce unintended bets and biases/risks, and can be an investment decision in itself

1 The MSCI Standalone Market Indexes are not included in the MSCI Emerging Markets Index or MSCI Frontier Markets Index. However, these indexes use either the Emerging Markets or the Frontier Markets methodological criteria concerning size and liquidity.

2 The West African Economic and Monetary Union (WAEMU) consists of the following countries: Benin, Burkina Faso, Ivory Coast, Guinea-Bissau, Mali, Niger, Senegal and Togo. Currently the MSCI WAEMU Indexes include securities classified in Benin, Senegal, Ivory Coast and Burkina Faso.

3 G. Brinson, L. Randolf Hood and G. Beebower. (1986). ”Determinants of Portfolio Performance.” Financial Analysts Journal, July/August.

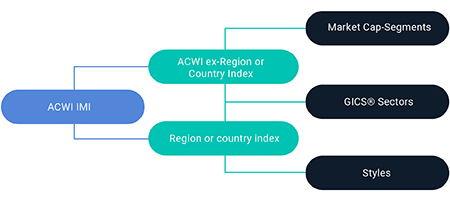

A BUILDING BLOCK APPROACH

Our building block approach

MSCI ACWI Indexes offer a building block approach with a rules-based, consistent and transparent methodology.

Using MSCI ACWI as a framework to build portfolios helps to avoid unintended bets and risks.

Robust foundation allows investors to measure exposure to all sources of equity returns using a single global framework.

MSCI ACWI

MSCI ACWI Index Daily Performance

Index Preview

Flagship Indexes

Flagship Indexes

Our Market Cap flagship Indexes are used by investors around the globe to define and help structure their equity allocations and portfolios.

-

ACWI IMI

Covers more than 9,200 securities across large, mid and small-cap size segments and across style and sector segments in 23 developed and 24 emerging markets.

-

ACWI All Cap Index

Covers more than 15,000 securities and includes large, mid, small and micro-cap size segments for all developed markets countries plus large, mid and small-cap size segments for emerging markets.

-

Developed Markets

Our suite of Developed Markets Indexes is designed to offer investors a wide range of choices that reflect different regions, countries, size segments and sectors.

-

Emerging Markets Indexes

Our suite of Emerging Markets Indexes is designed to offer investors a variety of choices that represent different regions, countries, size segments and sectors.

APPLICATIONS

The MSCI ACWI Index provides a broad global equity benchmark to support:

- Asset allocation: Consistent, complete representation that captures the full spectrum of the global equity opportunity set without home bias.

- Performance measurement and attribution: The industry-leading benchmark for global mandates, with regional, country, sector and other subsets available for more targeted investment mandates.

- Research: A trusted source for global equity markets and underlying security-level data for sell-side research.

- Investment product development: May be licensed for use as the basis for structured products and other index-linked investment vehicles, such as ETFs and ETNs.

ACWI related content

Related content

Investing in China

In 2019 MSCI increased the inclusion ratio of China A shares from 5% to 20% in the MSCI Emerging Markets Index. Investors globally are now increasingly re-evaluating the appropriate allocation framework of their equity portfolios.

Learn moreMSCI Country Indexes Performance Heat Map

Explore MSCI’s all-new interactive heat map which captures the performance for MSCI’s country indexes within the developed, emerging and frontier markets (as determined using our Market Classification Framework).

Explore moreSector Indexes

MSCI has developed a wide range of sector and industry indexes, across regions and countries, to support sector allocation decisions and to allow institutional investors to incorporate tactical views into their portfolios.

Read moreInterested in Indexes?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products.